Dividend poll: find out where investors are turning for income

An interactive investor survey shows what customers are doing for returns during the dividend drought.

22nd April 2020 14:51

by Myron Jobson from interactive investor

An interactive investor survey shows what customers are doing for returns during the dividend drought.

The suspension of yield requirements for UK equity income and global equity income sectors announced today by the Investment Association, coupled with a spate of recent dividend suspensions and cuts by UK plc, underlines the bleak outlook for income investors.

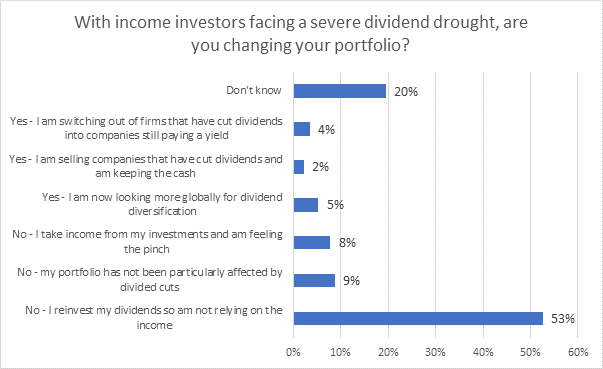

But a new poll of 1,228 investors conducted between 21 April to the morning of 22 April 2020 by interactive investor found that more than half (53%) of investors reinvest dividends so don’t rely on an income. These are leaving their portfolio unchanged, but many are feeling the pinch and many are turning to investment trusts for some of their potential structural advantages.

With investors facing a severe dividend drought, and at a time when many investors will likely be wondering if oil companies might be next for dividend cuts, one in five investors admit they don’t know what to do, while 8% say they are feeling the pinch as they take income from their investments.

However, most are keeping calm and carrying on. Just one in 10 (11%) of investors say they are tinkering with their investment portfolio as a result of the dividend onslaught - with 5% looking overseas for dividend diversification, while 4% say they’re switching out of firms that have cut dividends to those still paying an income.

Only 2% said they are selling companies that have cut dividends and keeping the cash.

Holding out for a dividend hero?

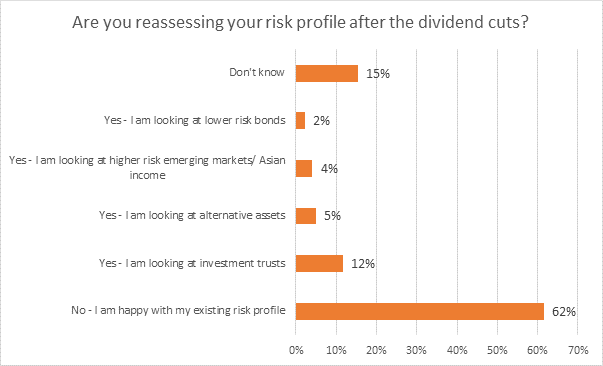

When it comes to investment risk, almost two-thirds of respondents have maintained their risk profile despite the flurry of dividends cuts, but 23% said they had reassessed their stance, of which, 12% said they are looking at investment trusts, 5% at alternative assets and 4% at higher risk emerging markets/Asian income. Only 2% are exploring lower risk bonds.

Teodor Dilov, Fund Analyst, interactive investor says: “These are unprecedented times. Where once companies would have been punished for cutting or suspending dividends, this time around it has been borne out of financial prudence. So it’s no surprise to see the Investment Association suspend the yield requirements on the UK Equity and Global Equity income sectors, considering everything that is going on in the income space – pressure from the FCA on financial companies and oversupply in the oil market. Together with the massive disruption on almost all sort of businesses that Covid-19 has had already, we need to note this is sensible move and timely move.

“Our poll suggests that investors are keeping a cool head and it’s no surprise to see that many are turning to the investment trust sector, where a number (but by no means all) are blessed with strong revenue reserves that have been built up over many years to help smooth dividends when times are tough. For many of the AIC ‘dividend heroes’, this is precisely the rainy day that many Boards have been saving for and their investors will be grateful. But careful research is key.

“Meanwhile, it is important not to panic. For more than half of our investors, it is total return that matters. We should remember that these dividend cuts won’t last forever and are likely to be a temporary, necessary blip. It is important not to write off high quality companies.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.