Brexit: Three options for investors

19th November 2018 10:25

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Two months spent switching from equities to cash leaves Saltydog analyst Douglas Chadwick in a difficult position. What will he decide to do next?

Stick or twist?

Like most good ideas, the principles of momentum investing are very straightforward. The greater the amount of money that is being invested into a fund, or asset class, the quicker its value will rise. This in turn will attract further investment, pushing the price even higher. Obviously, the opposite also applies. As a fund or asset class loses investors, the upward momentum ceases and it will reverse, gaining impetus in the opposite direction. Time to move your money and exit stage left.

Sometimes the transition is gradual, which is ideal for trend followers, and sometimes it is more rapid, in which case the only option is to react as soon as is realistically possible. Sometimes, it's clear when there maybe a change in direction, and sometimes it comes as a surprise.

After a week when Dominic Raab, Esther McVey, Jo Johnson, Suella Braverman and Shailesh Vara all resigned from the cabinet over the latest proposed EU Agreement, it was probably inevitable that I would end up mentioning the 'B' word.

Brexit has dominated our politics since the beginning of 2016 when David Cameron announced that a referendum would be held on the 23rd June and that the UK Government would recommend that we should remain a member of the European Union.

We all knew that the result would have a significant impact on the markets, we just didn't know what the outcome would be. It was one of those occasions when it was clear that there maybe a change in momentum, but which way would it go?

In these situations, there are three options that investors can take. Do nothing, cross your fingers, and hope that everything will work out OK in the end. Take a conscious decision to back one of the possible outcomes, or go safe and watch from the side-lines as the story unfolds.

We all know that in the end the country voted to leave. One of the most immediate consequences was that the pound weakened.

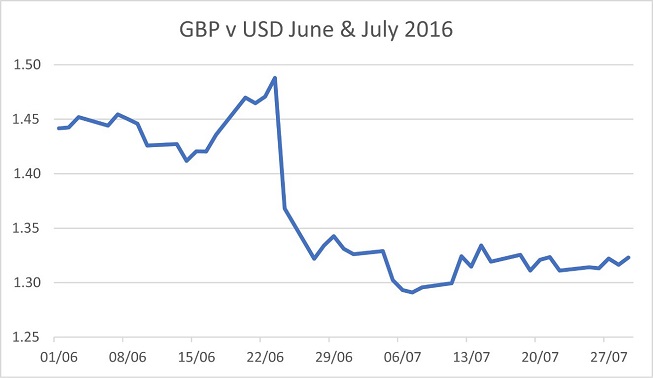

Here's a graph showing what happened to the value of sterling (GBP) relative to the US dollar during June and July 2016.

Source: interactive investor Past performance is not a guide to future performance

This shows the opening prices each day, if you look at the intraday prices then the swing is even more extreme. At one point on the 24th June 2016 the pound reached 1.502.

The following day it fell to a low of 1.312 – a drop of 19%. The value of any overseas investments (including the overseas earnings of the large international companies in the FTSE 100) immediately went up.

In recent weeks the value of sterling has been on a rollercoaster as the news on Brexit has moved from 'deal almost done' (pound strengthens) to 'deal impossible' (pound weakens).

We know what's causing the fluctuations, we suspect that the situation will get worse before it gets better, but we don’t know the final outcome.

In our demonstration portfolios we increased our cash holding in September, and again in October, as stockmarkets around the world headed down.

We now have to decide what to do next. Do we bet on a good Brexit, a bad Brexit, or do we sit tight and wait and see what happens? The last option will certainly help us sleep at night.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.