Does fall in tech stocks signal the end of the bull market?

Tech's outperformance may be coming to an end – and that has potential implications for the wider mark…

31st October 2018 16:37

by Tom Bailey from interactive investor

Tech's outperformance may be coming to an end – and that has potential implications for the wider market.

Over the past few years the fortunes of stockpickers, be it fund managers or private investors, have often rested upon whether they have owned one or two high-flying US tech stocks.

So-called FAANG (Facebook, Apple, Amazon, Netflix and Google’s Alphabet) stocks have provided investors with returns way above the norm, as have a number of a number of rival Chinese technology firms.

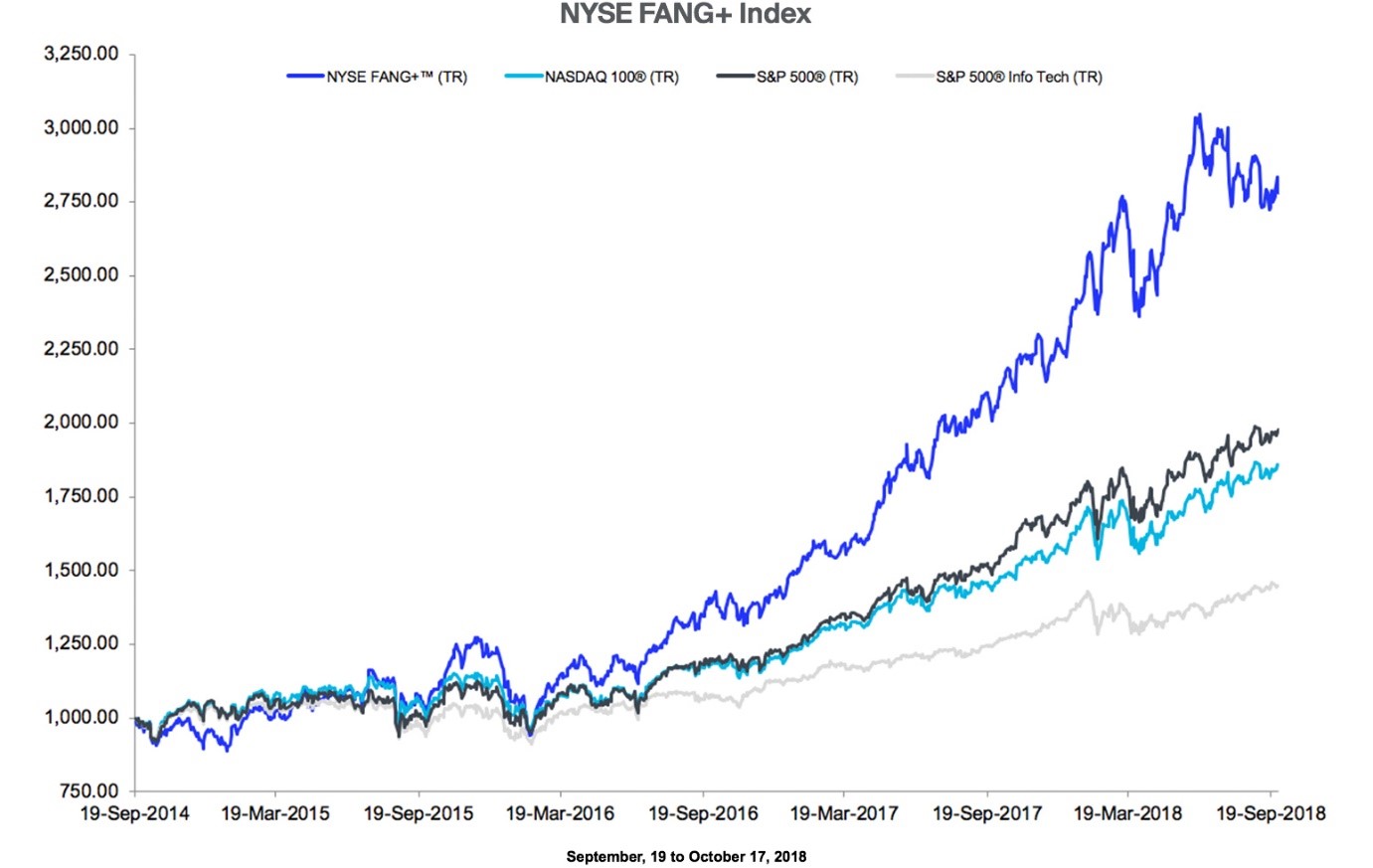

This outperformance can be seen by looking at the NYSE FANG+ index, composed of the FAANGs alongside Twitter, Tesla and computer game company Nvidia, as well as Chinese tech giants Alibaba and Baidu.

According to the Intercontinental Exchange, this index provided investors with a 26.8% annualised total return from 19 September 2014 to 17 October 2018. In comparison, the broaderNasdaq100 has provided 15.1% and the S&P 500 8.6% over the same period (prices on these indices have continued to fall since).

That outperformance, however, may soon be coming to an end – and that has potential implications for the wider market.

While the index is still up around 8% on the year, measured against its yearly peak, the NYSE FAANG+ index’s is approaching bear market territory. The index closed at a peak of 3,046 points on 20 June earlier this year. Since then, however, the index has plummeted by 19.7% (as of 30 October 2018).

According to Russ Mould, investment director at AJ Bell: “If this proves to be no more than a so-called ‘healthy correction’ then all well and good.”

However, he notes, if these stocks continue to tumble under the weight of regulatory pressure, growth concerns or their stretched valuations, “this could have serious implications for investors’ portfolios.”

- Can investors profit from China’s Belt and Road Initiative?

The risk, says Mould, is that if the FAANGs decline continues, the rest of the market is in for a prolonged slump: “History suggests that if prior market leaders roll over, it can be very hard for the broader indices to make fresh gains in a best case, and may herald a substantial downdraft in a worst case.”

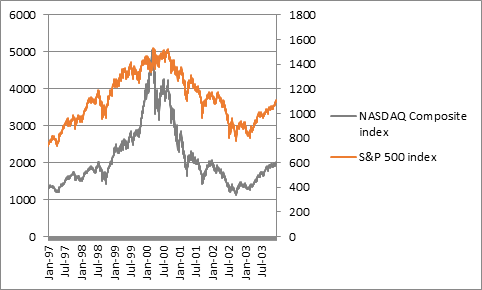

Mould cites the example of the collapse of tech stocks in the early 2000s, noting that back then the Nasdaq Composite index “rolled over” before the broader US market. “The bursting of the technology, media and telecoms bubble sowed the seeds of a wider equity market downturn in early 2000s,” he says.

Equity markets in the US, UK, Europe and Asia fell into a three-year long bear market.

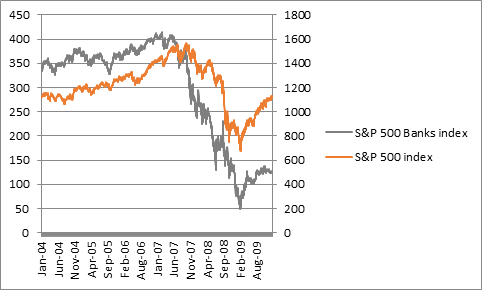

Soon after that, financial stocks roared ahead, leading the market between 2003 and 2007.

“Lo and behold they peaked in 2006, as someone somewhere sensed that too much money was being loaned in too free-and-easy a way, and that rising interest rates would make things a lot more difficult for borrowers and lenders alike,” Mould says.

“Global stock indices hit the wall in mid-2007 and a brutal 21-month market slump followed.”

As Mould points out, the past is not guaranteed to repeat itself; the current drawdown in FAANG stocks is not necessarily a precursor to a wider market crash.

But he cautions: “Their swoon may mean that investors should at least consider how much risk they are taking in the portfolio, especially if they have substantial exposure to richly valued growth and momentum plays via their preferred active and passive funds, or even via direct investment in the stocks themselves.”

- Active funds fail to keep pace with passive fee cost cuts

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.