Commodities outlook: Here's what could push prices higher

23rd July 2018 13:45

by Rajan Dhall from interactive investor

Industry analyst Rajan Dhall discusses where investors should expect oil, gold and copper prices to move this week.

This week, we will resist playing the broken record and talk about how the Donald has crushed commodities prices. I will instead focus on the value levels we may see if this dynamic turns (it may not though, for some time). Yes, there is a clear chance that the fallout can continue, especially as China has retaliated this morning by saying they did not intervene in the currency markets. Recall, Friday's accusations on devaluation pushing up the USD and pricing out competitiveness, singling out China and the EU as well as the Fed and the rate hiking cycle.

But how low is too low? We asked ourselves this question when the oil markets were falling quicker than Neymar Jr. hitting the ground (Brazilian Footballer). Now that the oil markets have recovered somewhat and we hover around the $70/bbl level, we find ourselves asking if the production increases are priced in. If the USD gets weaker from here, as Trump would like, what could potentially push the market higher? Tensions in the Middle East for one; Iran has not calmed down since America left the Iran nuclear deal. Indeed, the 'Republic' has already threatened to block the Strait of Hormuz shipping pathway - what is to stop them from trying this again? Iran has common allies in the form of China and India, and China have agreed to buy Iranian oil against the wishes of America. This keeps Iran happy for now but the leaders have proved themselves volatile, with president Trump warning against threats again this weekend!

Past performance is not a guide to future performance

Our view on gold is all about the price action. There was a large rejection last week and it seems that traders and investors refused to meet the $1200/oz level. If the USD continues to fall we could expect a move back to the mean of around $1260/oz. That also takes us up near the trend-line it broke recently which it is yet to retested and the 0.382 Fib retracement level at $1250/oz. Unfortunately, it is hard to predict the path of the yellow metal with heavy central bank flow combining with rhetoric from Trump and/or China at any minute, but if things stay as they are, we could get the retracement, that in our view is much needed.

Past performance is not a guide to future performance

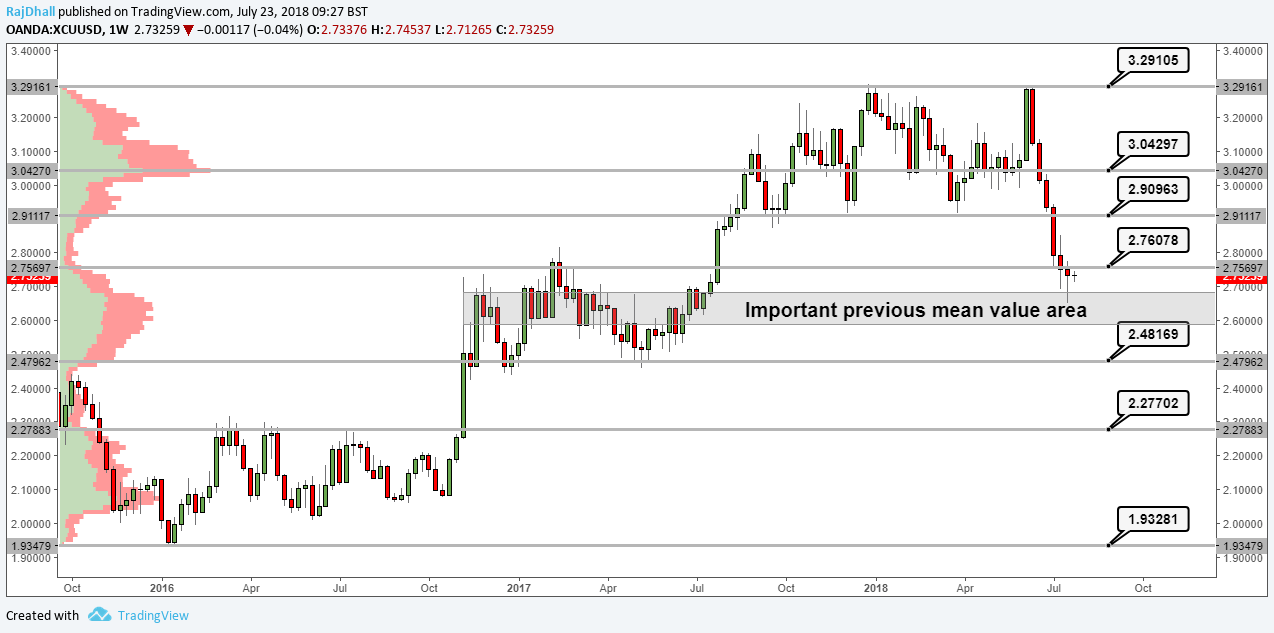

Base metals have been hit hardest of late, but technically some of the notable levels have held firm. Copper hit the mean value pointed out last week and rejected hard. Copper traders are deciding if the fundamentals of value mean that the price should be at the level it was in early 2017. This should see some near term consolidation at least. Demand is actually higher than it was then but the tensions surrounding international trade and the stronger USD tell us there is clear risk of more room to the downside, perhaps after a retracement. Price fell too far too fast - along with the USD scenario mentioned above - and for this reason valuation kicks in. Once we have a reversion, we will need to track demand levels carefully and monitor geopolitical risks to global growth.

Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.