bitcoin: A store of value or time to ban it?

14th December 2018 12:23

by Gary McFarlane from interactive investor

Still dividing opinion like no other asset class, cryptocurrency writer of the year Gary McFarlane brings the latest on bitcoin, Ripple and Revolut from Allianz, the FCA and IMF.

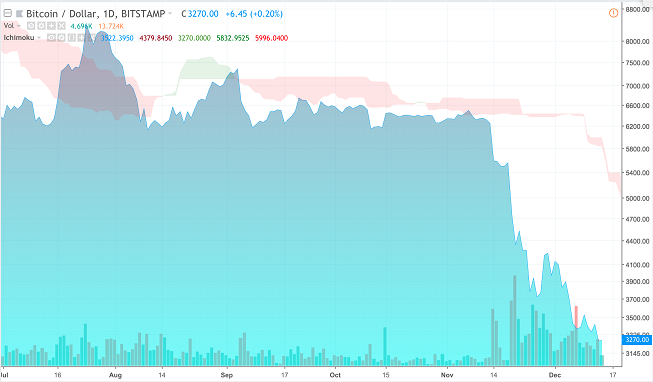

This time last week bitcoin was priced at $3,800 but has declined $500 in the seven days since, trading today at $3,300, as the down trend continues.

The top cryptocurrency has been rangebound for the past few days between $3,400 and $3,500, but has today slipped 3% to $3,300.

Total crypto market cap is now at $104 billion as valuation edges closer to falling below that $100 billion mark.

Bitcoin Permabull Tom Lee, co-founder of Wall Street analyst firm Fundstrat, reckons fair value for bitcoin is somewhere between $13,800 and $14,800.

He comes to that conclusion on the basis of the number of wallet openings.

Lee suggests a long-term price of $150,000, which he calculates on a regression model that assumes bitcoin user adoption reaches 7% of the number of users of the Visa network (4.5 billion).

"Hence, the risk/reward is still strong. Given the steep discounts of [bitcoin] to our fair value models, the excessive bearish sentiment about fundamentals does not seem warranted," Lee said in remarks to CNBC.

Put that another way: the market has got the price wrong.

In November Lee reduced his price target from $25,000 to $15,000.

Source: interactive investor past performance is not a guide to future performance

Allianz demands banning of crypto

With crypto still stuck in the bear market doldrums, it may have been assumed that any perceived threat posed to financial incumbents might have waned.

Not so, if the remarks of the boss of German investment and insurance giant Allianz are anything to go by.

At a conference in London on Tuesday, Allianz Global Investors chief executive Andreas Utermann called for the outright prohibition of cryptocurrencies.

"You should outlaw it" he said in comments directed at Andrew Bailey, the head of the UK's Financial Conduct Authority.

Uterman added:

"I am personally surprised that regulators haven't stepped in harder."

In reply to Uterman's comments Bailey said "that's quite strong actually".

Baily said "We are watching that very closely" and also had an eye on initial coin offerings (ICOs) used to raise fuds for blockchain projects.

ICO risk rewards and failures

Bloomberg today highlights a study by Boston College showing that 56% of initial coin offerings fail within four months of selling their tokens.

On the face of it then, ICOs sound like the chase for fool’s gold, but the study also found that investors on average earned high returns in the immediate aftermath of the start of token trading.

"Even after imputing returns of -100% to ICOs that don't list their tokens within 60 days and adjusting for the returns of the asset class, the representative ICO investor earns 82%. After trading begins, tokens continue to appreciate in price, generating average buy-and-hold abnormal returns of 48% in the first 30 trading days."

The paper by Hugo Benedetti and Leonard Kostovetsky entitled Digital Tulips? Returns to Investors in Initial Coin Offerings was published in May this year.

"What is bitcoin" is top definition search on Google

The public's fascination with bitcoin had many people asking "What is bitcoin", as they tried to get their heads around the seemingly impenetrable language and technical jargon that serves to mystify for many how a cryptographically secured decentralised digital ledger works.

Google Trends data shows that the question was the most asked for definition in the US and UK, with Ripple not too far behind in fourth place, with the question "How to buy Ripple".

Ripple's XRP token has become the number two cryptoasset to bitcoin because of its steady news flow of partnerships with leading financial institutions across the globe. There are around 100 major banks and other financial companies signed up to RippleNet, although most of the trials and projects don’t actually involve using the XRP token.

Another big Ripple deal

This week UAE Exchange and Ripple announced they are launching a remittance service targeting Asian markets, using the US company's blockchain technology for cross-border transactions.

Finablr, the owner of UAE Exchange, intends to list of the London Stock Exchange next year and UAE Exchange has been on an acquisition spree to grow its business, with the remittance market in Asia worth around about $613 billion annually. Among the brands it owns are Travelex and Xpress Money.

Promoth Manghat, chief executive of Finablr speaking to Reuters, said of the partnership: "Blockchain holds tremendous promise for the industry but there is progress to be made before we see it go fully mainstream.”"

"We expect to go live with Ripple by Q1, 2019 with one or two Asian banks. This is for remittances to start with, from across the globe into Asia."

US Commodity Futures Trading call for information

In a formal Request for Information, the Commodity Futures Trading Commission (CFTC) "is seeking public comment and feedback in order to better inform the Commission's understanding of the technology, mechanics, and markets for virtual currencies beyond Bitcoin, namely Ether and its use on the Ethereum Network."

US regulators have all-but outlawed ICOs in the US and some companies criticise its perceived overreach for holding back the crypto industry.

Gavin Smith, chief executive of Hong Kong-based Panxora exchange, is one such critic.

"US authorities are controlling the development of cryptocurrency globally by imposing draconian fines and sometimes criminal proceedings on companies. This can apply regardless of whether businesses are legally operating in their own jurisdictions," he says.

Is there a right to decentralisation?

The Kraken exchange, Chinese mining giant Bitmain and crypto enthusiast and entrepreneur Roger Ver are being sued by Florida-based United American Corporation.

United American alleges that the defendants “collectively engaged in unfair methods of competition and through a series of unconscionable, deceptive and unfair practices, manipulated the Bitcoin Cash network for their benefit and to the detriment of UnitedCorp and other Bitcoin Cash stakeholders”.

The fork in the Bitcoin Cash network, which took place on 15 November, led to two competing chains – BCH ABC and BCH SV.

United American claims that ABC introduced a “poison pill” to the network with its so-called “Deep Reorg Prevention” protocol changes, introducing a “checkpoint” system that ABC’s detractors say brings an element of centralisation to the network.

BCH ABC now trades under the old BCH ticker with the BCHSV chain, now called Bitcoin SV, using the BSV ticker.

Both coins have been battling for supremacy in the market cap rankings, with BSV briefly last week overtaking BCH in valuation. At the time of writing BCH is priced at $99 and BSV trading at $86.

Bitmain and Roger Ver’s Bitcoin.com mining pool are thought to have lost tens of millions of dollars mining BCH at a loss. The BSV camp, which is backed by billionaire Calvin Ayre and his CoinGeek mining pool, with much of the development work in the hands of nChain, owned by Craig Wright, have also been pouring resources into maintaining their BSV network – and also losing money in the process.

Weiss Ratings calls the bottom

Weiss Ratings which gave Bitcoin a lowly rating of C+ back in February 2018, has nevertheless tweeted to its followers that there's no better to time to start buying.

"BTC is getting to such low levels that it’s becoming one of the best buying opportunities of the year. As a store of value, bitcoin is here to stay. We truly think it’s the least speculative investment a person can make in crypto right now."

Presumably Weiss thinks the price has dropped to a price where the risk-reward potential now outweighs some of the issues it previously identified in its "first-generation" technology.

In September Weiss said that bitcoin would lose 50% of its market shares to Ethereum over the next five years, but this year the reverse has been happening, with bitcoin dominance growing, now standing at 54.9%, according to coinmarketcap.

Weiss is a respected ratings agency that has been providing its service to US customers for 46 years, so to some extent its strong endorsement of a buy position on bitcoin should be taken seriously. However, it is a tweet that could come back to haunt it if bitcoin fails to bottom at $3,000 as it predicts.

Part of the thinking behind its tweet centres on the launch of Bakkt by Intercontinental Exchange in January.

Weiss is banking on Bakkt

Lead crypto analyst at Weiss, Dr Bruce Ng, sees the launch of Bakkt as a game changer.

"It's hard to imagine a scenario in which Bakkt will NOT open the floodgates for large institutions to buy crypto. And the consequences are potentially far-reaching," he states.

Bakkt's bitcoin futures product begins trading on 24 January.

However, cryptowatchers will remember how the start in December 2017 of trading in bitcoin futures on the Chicago Board Options Exchange (CBOE), quickly followed by the much larger Chicago Mercantile Exchange (CME), coincided with the top of the bull market. Some blame the launch of the futures market for triggering the subsequent plunge in the bitcoin price, but with combined daily trading volumes of the two venues amounting to just 9,000, that seems far-fetched.

Weiss thinks Bakkt will actually lead to an increase in trading volumes because in order to launch the trading part of the platform it will be buying bitcoin to secure sufficient liquidity for smooth operations.

The ratings agency also expects institutions and high-net worth individuals who currently use the over-the-counter markets, to migrate to Bakkt, where its physically delivered bitcoin futures product will remove the headaches associated with custody.

It should also help improve the prospects for bitcoin exchange traded funds gaining approval, which to date have all been rejected by the Securities and Exchange Commission (SEC).

"Right now, we count 10 crypto ETFs that have already been rejected by the SEC. And the regulators' reasoning is twofold: No trusted price information and over-reliance on futures markets. But Bakkt could help resolve both issues, greasing the way for the launch of future ETFs like the VanEck/SolidX ETF in 2019."

Dr Ng also expects Bakkt will make it easier for corporations to raise capital with "regulated ICOs" that have become known as security token offerings.

Additionally, with Microsoft providing the cloud infrastructure for the trading and payments ecosystem, there's a possibility that Microsoft Pay might also "get into the act".

However, much more importantly where the payments service is concerned, is that fact that Starbucks is a partner.

Starbucks is the largest player in mobile payments in the US with 23 million app users, ahead of Apple Pay’s 22 million.

Bakkt is trying to solve the volatility problem holding back crypto as a means of payment by converting crypto into dollars on behalf of Starbucks' app users. Ng claims the app users "will be exposed to crypto like never before", albeit indirectly.

Sovren security token platform successful funding round

Regulated blockchain securities platform Sovren announced this week that it has raised $1,150,000 in a seed funding round led by Chaintechplc, a London-based incubator.

Sovren is muscling in on the security token offering (STO) space as it seeks shake-up the capital markets, and initial public offerings in particular.

Avijeet Jayashekhar, founder and chief executive of Sovren, said: "Our mission is to make the trillion dollars of illiquid assets, liquid and available to the global trading market. Blockchain and AI technologies will streamline fund raising and investment businesses that to date have seen very slow progress for innovation, specifically when it comes to making use of the best technologies to make investment more accessible to a global audience to build and create wealth."

Another UK-based start-up, Globacap, has built a platform for "creating securities in blockchain" and chief executive Myles Milston says it was "the first in Europe to do tokenisation of equities".

Cryptocurrencies are like lottery tickets that might pay off

Former IMF chief economist Kenneth Rogoff wrote in the Guardian this week that buying crypto was a bit like buying a lottery ticket.

He dismisses the notion that bitcoin is digital gold as "nutty" because it lacks any intrinsic value of the precious metal which, although used primarily as a store of value does also have growing industrial uses "from iPhones to spacecraft".

However, he cautions against writing off crypto completely.

"Just because the long-term value of bitcoin is more likely to be $100 than $100,000 does not necessarily mean that it definitely should be worth zero."

Rogoff also observes that central banks will "get into the game".

The crucial question is will they allow private money autonomy beyond the state? He thinks that's extremely unlikely. "When it comes to new forms of money, the private sector may innovate, but in due time the government regulates and appropriates."

So why is crypto like buying a lottery ticket?

Rogoff explains:

"Like lottery tickets, there is a high probability that they are worthless. There is also an extremely small outside chance that they will be worth a great deal someday."

UK unicorn and challenger bank Revolut has just received a European banking licence which means it can offer its customer full-blown banking services which in turn will see deposits protected up to €100,000 under the European Deposit Insurance Scheme.

Founder and chief executive Nikolay Storonsky, said: "With the banking licence now secured, commission-free stock trading progressing well and five new international markets at final stages of launch, we are living up to our reputation as the 'Amazon of banking.' Our vision is simple: one app with tens of millions of users, where you can manage every aspect of your financial life with the best value and technology."

Revolut has three million customers across Europe and intends to expand to the US, Japan and a number of other countries in 2019.

Revolut is valued at $1.7 billion and will be introducing commission-free stock trading in the near future. Another UK-based trading app, BUX, has just brought in commission-free trading, with Robinhood in the US having led the way with this pricing model.

"This is worrying for companies operating outside of the US, as you could create a business that is perfectly legal in your own jurisdiction, but still risks prosecution by the US Federal Government. Until sovereign governments take a stand to protect businesses operating within their borders, the US is being handed unchecked power in controlling the development of the crypto-economy."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.