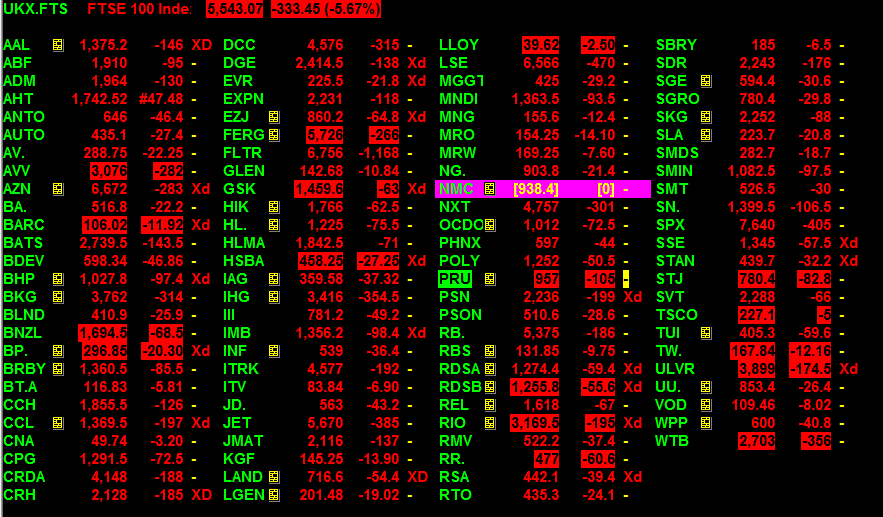

A common sense approach amid the stock market chaos

Our head of markets shares his thoughts on the US travel ban, Wall Street futures and the ECB.

12th March 2020 11:34

by Richard Hunter from interactive investor

Our head of markets shares his thoughts on the US travel ban, Wall Street futures and the ECB.

These are unquestionably dark days for investors.

The latest pronouncement from the US has exacerbated the sour mood, with a travel ban from Europe dealing another blow to the beleaguered tourism and travel sector.

At the same time, the lack of any specific positive measures in the update has given markets an additional and unwelcome hit to factor in to share prices.

Notable by its absence at the moment is any good news. The coronavirus has yet to peak, the oil price is under renewed pressure (although this may prove positive for consumers in the medium term) and only a fraction of the eventual economic cost has been confirmed, even though a growing number of companies are valiantly trying to put a figure on the hit to their earnings.

Meanwhile, there is nowhere to hide, with even the traditional haven of gold in negative territory today.

Sellers are pushing against an open door, and the situation could unfortunately get worse before it gets better. Hours ahead of the open, Dow futures have already hit the “limit down” circuit breakers, which suggests that another traumatic day is in the offing.

Even interactive investor customers are buying with less conviction. Of those choosing to trade today, 75% are buyers, which compares to the initial falls on Monday this week where the figure was 90%.

These factors will put additional pressure on the ECB to deliver an economic and psychological boost in their announcement later today, although even a coordinated fiscal and monetary response as displayed in the UK yesterday is no guarantee of stemming the downward tide.

If there is a glimmer of hope, it is that there will have been certain sectors caught in this crossfire which will have simply been oversold. Such businesses, whose fundamentals will not have changed overnight, will potentially lead the charge as and when sentiment improves.

For the moment, however, matters need to stabilise at a macro level before any sort of market recovery can be entertained.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.