Brexit fears weigh heavy on investors, poll shows

Our poll reveals customers’ stock market concerns.

16th December 2020 14:33

by Myron Jobson from interactive investor

Our poll reveals customers’ stock market concerns.

After a gruelling year socially, emotionally, and economically due to Covid-19, the first vaccine rollouts have not cheered all investors, whilst Brexit remains the biggest concern for interactive investor website visitors.

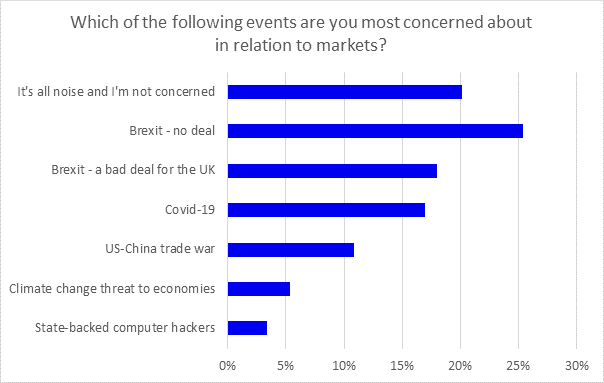

In a flash poll of 1,200 investors between 14-16 December 2020, interactive investor, the UK’s second largest DIY investment platform, found that Brexit uncertainty was the biggest stock market concern for 43% of investors. Of these, a quarter (24%) were most concerned about ‘no deal’, whilst 18% said that a ‘bad deal’ for the UK was their biggest concern.

And during a week in which a new strain of the coronavirus was announced (although there is no evidence to suggest it is more serious or has any implications for a vaccine), interactive investor found that 17% of respondents still think that coronavirus is still the single biggest threat to stock markets.

Many investors are happy to brush aside the macro events and keep to their trading strategy, but there are plenty of possible banana skins for investors to navigate in the final days of 2020 and into 2021.

Lee Wild, Head of Equity Strategy, interactive investor, says: “Despite the threat the pandemic still poses, Brexit is by far the biggest concern to our customers as trade talks enter the final throes. Failure to agree a set of rules for trade between the UK and EU after 31 December would cause serious disruption to many UK businesses, certainly in the near term. Higher tariffs might trigger price increases for certain goods, putting pressure on stretched household budgets, and at a time when many are struggling during lockdowns and the new tier system.

“But a ‘bad’ deal, which is of course subjective, is just as big a risk, according to many investors. Brexiteers demand that negotiators stick to the principles underpinning the Brexit vote, while Remainers hope for greater flexibility on a final deal. As is so often the case, it is impossible to please everyone all of the time.”

Some 11% were more concerned about a China/US trade war, whilst 5% are concerned about the climate emergency and its potential impact on markets. A sanguine 20% believe it is ‘all noise’ and say they are not concerned from an investment’s perspective.

What are investors doing?

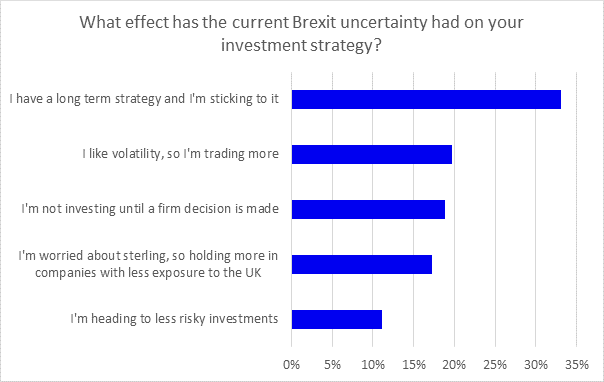

On Brexit uncertainty, almost a third (33%) are keeping their eyes fixed on the long term and are sticking to their strategies. The rest are evenly split between trading more because they like volatility (20%), not investing until a firm decision is made (19%) and moving away from UK investments due to fears about currency risk (17%). Some 11% say they are heading into less risky investments.

What about a no deal?

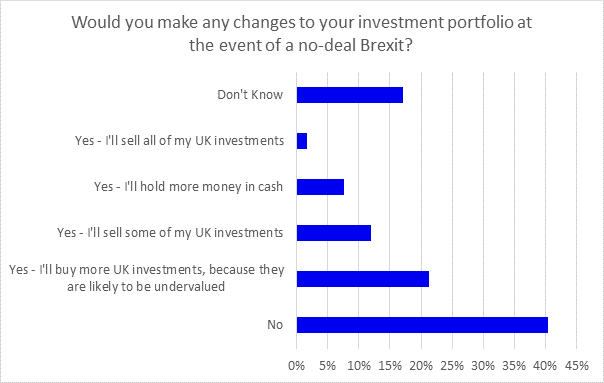

Whilst there are suggestions that a ‘path to an agreement’ could be days away, 40% of respondents said they would make no changes to their portfolios in the event of no deal. And whilst 12% say they would trim their UK shares exposure, 21% said they would top up their UK exposure because it would likely be undervalued. Some 8% say they will increase their cash holdings, whilst 17% don’t know what they would do.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.