Bitcoin pulls back from two-month highs, Samsung turns to crypto

Our award-winning analyst has all the crypto news, including the views of Warren Buffett and Elon Musk.

26th February 2019 10:30

by Gary McFarlane from interactive investor

Our award-winning analyst has all the crypto news, including the views of Warren Buffett and Elon Musk.

Just when the market thought it was settling down into a much-welcomed price recovery, the bitcoin price ran into strong resistance near US$4,200, recoiling dramatically.

On Sunday, bitcoin lost around 10% of its value in the steepest pull-back of the year. The violence of the decline, shedding $400 in the space of half an hour, follows the bullish shift in sentiment of recent days.

Now market watchers are focused on whether bitcoin can hold above $3,800.

Ethereum is currently trading at $136 on Coinbase, while bitcoin is priced at $3,811 on Kraken, according to CryptoCompare.

Trading volume across the entire crypto market is still strong at $38 billion but market cap has seen $12 billion evaporate since Sunday, shrinking to $129 billion.

Bitcoin remains higher than where it was between 8-17 February, when it spent days hovering around the $3,600 mark. However, a retrace to sub $3,500 levels would confirm the bear market is very much intact.

Sunday's correction will also be further grist to the mill of the crypto sceptics.

Yesterday in an appearance on CNBC, renowned investor Warren Buffett and chief executive of Berkshire Hathaway, repeated his firm conviction, "explained to me by people a lot smarter than I am" as he put it, that bitcoin is worthless.

"Bitcoin has no unique value at all. It doesn't produce anything. You can stare at it all day and no little bitcoins come out. It's a delusion basically."

Buffett added that "it attract charlatans". He conceded that the underlying blockchain technology was "important" but said its success was not dependent on cryptocurrencies.

So where does the bitcoin price go from here?

CoinDesk's Omar Godbole highlights the bearish cross seen in the 50-day moving average (MA) dropping below the 100 MA as indicative of a bottom being formed. Such a cross on the one-week chart was last seen in April 2015, signalling the end of the bear market back then.

Source: Tradingview Past performance is not a guide to future performance

Godbole convincingly notes that the break in relative strength index (RSI) declining trendline coincides with bear cross which he sees as a warning that "could trap sellers on the wrong side of the market".

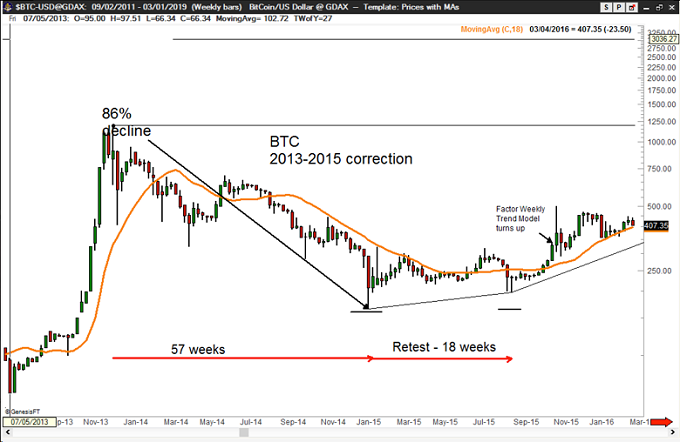

Another view comes from respected professional trader Peter L Brandt and author of Trading Commodity Futures With Classical Chart Patterns. He also sees parallels with the 2013-15 bitcoin price correction, but is keeping his options open on whether the bottom is in or there are more retests of the lows to come, as illustrated in the charts he posted on Twitter reproduced below. The recovery of the past 10 days or so may have been a dead cat bounce:

Source: interactive investor Past performance is not a guide to future performance

However, Brandt's charts do indicate that although we may not be quite there yet, the bear market is near the endgame.

This latest rejection of overhead resistance above $4,000 underscores the fact that the bulls are not out of the woods just yet, with the advance of previous days obliterated by sell orders triggered close to $4,200, with profit-taking setting in.

Mati Greenspan, senior market analyst at investment platform eToro in comments on email, pointed out that yesterday's precipitous fall began with Ethereum weakness, not bitcoin.

"Curiously, this slide was led by Ethereum, which dropped about 5 minutes ahead of the rest of the market. As such, Ethereum has now become a bell weather asset for the market. Last week's miniature bull run was led by Ethereum, and this latest slide means the asset cements its place as a key signal for investors watching the market."

Up until yesterday the crypto market had been digesting a clutch of favourable developments that were being interpreted as signs of strengthening in fundamentals and adoption prospects.

Samsung's new phone has crypto wallet, targets gamers with Enjin Coin?

Korean industrial conglomerate and smartphone giant Samsung has said its new flagship phone, the Galaxy S10 will come with a built-in cryptocurrency storage solution, although it did not use the word wallet.

In a statement the company said: "Galaxy S10 is built with defence-grade Samsung Knox, as well as a secure storage backed by hardware, which houses your private keys for blockchain-enabled mobile services." Samsung Knox is the company's proprietary enterprise mobile security solution.

In order to guarantee full access to their crypto holdings, owners need to securely store their private keys under their own direct control.

Although Samsung's solution achieves this, users would still need to store the 12-word recovery phrase "seed" required to restore the keys if the phone (and therefore the wallet) was lost.

Samsung is the number one smartphone manufacturer globally, with a 17% market share according to research firm Gartner. With a presumably easy-to-use crypto wallet in the hands of millions of consumers, the Galaxy S10 could provide a substantial fillip to adoption hopes, especially in Asia where mobile payments has greater penetration than in the Europe and especially the US, which is something of a laggard in that regard.

Little is known about the wallet but leaked photos appear to show that it may support ERC-20, ERC-1155 and ERC-721 tokens of the Ethereum blockchain in addition to bitcoin.

Tworld, South Korea's second-largest telecoms company, released an image showing what appeared to be the wallet of the gaming-focused Enjin project.

Additionally, images and video from the Samsung Mobile Business Summit held in Barcelona yesterday confirm that at minimum the Enjin Coin is being supported as is South Korean decentralised app focused on the beauty industry, Cosmee - both cryptoassets were pictured in stage slides as being supported, alongside bitcoin and Ethereum.

(Credit: Asia Crypto News)

Enjin Coin (ENJ) has appreciated 179% to $0.1012 on the back of the rumours and the subsequent corroborating evidence that appear to show it is indeed a Samsung partner. Cosmee is 45% higher today.

However, there is a big difference between on the one hand Samsung's Galaxy S10 supporting the Enjin Coin and, on the other, using the Enjin Crypto Wallet as the default pre-installed crypto storage solution for the Galaxy S10.

Enjin is building an ecosystem for gaming that has impressive traction, with 20 million users with 250,000 gaming communities already onboard. The Enjin Coin token is used for buying in-game digital assets and assigning ownership.

Statista estimates $32 billion will be spent on in-game virtual items by 2020.

The tie-up with Enjin may be a smart move on Samsung's part as it would help it to target the fast-growing gaming and e-sports markets, particularly in Asia.

ERC-1155 (invented by the Enjin team) and ERC-721 are what are known as non-fungible tokens – each token is different and as such can represent unique items, for example in-game digital assets.

Given the fierce competition in the handset world, other manufacturers may follow where Samsung has led. HTC and Huawei already have phones in their line-up with blockchain features and Sirin Labs has built a blockchain-based smartphone called Finney, launched late last year.

Separately, Enjin Crypto Wallet has been available to download since last year for both Android and iPhone and supports storage of 700 tokens. It also includes a feature called Beam that allows the user to receive crypto deposits by scanning a QR code. In January it also introduced in-app token conversion, enabling trading of tokens between each other with a feature called Enjin Wallet Swap.

Dubbed the world's most secure browser by Enjin, the software wallet uses the NSA “Rule of Two” encryption method to encrypt data that has previously been encrypted using the same or different algorithms.

Nasdaq, JPM Coin and pizza

On 11 February Nasdaq released news that it would start disseminating real-time price data for bitcoin and Ethereum. The indices – the Bitcoin Liquid Index (BLX) and the Ethereum Liquid Index (ELX) – are constructed by New Zealand crypto research house Brave New Coin with data going back to 2010 and 2014, respectively.

Nasdaq's announcement is noteworthy because it goes some way towards addressing concerns at the US Securities and Exchange Commission (SEC) about price discovery and market manipulation in crypto markets, given the Nasdaq's regulated status. As with the CME and CBOE derivatives exchanges' bitcoin reference prices, it will also help in assuaging the worries of institutions looking to get into the crypto space with their own products.

The Nasdaq exchange says its independent auditors have vetted the indices to International Organisation of Securities Commissions (IOSCO) standards. The indices take data from a number of exchanges and the data will be available on Nasdaq effective from today (25 February).

According to Bloomberg, Nasdaq is planning to launch a bitcoin futures product this year.

The plans of JP Morgan Chase to launch a JPM Coin - although dismissed by some in the cryptocurrency industry because of its private nature and peg to the US dollar - has nevertheless had the effect of validating for doubters the value of blockchain technology.

On the fundamentals, the Lightning Network second layer used to increase transaction throughput has been going from strength to strength. Network capacity is up 26% in the past 30 days and capacity now at $.7 million (725 BTC).

Following the launch of an app called Lightning Pizza (ln.pizza) by US crypto payments start-up Fold, consumers in the US can now buy pizza from Domino's Pizza with bitcoin.

Germany turning to blockchain?

Elsewhere, the German government is consulting the crypto and other industries on how blockchain can be deployed most effectively in the country's economy, Reuters reported on 18 February. The consultation is with a view to presenting a report outlining a strategy by the summer.

The Reuters story citing unnamed sources said it was as yet unclear whether the consultation would result in new legislation but interest in submitting ideas on the technology's implementation was keen across industries, "including cars, pharmaceuticals, energy and public sector administration that hope to transform mass market processes via blockchain".

Germany is the world's fourth-largest economy and Berlin has become a hub for blockchain development, being the home to 170 crypto start-ups.

World first in trade by Argentina and Paraguay, crypto a lifesaver in Venezuela

In Latin America, Argentina and Paraguay caused a stir with news that they had settled a trade deal using blockchain technology. The transaction was small but nonetheless significant as the first international trade settled with crypto.

Paraguay bought $7,100 worth of pesticides from Argentina using bitcoin. The trade was conducted on the platform of regional financial services provider Bitex. The transaction was initiated with bitcoin and then converted into Argentine peso on settlement with the exporter.

Staying in Latin America, an article in the New York Times by Venezuelan economist Carlos Hernandez headlined Bitcoin Has Saved My Family, again highlights the progress being made by bitcoin as a store of value in Venezuela amidst the country's economic and political travails. By way of example, the author said his brother is sending BTC to Colombia in preparation for when he emigrates there. The peer-to-peer trading platform localbitcoins.com, where buyers and sellers connect with each other to arrange transactions, is the most popular trading venue. Inflation in 2018 was running at 1.7 million per cent.

The Dash cryptocurrency is also increasing in popularity in Venezuela. It uses a privacy feature called Private Send that mixes the coins of three users, with this process repeated as many as eight times. Given the current government's strict oversight of monetary activity, it makes so-called privacy coins that add layers of anonymity not available with bitcoin attractive.

Elon Musk likes bitcoin's value transfer but not its energy consumption

Tesla chief executive Elon Musk in a podcast interview with ETF provider Ark Invest made some widely reported glowing remarks about crypto.

"Bitcoin structure was (is) quite brilliant," he gushed. He also thinks Ethereum and some others are worth watching.

Speaking about crypto more generally and comparisons with fiat, he said:

"It bypasses currency controls. … Paper money is going away. And crypto is a far better way to transfer values than a piece of paper, that's for sure."

However, not so widely circulated by those looking to accentuate the positive, was Musk's thoughts on bitcoin's weakness, as he sees it, in its proof-of-work consensus system for verifying transactions that requires large amount of computing power for the "mining" process, which in turn leads to the protocol minting new coins.

"It's very energy intensive to create bitcoin at this point," said Musk.

And just to be clear, in case any shareholders were listening, Telsa is not about to accept bitcoin for payment for its electric vehicles. Musk is big on renewables so at this juncture it would not be "a good use of Tesla's resources to get involved in crypto".

Bitcoin ETFs up for approval

The US SEC has started the clock on its decision on whether or not to approve two bitcoin exchange traded funds.

Awaiting consideration is one proposal from VanEck, SolidX and the Chicago Board of Exchange's BZX exchange and a second from Bitwise Investment Management and NYSE Arca.

The SEC has until 5 April to say whether either will be approved or rejected. It could kick the can down the road by deferring the decisions to a later date.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.