bitcoin crash: All you need to know

16th November 2018 12:21

by Gary McFarlane from interactive investor

The plunge to a 12-month low is largely self-inflicted, argues cryptocurrency writer of the year Gary McFarlane, but how, and what happens next?

Just when things were getting boring, in a good way, bitcoin decides to crash through key support levels, dragging down the rest of the crypto market with it.

In the past 24 hours, bitcoin has recovered somewhat, although is down 12% in the past week, at $5,564 on Coinbase, for a 12-month low.

Market participants have been left asking, what the hell happened?

Well, the answer is the wounds were mostly self-inflicted. Most leading crypto are higher with the notable outlier being Bitcoin Cash (BCH), which is down 16% on Coinbase at $365.

The Bitcoin Cash upgrade, far from improving its prospects, has left it damaged, at least until the picture is clearer.

Bitcoin Cash's hard fork (software upgrade with no backward compatibility) that took place on 15 November is the root of the problem.

Not so decentralised after all

Critically, the Bitcoin Cash mess raises questions about decentralisation and how in practice a handful of individuals can make decision with such widespread impact.

For weeks, two opposing camps have been fighting a battle over the future of the BCH protocol. What had begun life as an uncontroversial upgrade is now being contested by a group led by Australian Craig Wright and his company nChain.

Wright's camp, which is supported by the coingeek mining pool controlled by billionaire Calvin Ayre, wants to increase block size to 128MB, while the “official” fork aims to make it easier for Bitcoin Cash to run smart contracts and prepares the network for future scaling challenges.

As we reported last week, on one side is the Bitcoin Cash ABC full node implementation developed for the official roadmap and supported by Jihan Wu, chief executive and founder of Chinese mining giant Bitmain and Roger Ver, the owner of bitcoin.com and a notable BCH booster.

The roadmap stipulates that there should be six-monthly software upgrades. In retrospect, that looks way too rigid given the fork has now happened at the worst possible time.

Jihan Wu and others had threatened to attack the rival implementation from nChain known as Bitcoin Cash SV. The SV acronym stands for Satoshi's Vision.

Wright rose to fame – or infamy, depending on your perspective – after claiming in 2016 that he was the inventor of bitcoin, Satoshi Nakamoto.

His failure to provide evidence that he mined bitcoin's genesis block immediately cast doubt on those claims, earning him the moniker "fakesatoshi".

He hasn't backed down from that claim, however, hence the "Satoshi's Vision" label he has given to his BCH fork.

Bitcoin Cash is itself a fork from bitcoin that took place in August last year. The failure of the bitcoin devs to increase block size (although the SegWit upgrade increased effective size to 2MB) led to the creation of Bitcoin Cash.

None of this seemed to matter all that much until past few weeks or so. It was expected that ABC chain would be the most stable chain, with Binance and Coinbase two major exchanges announcing support.

This has been borne out by both the pricing and the block heights of the respective chains, with BCHABC ahead on both counts. Currently, BBCHABC is 38 blocks ahead with 154 blockcs in total mined by the new consensus system (see coin.dance data here).

Binance announced today it is distributing BCHABC and BCHSV to its customers holding BCH, making it the first exchange to do so.

Mounting Bitcoin Cash fork worries

In a sign of the worries that emerged around the fork, Coinbase said earlier this week that it would not allow trading in the cryptoasset, whereas previously it had said it was only planning to pause deposits and withdrawals.

Also, the OKEx exchange, which offers trading on margin in its BCH futures product, said it would be bringing forward the delivery date.

Wright had claimed that BCH futures (Poloniex had the largest market) were "illegal" and said he would get his supporters to "reverse" transactions on the ABC chain. That has all turned out to be hot air on Wright's part.

In response, some supporters of ABC had suggested changing the proof-of-work consensus mechanism so that BCHSV transactions become invalid. All of this depends on who has the hashpower to enforce their will and it is Bitcoin ABC that’s winning.

Two days ago, it appeared possible that BCHSV might overtake BCHABC in the futures market as traders bet on who will win, but today BCHSV is down 28% to $113 on Binance and BCHABC is 3% higher at $287, at the time of writing.

Wright may have bitten off more that he can chew in his fight with ABC.

Bitmain, currently conducting its initial public offering in Hong Kong, has very deep resources, financially and in mining capacity. Key to the health of a blockchain is the hashrate (a measure of the amount of computer processing power being used to verify transactions on the network).

In that regard BCHSV was is in front with an estimated 72-75% of hashrate for most of the past week.

But that, as has played out, was not the end of the story. The other important consideration for a well-functioning crypto network is the number of nodes that are doing the mining – the more the better for a decentralised system.

When assessing that metric, the data was consistently showing the numbers reversed, with ABC commanding the loyalty of 75% of nodes and SV a lowly 8%, according to crypto analytics website coin.dance.

Bitmain's trap

Going by the futures market, no-one had expected SV to come out ahead. There were already reports that Bitmain-controlled mining pools, Antpool and BTC.com, would switch some of their hash power from bitcoin to Bitcoin Cash. That doesn't seemed to have happened, or not to the extent that it would affect bitcoin network performance.

However, there was news out of Asia earlier in the week suggesting that Bitmain was installing 90,000 Antminer S9 rigs to support ABC, as reported by AsiaCryptoToday website.

Also, a report on a little-known website (coinintelnews.com) revealed that an anonymous source at nChain claimed the Wright camp had "a lot of hidden hashrate", but that they were still worried by what Jihan Wu would do and the reputational damage Wright was wreaking. Events seem to have confirmed those fears.

Bitmain had flagged up its intention to pounce well in advance. Jihan Wu tweeted on 8 November: "The whole BCH community are working together to kick Fake Satoshi out. The resisitence [sic] against cult leader proves the inner strength and sophistication of the BCH ecosystem!"

Wright and his nChain team were caught in a carefully laid trap of Jihan Wu's making.

Having said that, the BCHSV chain will likely continue for a while yet, but keep an eye on the price direction. BCH has weak network adoption fundamentals, in other words no one much is using it to buy and sell stuff, the forks will be even weaker. Both teams claim to be preparing for the future.

Wright was not much liked by many in the crypto community before the fork wars started.

Now his standing has fallen still further due to his abrasive and confrontational approach and refusal to reach an accommodation for the sake of the BCH chain.

The source at nChain says the team is acutely aware of this, according to the coinintelnews report: "A lot of people in the community hate him. This little episode may just create more enemies."

It has also been claimed that some at nChain were selling crypto into the fork.

The danger for the market now is that the Bitcoin Cash war deepens and drags on with no emphatic winner emerging, leading to two chains.

The direction of travel points to BCHABC winning sooner rather than later – and that has probably helped to stabilise the wider crypto market.

It should be noted that there is a third chain associated with Bitcoin Unlimited and backed by BitPay, although they are thought to have thrown in their lot with the Bitcoin ABC implementation group.

Other factors creating a perfect storm for crypto may have come from the stock market, where the tech rout may be having a knock-on effect, but news from the IMF may ot have helped.

Beware the embrace of the IMF and central bank crypto?

Also, earlier this week IMF head Christine Lagarde made on the face of it some surprisingly positive noises about crypto. Lagarde thinks that central banks should explore the possibility of setting up central bank digital currencies (CBDCs).

Lagarde says crypto is “legitimate” but CBDCs in the mix would compete with private money in the shape of crypto and the financial authorities could create a regulatory framework to make CBDCs king and kill-off public blockchain cryptocurrencies.

Speaking at the FinTech conference taking place in Singapore this week – one of the largest such events anywhere in the world – Lagarde saw the pluses of crypto:

"The advantage is clear. Your payment would be immediate, safe, cheap, and potentially semi-anonymous. And central banks would retain a sure footing in payments."

She continued: "In addition, they would offer a more level playing field for competition, and a platform for innovation. Meanwhile your bank or fellow entrepreneurs would have ensured a friendly user experience based on the latest technologies."

Today, the Bank of England in conjunction with the Monetary Authority of Singapore and the Bank of Canada, released a report on CBDCs with the entitled "Cross-border interbank payments and settlement: emerging opportunities for digital transformation".

Technical analysis

On a technical view, bitcoin’s failure to push above $6,500 has led to a reversal as bulls tired.

This was seen in the "death cross" signal that flashed on 10 November s seen in the 1-hour BTCUSD chart below using Bitfinex exchange data, when the 50-day moving average (green line) fell below the 200-day MA (red line). Prices on Bitfinex often trade at a premium to other exchanges:

Source: Bitfinex Past performance is not a guide to future performance

Bullish exhaustion is certainly the view of Naeem Aslam, chief market analyst at Think Markets UK: “After the recent attempt to clear $6,500 bitcoin has lost all its momentum and now we are seeing some very bearish signals.”

The dramatic fall may also have taken out traders’ stop-losses as the bitcoin price sank below $6,000.

But the technicals alone rarely tell the whole story – sentiment has driven this sell off.

It remains to be seen at what level buyers will return, given the fragility of the market which many participants thought had already found a floor over the past few weeks of low volatility.

Brian Kelly, chief executive and founder of BKCM is resting the blame squarely on Bitcoin Cash. “When you do a software upgrade, everybody usually agrees. But in this particular case, everybody is not agreeing.”

But Kelly thinks this will be a temporary setback.

Some asset will be "marked to zero"

Meltem Demirors, chief strategy officer at CoinShares, the company behind the XBT Provider Bitcoin and Ethereum exchange traded notes, thinks this latest downturn could doom many projects, as they start to run out of funds.

“What we see across the board is asset prices are down 75% or more, in some cases 95%. They’re going to need to start firing employees. They’re going to need to cut costs.”

As with been saying for some time, consolidation will gather pace the longer the bear market persists. “You’re going to see consolidation, and some of these assets, inevitably, will get marked to zero,” Demirors told CNBC.

Meanwhile, the battle for second place in the crypto league table is ongoing between Ethereum and XRP.

Currently, XRP is at $18,163,539,478 having pushed ETH into third place for now, at $18,080,656,480, according to coinmarketcap data.

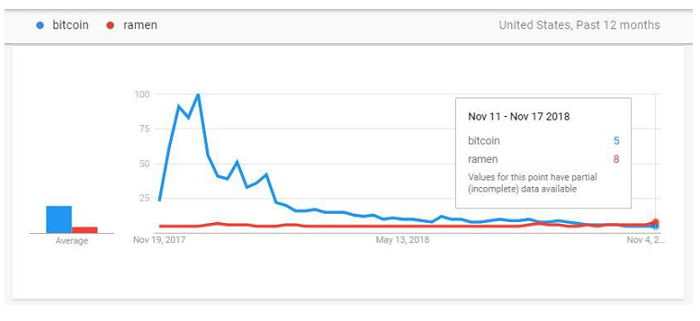

Ramen beat bitcoin, but 9% of millennials have bought

On a lighter note, US consumers are more interested in Ramen noodles than they are bitcoin if Google Search data is anything to go by:

Finally, according to a YouGov survey this week, 9% of UK millennials (18 to 24-year-olds in this case) have bought bitcoin and 93% of Brits have heard of the crypto asset.

Additionally, 21% of Brits reckon that crypto will eventually be used as money just like paper money and credit and debit cards, while 34% are undecided on whether crypto has a successful future to look forward to.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.