At this crucial time, where will the bitcoin price go from here?

Our award-winning cryptocurrency writer brings you the latest news and analysis from cryptoland.

24th April 2020 16:31

by Gary McFarlane from interactive investor

Our award-winning cryptocurrency writer brings you the latest news and analysis from cryptoland.

Bitcoin is in recovery mode, for now. It’s the same story in equity markets and that is the dominant narrative of the price action in crypto: the tightening correlation of bitcoin with equity market moves.

The leading cryptocurrency has leapt 100% from its mid-March lows, so you are well in the money if you were brave enough to buy the dip (crash).

Trading at circa $7,500, bitcoin (BTC) is up 6% in the past seven days and 13% for the month.

(BTC/USD 24 April 4-hour candles, Bitfinex exchange, courtesy TradingView)

Where does the price go from here with bitcoin block reward halving coming up in May? Halving is when the network’s bookkeepers – the miners – start getting paid 6.25 bitcoins, instead of the current 12.5 for validating transaction blocks, is difficult to gauge, coming as it does in historic times.

With determination of values made ever-more difficult in traditional asset classes by the unprecedented economic impact of this pandemic, in particular the speed of the descent to what is in effect a depression the duration of which is at this time unknown, it is not surprising that price prediction are a little more circumspect, even by crypto standards.

Christel Quek, chief commercial officer at media and content blockchain platform Bolt, saw “sluggish momentum” for bitcoin in mid-April, and notes the “solid performances of late” for both smart contract Ethereum (38% higher on a month view) and Ripple’s XRP cross-border liquidity token (21% higher over the past 30 days).

Christian Miccoli, founder of Italian-based wallet app Coinio, is doubling down on bitcoin as a safe haven, declaring that “investing a small part of any portfolio (1%-2%) in Bitcoin, offers the chance of boosting the overall portfolio alpha and mitigates the overall portfolio risk.”

He bases his belief on bitcoin’s finite supply, decentralisation, the backdrop of central bank money printing and his contestable claim that bitcoin is “uncorrelated to traditional markets”.

Understandably, given Coinio’s tie-up announced yesterday with challenger bank Hype, which has one million customers in Italy, and to which Coinio will be providing bitcoin trading services, Quek sees this sort of demand-positive news as key to bitcoin’s future fortunes.

BTC price targets range from $1,000 to $333 million

But if, unlike Quek’s assumption, bitcoin continues to be correlated with other assets, and the outlook for the global economy – beyond the stock markets – worsens, then bitcoin may yet revisit near-term lows or go lower still.

That at least is the thinking of BitMEX crypto derivatives exchange chief executive Arthur Hayes, who has pencilled in a $3,000 price target if such a scenario unfolds.

That stands in stark contrast to price musings from crypto notables, Ross Ulbricht, currently languishing in prison as the founder and operator of the shuttered darkweb ecommerce platform Silk Road, and mainstream trader turned crypto enthusiast, Tone Vays.

Referencing Elliott Wave theory, Ulbricht postulates that we are in wave 2, as defined by the current bear market. Near-term (2021) this could see the price go to $1,000.

But then things get really off the scale. In the follow-on third wave he says, in all seriousness, that the price could hitch a ride on the mother of all parabolic curves to reach $333 million. Yes, that’s right: one bitcoin to equal $0.333 billion.

Presumably, the mind can wander when you’re stuck in a prison cell.

Vays sees the previously mentioned block reward halving, due on 12 May, as the catalyst for the bitcoin price targeting $9,400-$9,700, on the basis of recent higher highs creating an ascending triangle chart formation.

Global economic outlook has bitcoin in a vice

With the deepest recession since the Great Depression of the 1930s looming, it is not just crypto that is in uncharted waters.

Bitcoin is very much tied in with equity markets at this juncture and that could throw previously bullish May halving predictions awry.

Judging by the recent upswing in equities, investors are clearly banking on a V-shaped recovery and that may pull bitcoin higher in its wake.

But it is difficult to square those hopes with the recent IMF forecasts and perhaps more pertinently, the spread of the coronavirus.

For as long as there isn’t a vaccine, consumer behaviour will change for the worse as far as demand is concerned, so this bear market could be just getting going and that would be bad news for bitcoin.

Even when the “reopenings” begin – which they will eventually – there is the danger of subsequent waves of infections, signs of which are already evident in China.

None of that is bullish for bitcoin unless the equation changes in other respects – such as the advent of a central bank digital currency in a major economy, Libra launching or a crypto killer app shifting the zeitgeist.

Or, indeed, of bitcoin developing a use case in the most distressed economies as a store of value when all other alternatives lack credibility (imploding local currency – see Argentina where bitcoin usage has recently spiked) and, perhaps most importantly, portability.

Drawing on the situation in Argentina, Bolt’s Quek concludes:

“Bitcoin is therefore dealing with a varied macro-economic scenario, dependent on the jurisdiction. It continues to be a hedge against inflation, and in countries dealing with hyperinflation such as Argentina, local exchanges have seen tremendous spike in activity.”

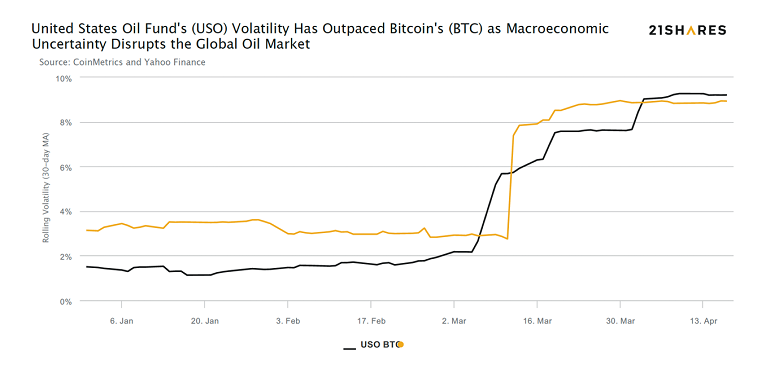

As a worldwide 24/7 cheap pseudonymous value exchanger bitcoin arguably remains unrivalled, but its volatility is still its Achilles Heel, although comparable to some other assets recently, namely gold, as the chart from crypto exchange trade note issuer Amun shows.

But notwithstanding that, as a last resort bridging currency alternative for narrowing fiat options in certain economic scenarios, bitcoin could still find a near term use case, and that includes in the advanced economies too, as investors worry about the burgeoning debt mountains and their sustainability over time.

Libra 2.0 bites back

In other news, Libra was back in the headlines as it set out to assuage the fears of governments and regulators about its plans for a global money system. Suffice to say it has dialled back on those loft ambitions, but it might be a mistake to right-off the project, as many in crypto and outside are prone to do.

The new regulator-friendly Libra will likely bring forward its much-delayed launch and in the round should deliver a boost to the credibility of the crypto space.

Already, Libra’s whitepaper alone has quickened the pace of central bank digital currency development (China’s central bank has started “piloting” a new Digital Yuan app) and sharpened regulatory minds.

Expect the regulatory reactions to come to fruition with a flurry of legislation around digital currencies. This should be in line with the G20 Financial Action Task Force recommendations on virtual asset service providers in terms of tracking payments and the parties involved.

Libra 2.0 will still probably be giving current payment incumbents nightmares, although Calibra’s David Marcus (Facebook’s Libra wallet and services company – because it is still Facebook driving all this) has taken the hint and wisely steered the Libra Association away from infringing upon sovereign money monopoly and associated seigniorage rights.

This means abandoning immediate aims of achieving frictionless global money status in its hopes of becoming the undisputed champion of the unbanked and underbanked.

Maximalists who bemoan Libra’s “permissioned” (i.e. a private blockchain in which only “nodes” that meet the criteria laid down by a centralised controlling entity can be block verifiers) properties and compliant onboarding (users will have to present government-issued ID), would like the world to conform to the architecture of public blockchains, not the other way around.

Libra 1.0, despite the whitepaper roadmap pointing to an eventual public decentralised future, was always imagined in its first iteration as a permissioned decentralised ledger.

This is the route we should expect most corporations to take, be it in the finance sector or any other.

Newly refashioned, it means the Libra network will still be able to capture the efficiency and cost-reduction gains, in addition to grasping the present opportunities for association partners to embed digital money into their offering and revolutionise closed-loop payments.

This is already a fast-growing area as retailers look to bring consumers into a wall-garden relationship by offering benefits from holding store cards and participating in loyalty programmes, perhaps in the future through their own Libra-powered wallets.

With coronavirus accelerating these moves towards digital wallets (fiat and crypto variants) – the crypto digital wallet could yet come to the fore, but most likely with stablecoin approaches similar to Libra with token value pegged to traditional currency or some other asset class.

Libra could put itself at the centre of those conversations, or at the very least make itself highly relevant in those developments as more shopping migrates at speed online, and Libra’s advantageous position as the likely native currency of the Facebook family of platforms, with its 2.4 billion user base.

Expect to see fintechs look to leverage the Libra technology, especially in plugging into the network to take advantage of the synergies afforded by this new payment rail.

Libra is like PayPal but more than PayPal. You can’t build apps on PayPal.

All that said, as a permissioned chain that threatens to popularise the “idea” of crypto, if not the original decentralised public vision, it will help the crypto space in the short to medium term, even if certain sectors will be squeezed – such as rival stablecoins.

Libra, seen as a sort of roundabout diversion then to a decentralised destination in which it might be others that arrive at in a different time, it will enhance the currently existing value differential of truly global, frictionless (fees and transaction speeds aside), censorship-resistant cryptocurrencies – in other words bitcoin will be a beneficiary and, more broadly, Libra could help to lift all crypto boats.

Around the crypto world in 2-minutes

In other crypto news in brief, top exchange Binance has bought e most popular crypto data provider New York-based coinmarkecap.com.

Billionaire Tim Draper has launched a plugin for the Wordpress platform, upon which at least a third of the internet’s websites are built.

The software allows any site owner to install the plug-in and offer its visitors white label crypto exchange.

However, security and regulatory may put a dampener on the growth prospects of the plug-in, but nice idea.

Ripple is suing Google’s YouTube for allowing scammers to run videos on its site with promises of acquiring ownership of free XRP tokens.

Binance has launched a new social payment app in which users will be able to exchange both fiat and crypto currencies, with the product aimed at the Africa market, where payments are increasingly “mobile-first”.

The new app is called Bundle with Binance targeting initial efforts on Nigeria.

There’s been another hack in the decentralised finance world, this time of dForce. The criminals stole $24 million in tokens, but then had a change of heart and returned the funds.

In some quarters, dForce is dismissed as a clone of code from a protocol called Compound.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.