Don’t write off this Covid vaccine developer

It’s behind the big players, but this company could surprise us, thinks our overseas investing expert.

2nd December 2020 09:50

by Rodney Hobson from interactive investor

It’s behind the big players, but this company could spring a surprise, thinks our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

There are usually no prizes for coming last, and all the attention is focused on the leaders in the race to produce a Covid-19 vaccine. It may, however, be too early to write off backmarker Novavax (NASDAQ:NVAX), which has made disappointing running so far but could yet come through on the rails.

Novavax is an American biotech company that develops vaccines, working on the clinical stage of the development of products to treat a variety of existing and emerging diseases in all ages of people. It also has a subsidiary in Sweden.

Its shares leapt earlier this year when it received $1.6 billion in US federal funding to develop a coronavirus vaccine, and many investors believed, prematurely, that it held an advantage because this kind of work was what it specialises in, whereas larger rivals such as Pfizer (NYSE:PFE) had irons in other fires.

- International Biotechnology Trust: star stocks and Covid vaccine race

- Moderna, Covid cures and cheap cyclical stocks

- Want to buy and sell international shares? It’s easy to do. Here’s how

In the event, Pfizer and Moderna (NASDAQ:MRNA) had vaccines in stage 3 trials – the larger scale trials in humans that are vital in gaining regulatory approval – earlier than expected and are planning to roll out millions of doses this month or early next year. Novavax has only just recruited the 15,000 volunteers that enable it to launch its UK Phase 3 trial early next year, with similar trials in the US and Mexico, which have been delayed, coming a couple of months later.

Given that Pfizer and Moderna have both reported over 90% efficacy rates for their vaccines, it will be tough to catch up, let alone demonstrate better results. By the time Novavax is ready to go, several million people in the US, UK and Europe will have been vaccinated and Novavax’s doses are unlikely to have an advantage in terms of pricing.

All is not lost. Phase 2 results from Novavax’s vaccine were particularly impressive and, although a lot can – and often does – go wrong, particularly with safety issues in Phase 3 trials for drugs of all kinds, Novavax could end up with the best immunity record.

Assuming that all does go well, Novavax will have no difficulty in making initial sales. It has agreements with governments in the US, Canada, UK and Australia to supply 276 million doses.

A vaccine for Covid-19 is fortunately not Novavax’s only potential. It has a promising flu vaccine called NanoFlu, and in October it set up a dedicated team that is already seeking regulatory approvals in key markets around the world. It could endeavour to combine this with its Covid-19 vaccine to provide a joint treatment.

That would put Novavax at the front of the field, as Pfizer’s collaboration on a flu vaccine is still in preclinical trials – before any testing on human volunteers – and Moderna’s plans are little more than a statement of intent.

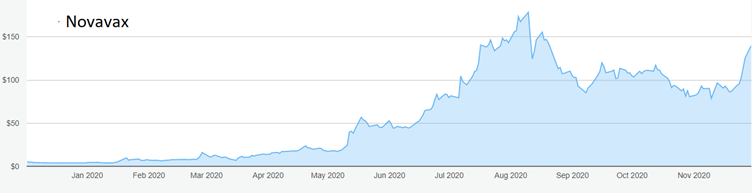

Source: interactive investor. Past performance is not a guide to future performance.

Again, investors should exercise caution rather than indulge in euphoria. There is no guarantee that Novavax will be successful in gaining regulatory approval for a combine flu and Covid vaccine, and it could come after the 2020-21 flu season is over. But if Covid-19 becomes a seasonal virus like flu, as many health experts believe, a combined treatment would be the route of choice for health authorities everywhere.

There are a lot of hurdles along the way but it seems likely that no one company will corner the Covid-19 vaccine market, so there should be something worthwhile for Novavax. Most analysts are positive on the stock.

- Fund managers turn bullish on Covid-19 vaccine breakthrough

- Investing in the US stock market: a beginner’s guide

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The shares have shot up from around $4 at the start of the year, before the Covid-19 scare began in earnest, to a peak of $178 in August as buyers allowed wild hopes to overwhelm realistic scenarios. As Novavax has slipped behind rivals, the stock has slumped towards $120, opening up a buying opportunity that seriously underestimates the potential of the company’s vaccines.

Hobson’s choice: Investors may prefer to wait to see if the shares have bottomed out before taking a punt. If you are tempted, buy up to $135.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.