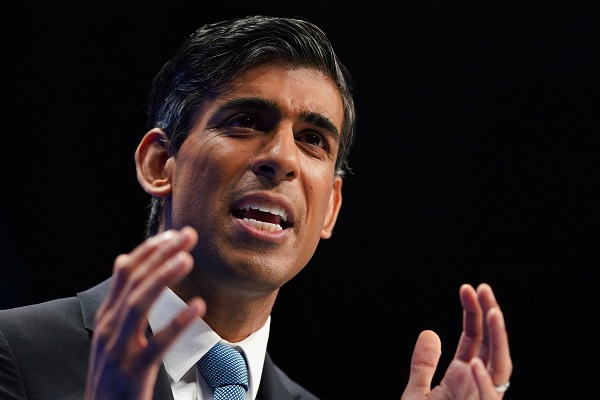

Chancellor and health secretary exit as cost-of-living crisis rages

6th July 2022 11:41

by Myron Jobson from interactive investor

Sinking feeling for HMS Britain as duo jump ship.

Commenting, Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “There is a sinking feeling for HMS Britain, with the crisis chancellor and the health secretary first to abandon ship amid the raging cost-of-living crisis and rising Covid levels.

“HMS Britain’s engine room is in a state of emergency and questions around the captain of the ship won’t go away any time soon. The UK is facing immense challenges with a spiralling rate of inflation which is at a 40-year high and has pushed the cost of virtually everything higher - from the food we put on our tables to how much we spend to fuel our vehicles.

“Rising interest rates, food and energy supply shortages stemming from the devastating war in Ukraine as well as Covid-related pressures are further headwinds that are buffeting household budgets - many to breaking point.

“Consumers are crying out for a steady hand on a tiller to steer the UK economy through unchartered waters.

“UK investors, meanwhile, have for the last few months turned away from personalities in favour of passives and ‘steady as she goes’ capital preservation strategies, according to our most-bought investments data.

“Diversification is the name of the game when it comes to investments – and even more so in a time of geopolitical tensions and rising inflation. Think global, think well-diversified investment funds and investment trusts as a starting point. These help to spread investment risk across sectors, markets and countries.”

Richard Hunter, Head of Markets, interactive investor, says: “The UK’s premier index staged a rebound in early exchanges, with gains broadly based and with the more beaten down stocks enjoying some relief. This comes after a punishing session yesterday which wiped almost 3% from the index as energy stocks felt the full force of the selling pressure. This was enough to add to the damage which has been done over recent weeks, and the FTSE 100 is now down by 3.5% in the year to date, despite the early bounce today.

“UK markets will be in general focus today as the latest round of political drama unfolds, with sterling likely to feel most heat. The domestically focused FTSE 250 also managed a small bounce, although remaining significantly weaker in the year to date, having lost some 21%.

The imminent reporting season on both sides of the pond now takes on additional significance as investors attempt to gauge not only the current performance of corporates on the ground, but also outlook and guidance comments from companies given the murky waters of growth and economic prospects.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.