Commodities outlook: Is this copper's bottom?

The economic outlook is worsening, but both copper and oil have put in decent gains. Here's why.

5th September 2019 12:21

by Rajan Dhall from interactive investor

The economic outlook is worsening, but both copper and oil have put in decent gains. Here's why.

If you follow commodities or commodities-related stocks all the world seems to be about the China vs US trade conflict.

Just yesterday, we have had a new development. Stock markets around the world rejoiced as both superpowers agreed to set a date to meet in early October. The market reaction is interesting as they have done this before and it amounted to nothing. After the last meeting before the G7 it was said that the relationship was good and they still slapped extra tariffs on one another.

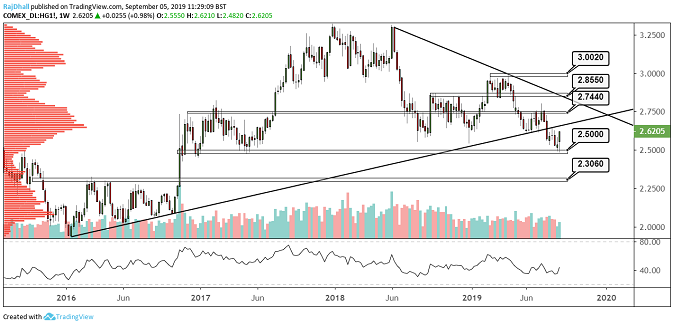

Setting up a new round of trade talks is clearly a good thing, but copper rose (see chart below) and nothing has really happened yet. Let's see how the talks go; both sides seem to need it right now as US ISM manufacturing missed expectations and recorded its lowest level in two years, while the Chinese economy continues to slow down. Lastly, one more point on the economic front.

Today we had the latest German factory orders data, which missed expectations of -1.5% to print at -2.7%. Germany is a manufacturing powerhouse and Brexit is taking its toll. Many raw materials and goods are needed to develop things like cars and machines and the UK is one of their biggest customers, so it's definitely one to keep an eye on.

Source: TradingView Past performance is not a guide to future performance

From a technical perspective, the weekly copper chart above shows that weakness may be over for the time being. The technical levels have worked a treat and $2.50 per pound held as a massive support level.

Now, we have a pretty bullish scenario if the US and China play nice leading into the talks, and $2.74 per pound might be a target. The medium-term level which is more realistic is at $2.66 as the volume profile indicates it is a mean value where traders exchange the most contracts.

As with gold and copper, the strong US dollar had a massive impact on oil. The daily futures candle chart below shows that as the dollar has come off in the last few days the oil price has risen (see chart below).

Source: TradingView Past performance is not a guide to future performance

From a technical standpoint, we are in quite a large triangle formation where a break will indicate the future direction of price. If the price manages to hold above the $58 per barrel resistance mark, the next target could be $60.

On the supply side, there was a surprise build in API oil inventory levels last night and today we have Department of Energy (DoE) figures. If the DoE data produces a draw, oil traders could be in dreamland as we could have a weaker dollar, scheduled trade talks and lower inventory. Watch for the report later.

Rajan Dhall is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.