A cheap bank share offering respectable dividend income

This stock is insulated from global uncertainties, but benefits from the relatively strong US economy.

19th February 2020 09:15

by Rodney Hobson from interactive investor

This stock is insulated from global uncertainties, but benefits from the relatively strong US economy.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Solid fourth-quarter results were reported by Citizens Financial Group (NYSE:CFG) but they have not been reflected in the share price. On the contrary, recent share price weakness has opened up a buying opportunity.

Citizens is one of the oldest and largest financial institutions in the United States, though it has many better-known rivals, perhaps because its headquarters are in Providence, Rhode Island, rather than a more fashionable business centre such as New York or Boston.

Nonetheless, it has assets of $166 billion and it offers a broad range of banking services and products to individuals and to companies, ranging in size from small businesses to large corporations. It has 1,100 branches in New England, Atlantic coast and Midwest states.

Source: interactive investor Past performance is not a guide to future performance

Citizens reported underlying net income of $454 million in the final quarter of 2019, up 4% on the same three months of 2018. Highlights were record non-interest income, up 17% year on year, record results in capital markets, foreign exchange and interest rate products and strong results in mortgage banking. That’s a fair slab of any bank’s business.

For the full calendar year, net income rose 4% to $1.8 billion and earnings per share jumped 8% to $3.84. The figures beat analysts’ expectation. The balance sheet remains strong.

Once again, the quarterly dividend has been raised, this time by 8%, which means the dividend for the first quarter of 2020, paid last week, was 22% higher than a year ago.

Citizens bought back 10.9 million shares in the final quarter of 2019 at an average price of under $37. That took the total buybacks over the full year to 34 million shares at an average of around $35.50. That level may not be seen again, so this looks an astute move.

- Three banks to buy and one to avoid

- Want to buy and sell international shares? It’s easy to do. Here’s how

One downside among the latest figures is a 29% increase in provisions for credit losses to $110 million. This is probably erring on the side of caution, as total non-performing loans and leases were down 8% to $703 million.

The outlook for this year is positive, with a small boost from a string of mainly small acquisitions that expand the bank’s geographic reach and business clientele. As a regional US bank, Citizens should be reasonably insulated from global uncertainties while it continues to benefit from the relatively strong performance of the US economy.

Net interest income should be higher, at least in the first quarter, with some growth in loans accompanied by stable margins. Non-interest income could be down a little from the particularly strong fourth quarter but still ahead of the comparative figure from the start of last year.

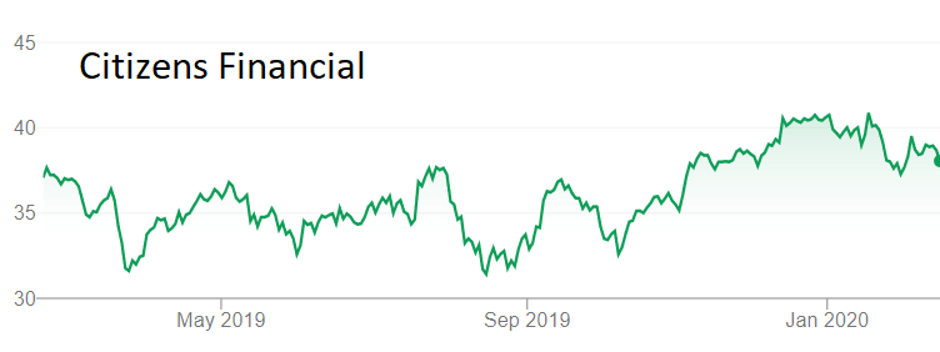

I pointed to Citizens as a potential investment last February when the shares were trading at around $35. It has been a roller coaster ride since then, with the stock swinging between $31 and $37 until November. They then surged to $40 in December and January before slipping to their current level of $38, still ahead of my origin buy level but more than 2% down since the 2019 figures were released.

Analysts think that the share price will do no worse than hold at current levels over the next 12 months and at best it will rise to $42. That higher target does not seem too challenging, considering that the consensus recommendation is to buy.

The yield is attractive at 4.1%, even if there are no further dividend increases in 2020, while the price/earnings ratio is undemanding at just under 10.

Hobson’s choice: As there will probably be no more financial news for nearly three months, it wouldn’t be wrong to hold off and see if the shares slip further, especially given the wild swings of the past year. If, however, there is any sign of share price recovery it would be wise to get in before the recent peak of $40 is reached.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.