A chapter closes, but it’s not the end of the Share Sleuth story

Richard Beddard shares a message with loyal followers of his model portfolio.

20th July 2020 14:58

by Richard Beddard from interactive investor

Richard Beddard shares a message with loyal followers of his model portfolio.

I wrote my first Share Sleuth column over 12 years ago, and it was published in the July 2008 edition of Money Observer magazine. The article was a profile of Haynes Publishing, the company behind the famous motor manuals. The column has outlived Haynes’ listing on the stock market, just. Haynes was taken over by Infopro Digital, a Dutch business, in February, and less than six months later I’m unexpectedly writing my last column for Money Observer.

Forgive me a moment of sentimentality before I get down to business. I had hoped Money Observer and I might grow old together because I hold you readers in high regard. Over the years you have sent me many encouraging and curious emails, even though I write about shares and the magazine is predominantly about funds.

Mutual affection

Our mutual affection may be because we have much to learn from each other irrespective of the financial instruments we buy and hold. I hope it’s also because I have always resisted the urge to pose as an expert. There are many private investors I look up to who don’t even consider themselves to be expert, and the stock market has a tendency to make any expert look foolish. Like you, I am a human being, with some useful knowledge, trying to provide for an uncertain future.

Share Sleuth has a new home, but I’d like to close its first chapter with an observation: which is that in investment, working out which pundits will do well is probably just as difficult as working out which fund managers or companies will. That is the notion that got me into stock-picking 25 years or so ago, and the challenge of finding shares in good companies at reasonable prices has occupied me ever since, as a hobby at first, and then as a researcher and writer. I believe successful investors put their trust in themselves. Based on the emails I have received, you do too.

This being a Share Sleuth column, it would be remiss of me not to report some activity in the portfolio. I have reduced its holding in one of my favourite shares, but not because I no longer rate the company – I do. And not because the directors have been selling shares, although they have. I’ve reduced the portfolio’s holding in XP Power, a manufacturer of power converters used in industrial and medical machinery, because the share price has risen strongly. As a consequence, the size of the portfolio’s holding has grown to nearly 9% of its total value.

To spread risk more evenly, on 29 June, I reduced the portfolio’s holding from 339 to 240 shares. At a share price of £34.45, the transaction raised £3,500 after a £10 deduction in lieu of broker fees. On the day, the remaining holding was worth £8,592. It remains a large holding, worth more than 6% of the total value of the portfolio, and ranks third after Games Workshop, the parent of Warhammer, the wargaming powerhouse, and Solid State, a distributor of electronic components and manufacturer of electronic equipment.

The portfolio’s cash balance has risen to £5,675, more than enough to add to an existing holding or buy a new one. The most compelling of the shares I watch most closely, based on its merits as an investment and the portfolio’s relatively modest position (3% of its total value), is Howden Joinery, the supplier of fitted kitchens to the building trade, which profiled in Share Watch in May. That though, is a decision for another day.

The next Share Sleuth update will be published in early August on interactive investor, so if you would like to keep hearing from me please bookmark my author page. As always, I will be glad to receive your emails.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

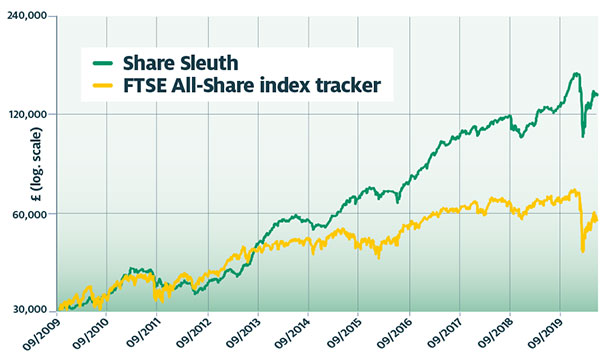

Profitable benchmark divergence

Trimming XPower to add elsewhere

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 5,675 | ||||

| Shares | 133,637 | ||||

| Since 9 September 2009 | 30,000 | 139,312 | 364 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 6,653 | 1 |

| AVON | Avon Rubber | 192 | 2,510 | 6,490 | 159 |

| BMY | Bloomsbury | 1,256 | 3,274 | 2,455 | -25 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 2,552 | -30 |

| CGS | Castings | 1,109 | 3,110 | 4,114 | 32 |

| CHH | Churchill China | 341 | 3,751 | 3,717 | -1 |

| CHRT | Cohort | 1,600 | 3,747 | 8,320 | 122 |

| DTG | Dart | 456 | 250 | 3,867 | 1,447 |

| DWHT | Dewhurst | 735 | 2,244 | 6,615 | 195 |

| GAW | Games Workshop | 113 | 324 | 9,611 | 2,865 |

| GDWN | Goodwin | 266 | 6,646 | 8,206 | 23 |

| HWDN | Howden Joinery | 748 | 3,228 | 4,172 | 29 |

| JDG | Judges Scientific | 159 | 3,825 | 8,236 | 115 |

| NXT | Next | 45 | 2,199 | 2,264 | 3 |

| PMP | Portmeirion | 349 | 3,212 | 1,274 | -60 |

| PZC | PZ Cussons | 1,870 | 3,878 | 3,456 | -11 |

| QTX | Quartix | 1,085 | 2,798 | 3,450 | 23 |

| RM. | RM | 1,275 | 3,038 | 3,060 | 1 |

| RSW | Renishaw | 92 | 1,739 | 3,765 | 116 |

| SOLI | Solid State | 1,546 | 4,523 | 8,410 | 86 |

| TET | Treatt | 1,222 | 1,734 | 6,110 | 252 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,020 | 173 |

| TRI | Trifast | 2,261 | 3,357 | 2,566 | -24 |

| TSTL | Tristel | 750 | 268 | 3,188 | 1,088 |

| VCT | Victrex | 323 | 6,254 | 6,379 | 2 |

| XPP | XP Power | 240 | 6,287 | 8,688 | 38 |

Notes: Reduced existing holding. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance £30,000 invested on 9 September 2009 would be worth £139,312 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £57,820 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 2 July 2020.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.