British American Tobacco issues Covid warning, but commits to dividend

A regular dividend payout is rare these days, but what about sales? Our head of markets reports.

9th June 2020 10:23

by Richard Hunter from interactive investor

A regular dividend payout is rare these days, but what about sales? Our head of markets reports.

The road ahead may be strewn with obstacles, but British American Tobacco (LSE:BATS), or BATS’ historic resilience will likely give the company a fighting chance in maintaining its premier position.

Providing guidance and confirming dividend aspirations are becoming increasingly rare in the current environment, but, in a refreshing change, BATS has delivered both.

The guidance reflects an impact from the pandemic, with the postponement of some product launches and the virtually complete removal of travel retail, or duty free, income resulting in a slight downgrade to revenues.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

The additional pressure has also meant that the revenue ambition of £5 billion has now slipped to 2025 from the previous 2023/2024, and the lockdown has resulted in tobacco bans in some emerging markets, most notably in South Africa where the company is currently embroiled in a legal challenge.

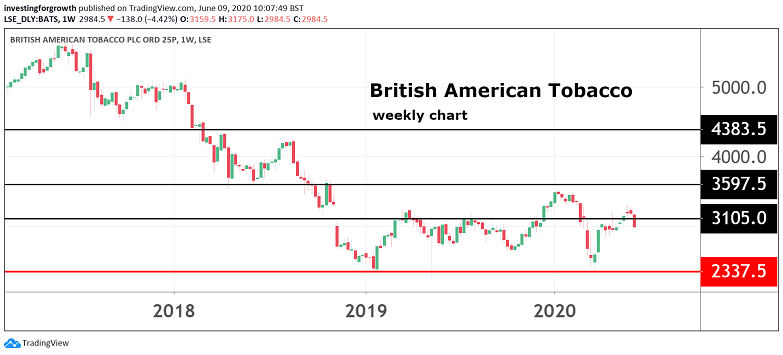

Source: TradingView. Past performance is not a guide to future performance.

BATS is also looking to stabilise its balance sheet by paying down some of its debt, for which it is well positioned given its cash generative abilities.

From a wider perspective, the structural difficulties of a declining market remain, while regulatory and retrospective legal actions continue to cast a shadow.

These were partial factors in what has been a tumultuous time for the industry, and BATS shares remain down 43% over the last three years given a particularly difficult 2018.

Even so, the bull case remains clear. BATS continues to generate cash on a prodigious basis given the underlying inelastic demand of its products, while also reaping the reward of high margins following a major cut to production costs after moving its manufacturing facilities some years ago to more cost-efficient geographies.

At the same time, it is ploughing capital into New Category products as tastes evolve and is currently showing market share growth in all three categories of Vapour, Tobacco Heated Products and Modern Oral.

Performance in its developed markets business, which account for 75% of revenues, has also been resilient and the net result is that BATS has confirmed its attitude to paying a dividend. The current yield of 6.6% seems, therefore, to be protected, which is both reflective of the company’s liquidity while also being of attraction to increasingly starved income-seeking investors.

The previous acquisition of Reynolds in 2017 has given BATS a strong foothold in the US, and where there are other pockets of potential growth, particularly in emerging markets, the company is well placed to continue its onward march.

Boss Jack Bowles also talked up BATS’ potential vaccine for Covid-19, under development at our US bio-tech subsidiary, Kentucky BioProcessing. It has apparently demonstrated an ability to “generate an immune response in pre-clinical testing and is poised to move to clinical trials”.

From a longer-term perspective, the company is cutting its cloth as new opportunities emerge in step with disappearing markets elsewhere.

Inevitably, any downgrades to revenue will be frowned upon by investors and the initial share price reaction is slightly negative. Over the last year, however, the price has outperformed the blue-chip benchmark, having risen by nearly 4%, as compared to a 12% decline for the wider FTSE 100 index, so displaying some of its defensive qualities. At the same time, appetite for the shares is undiminished, with the market consensus remaining firmly in place as a ‘strong buy’.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.