Do smart beta ETFs offer investors protection?

Factor investing with strategic beta ETFs can help investors to protect their capital.

6th May 2020 15:43

by Kenneth Lamont from interactive investor

Factor investing with strategic beta ETFs can help investors to protect their capital.

As I write, much of Europe is house-bound and the global economy is still reeling from the unprecedented impact of the Covid-19 virus and plummeting oil prices. The implications for the global economy are far from clear. That said, the lessons learned from previous crises are very clear: sit tight and wait it out, the storm will pass.

While this remains sound advice for investors with a long-term outlook, for those with shorter investment timeframes the preservation of capital may be a higher priority. For instance, switching core allocations out of equity into ‘safe haven’ assets such as the highly rated US Treasuries can help steady the ship and limit further potential losses in the midst of market uncertainty. On the other hand, a switch of this sort may also crystallise losses and reduce investors’ participation in any subsequent market recovery.

However, factor investing with strategic beta ETFs can provide a middle ground, allowing investors to trim risk while maintaining exposure to a market rebound.

- ETF analysis: three reasons why you need a dividend ETF

- Investing in water: how ETF investors can tap into returns

Factor refresher

Strategic or smart beta ETFs often track an index that attempts to exploit the same well-established alpha factors targeted by active managers. The five equity factors that best hold water are: value, momentum, size, quality, and minimum volatility. Each factor has its own unique investment characteristics.

Quality and minimum volatility are the two factors considered to be most counter-cyclical, meaning that they tend to lag in bull markets and outperform in downturns.

Quality strategies look to build a portfolio of stocks composed of quality companies, which are characterised by their durable business models and sustainable competitive advantages. These companies tend to have high and stable levels of profitability and clean balance sheets, meaning they are well-positioned to weather a downturn.

Minimum volatility strategies attempt to build a portfolio with the lowest volatility from a given universe. Investors in low-volatility strategies are also making an implicit quality bet, as lower-volatility stocks also tend to operate with lower leverage and have more stable earnings growth. Unsurprisingly, this approach also favours defensive stocks.

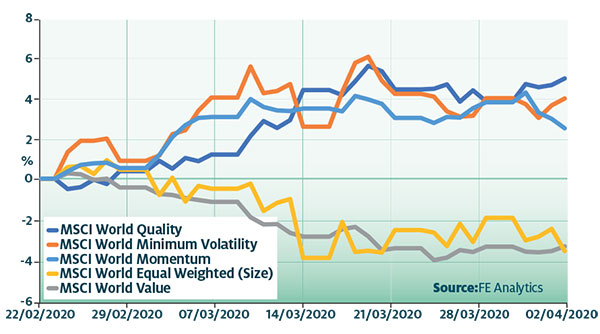

Both strategies have performed as expected since markets started to tumble in late February. The chart below shows the relative performance of each of the five main equity factors relative to the MSCI World index, a proxy for global large companies.

We can see that both quality and minimum volatility are the best-performing factors, falling between 4 and 5 percentage points less than the MSCI World index (which has itself plummeted 21%) over the past month.

This contrasts with the pro-cyclical size and value factors which have each sunk around 3% lower than broad equities over the same period.

The iShares Edge MSCI World Minimum Volatility ETF (MVOL) is one of our favourite global equity funds and earns a Morningstar Analyst Rating of Silver.

It attempts to construct the least volatile portfolio possible with stocks from the flagship MSCI World index, under a set of constraints. These include limiting turnover, exposure to individual names, and sector tilts relative to the index.

We also like other funds within the same stable which leverage a similar strategy in different equity markets, including theiShares Edge S&P 500 Minimum Volatility ETF(MVUS), which has also been awarded a Morningstar Analyst Rating of Silver.

Global equity factor performance relative to MSCI World Index (GBP)

Competitive edge

These funds tend to favour well-established names, particularly those in consumer staples and utilities sectors, such as Nestle, Coca-Cola and Nextera Energy.

Elsewhere, Xtrackers MSCI World Quality ETF 1C(XDEQ) targets large and mid-cap global developed stocks with the best profitability (measured by return on equity), strongest balance sheets and most consistent earnings growth within each sector. To mitigate unintended sector bets, the fund matches its sector weightings to the broad market cap-weighted MSCI World index.

Within each sector, the fund weights its holdings according to both the strength of their quality characteristics and their market capitalisation. This pulls it toward stocks with durable competitive advantages, such as Microsoft, Apple, and Johnson & Johnson. This fund also receives a positive Morningstar Analyst Rating of Bronze.

Kenneth Lamont is senior analyst, manager research, passive strategies at Morningstar.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.