Bitcoin latest: Facebook, Wall Street, G20 and Iran

Our award-winning crypto writer rounds up industry news and explains what's driving prices right now.

28th June 2019 15:05

by Gary McFarlane from interactive investor

Our award-winning crypto writer rounds up industry news and explains what's driving prices right now.

The bitcoin rollercoaster is back with a vengeance. From a recent peak at $13,800 to the trough at $10,500, the digital currency has fallen $3,300 for a 23% pullback.

The parabolic charge of the past few weeks has proven unsustainable, but does it take some of the more expansive price targets bandied about recently off the table?

Probably not. The price has now risen 10% from those lows and, at the time of writing, is priced at $12,075.

Wednesday’s sharp reversal saw the price initially drop $1,700 in the space of around 15 minutes, coinciding with major US crypto exchange Coinbase going offline.

That led many to jump to a causal connection, although that’s yet to be definitively proven.

The price recovered quickly from its US session low at $11,900 to trade back at the top end of the $12,000s, before dumping again the following day until it eventually found support at $10,500.

(4-hour candles on BTC/USD, courtesy TradingView)

Readers will recall that in our last roundup a week ago, we were predicting a breakthrough to $10,000. That has come to pass in spectacular fashion, with bitcoin now $2,000 above that level.

If you shut your eyes in the period between today's roundup and that of a week ago, you will see just an upward trend and no correction. In other words, the rally is still intact, with perhaps slightly more sedate progress ahead, but who knows – the parabolic rises could return and the attendant crashes too.

The busiest fiat-to-crypto exchange in the world in the largest crypto market becoming unavailable, was an unwelcome reprise of the infrastructure issues that plagued exchanges in the red-hot market conditions of late 2017.

It would appear that the cutbacks to capacity made by many exchanges during the downturn in prices in 2018, which saw daily trading volumes plummet, may have undermined some of the network resilience put in place in the previous market top.

Unregulated bitcoin futures trading go ballistic on BitMEX

Volumes in the futures contracts on the popular BitMEX exchange, where leveraged trading is offered, stood at $250 million when Coinbase's problems began.

Shortly after the price began dropping, one of the exchange’s most crowded bitcoin trades - the bitcoin/US dollar perpetual swap contract – had attracted $690 million in business. As the name suggests, perpetual swap contracts do not have an expiry date for settlement, so effectively are similar to rolled over futures contracts, except there’s no need to close the contract to roll the underlying asset into a new longer-dated contract.

Hong Kong-based BitMEX has been seeing huge trading volume increases, with customers attracted by its margin trading – its clients can trade on leverage of up to 100x.

BitMEX exchange is the largest margin and futures trading venue, and sophisticated investors are able to short markets - i.e. make money when prices fall. Daily futures volumes rose to $14.1 billion on Thursday.

With “open interest” in bitcoin futures contracts at records in both the unregulated exchanges such as BitMEX and on the regulated CME bitcoin futures market in Chicago, it is further evidence that institutional interest is growing, and so too purely speculative hot money.

Buying bitcoin at the top – ouch

Additionally, retail investor interest was piqued, to some extent it would seem, with the stratospheric price gains attracting attention – bitcoin was up 36% in the seven days before the reversal.

Those tempted to enter around the highs at $13,800 had their fingers badly burnt.

According to information shared on a WhatsApp group for London-based crypto industry insiders and traders, some punters were caught on the wrong side of the "flash crash".

"My ex just lost everything by longing", related one group participant. She had reportedly bought bitcoin at $13,700 using her life savings. Sadly, for her, she made use of the 5x leverage available on the Kraken exchange.

The recent news flow has put a floor under prices and extreme volatility remains a stubborn feature of the bitcoin market. That's good for traders who can go long or short, but not for ordinary folk trying to time buying into this market.

We hear a lot about short squeezes when prices rise but the reverse may have contributed to the speed of the pullback, as long positions were taken out, forcing sell orders at previously set stop-loss positions.

Although more institutional money flow should mature the market and improve order book depth, which in turn should help to tamp down on volatility, liquidity is still an issue in the markets, or the lack thereof.

Poor liquidity can have the effect of exaggerating price movements set in motion by relatively small trades. This is one of the factors that pushes many institutional buyers towards the over-the-counter markets where liquidity can be guaranteed to fill orders.

Overall crypto market capitalisation plummeted as a result of bitcoin giving up a large chunk of recent gains and altcoins joining the sell off, shrinking by $52 billion to $334 billion.

Bitcoin daily trading volumes hold up well

Bitcoin trading volume has held up rather well throughout the turmoil of the past couple of days.

Coinmarketcap shows daily volume of $39 billion for bitcoin, not too far below the $46 billion peak recorded yesterday.

Those headline figures are useful in terms of trends, but much of the data reported from crypto exchanges, and used in coinmarketcap's calculation, is unreliable.

A better indication is provided by Bitwise Asset Management, which takes data from 10 exchanges where data can be verified, the top four by volume being Binance, Coinbase, Kraken and Bifinex. That data shows daily volume of $4.9 billion for the spot markets.

Futures daily volume in the regulated futures traded on the Chicago Mercantile Exchange has been at record levels also, currently at $1 billion.

Old Wall Street hand says buy the dips

As we have suggested in previous reports, buy the dips may be back in vogue. And from that perspective, the sharp fall in the price, which was even more violent than the advance, is a good thing.

That's certainly how trading veteran Jim Iuorio of TJM Institutional Services sees it. He reckons the market is reintroducing healthy risk awareness and squeezing out some of the weaker hands.

Speaking on CNBC yesterday, before the bitcoin price had found support, Iuorio said: "The size and the speed of the rally was unsustainable, and the size and the speed of the correction was even worse," he said. "But what something like that just does is it shakes out the weak hands and reminds people that there's risk. This is, I hate to say, a healthy movement in something that's gone as far as it is... This is what has to happen. I think it could easily gather itself above the $10,000 level and resume what it was doing before."

Novogtraz sees stability at $10 to $14k with Facebook Libra help

Mike Novogratz, founder of Galaxy Digital, thinks the price will stabilise between the $10,000 and $14,000 levels. Although he sold some bitcoin in the rout and said "I wish I had sold more", he nevertheless remains bullish.

In line with other commentators, Novogratz thinks Facebook's Libra is the single biggest positive in the market right now, giving confidence to buyers.

As far as the institutions go he said: "One of the largest companies in the world said we believe in cryptocurrencies… If you're an institutional investor who's getting close and still worried about investing, it makes you that much more confident."

European Banks respond to Libra

Even though Libra is yet to launch and will have some sizeable regulatory hurdles to navigate before it does, the impact of Facebook's announcement is already impacting the plans of banks.

European Union finance industry spokesperson Etienne Goosse, director general of the European Payment Council says all banks in the bloc will be members of a real-time payments system. Several already exist, such as the European Central Bank's Target Instant Payment Settlement system and private clearing houses like the EBA.

According to a Reuters report, when asked about the impact of Libra, Goosse said:

"They come with a global solution, under a global brand offering many things that the consumers seem to find wonderful. So we have no time."

On plans to rationalise the competing systems to deliver a uniform platform that can compete with something like the proposed Libra infrastructure, Piet Mallekoote, chief executive of the Dutch Payment Association, said:

"The challenge now is to make these mechanisms interoperable."

In a further example of the current fragmentation, The Netherlands already has a national system for instant bank payments.

Iranian miners power up

The US-sanctioned Iranian economy is suffering and one side-effect of that is the growth in bitcoin mining. Such has been the explosion of mining activity it has led to a surge in electricity consumption, with a 7% increase recorded in June.

The government has had enough and moved to start seizing mining equipment, with 1,000 machines confiscated from two factories this week, according to local TV reports.

Mining is thought to be taking place in all sorts of different locales, with even reports of mosque premises being used to store and run the power-hungry mining rigs.

Speaking to the BBC, Mahsa Alimardani, who is a researcher at the Oxford Internet Institute and from an Iranian background, said:

"Everyone's talking about bitcoin and how to get it."

Crisis hit economies such as Iran and Venezuela also have cheap energy supplies (when the grid is working in the case of Venezuela), which makes bitcoin highly attractive to mine for its store of value properties.

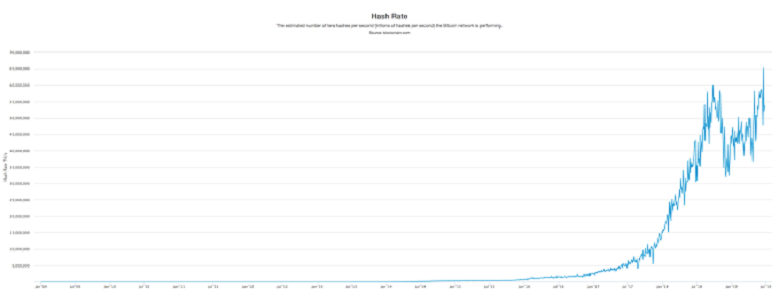

Meanwhile, the bitcoin network fundamentals continue to improve with the hashrate (computing power) registering record highs, no doubt with a little of help from Iran.

It hit an all-time high on 23 June.

(Chart Blockchain.com)

Keep an eye on the G20

With the G20 meeting currently under way in Japan, financial markets are anxiously waiting on news of how the Xi-Trump meeting goes on Saturday.

It is hoped that the two leaders will be able to get the trade talks back on track, although early indications were not good after Xi spoke about "bullying" tactics.

Chinese investors using bitcoin to get money out of the country are thought to be a key driver of prices, so expect G20-related bitcoin price action over the weekend.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.