Earnings quality is at a 25-year low and the timing is not great

30th June 2023 09:48

by Stéphane Renevier from Finimize

Companies’ earnings have been holding their ground, but it’s not enough to look at the growth rate, you also want to inspect their quality. And right now, there could be cause for concern.

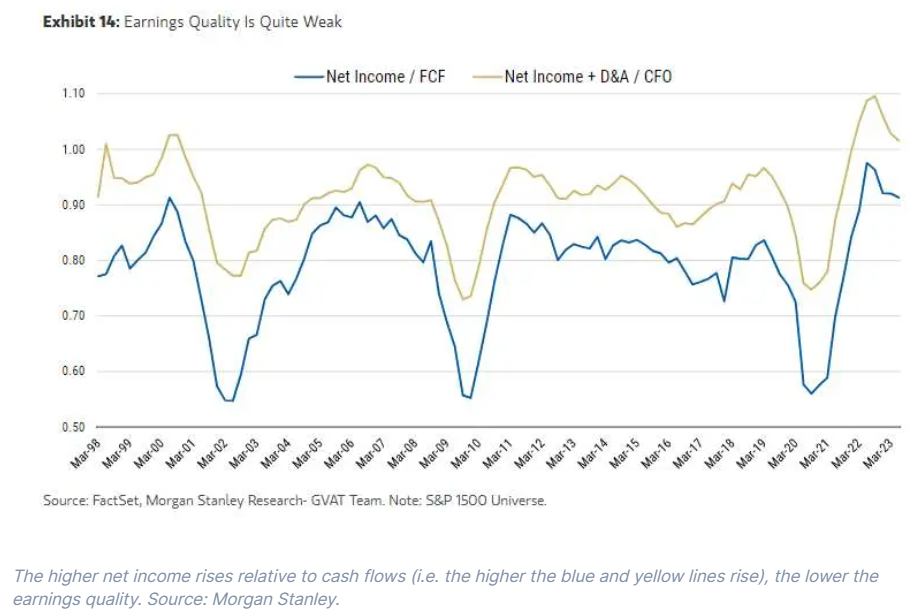

A good gauge of earnings quality is the difference between a company’s reported net income and its cash flows. They should move in sync. And when the former deviates too much from the latter, the quality of earnings is likely to be weak.

Right now, earnings quality is at a 25-year low, mostly because companies have amassed huge inventories and have recognized a big chunk of their costs as assets.

Should companies be forced to sell those inventories at a discount, their market value is likely to come in below their accounting value, and earnings are likely to be adjusted downward.

Companies’ earnings have been holding their ground – and it’s no small feat, with inflation and interest rates both sitting higher than we’re used to. But with earnings, it’s not enough to look at the growth rate, you also want to inspect their quality. That’s because high-quality earnings tend to be more sustainable, while low-quality earnings are more likely to drop if the economy struggles. And right now, there could be cause for concern.

How do you measure earnings quality?

You can get a good gauge of earnings quality by comparing a company’s reported net income (the earnings that are presented in financial statements) to its cash flows (the actual cash coming in and going out). Imagine them as two best friends: they do things differently, but at the end of the day, they should sync up. The money a company declares it has made (its net income) and the cash it actually rakes in (its cash flows) should align over time. Because let's face it: you can't just pull profits out of a magic hat (legally, that is).

But in the short term, discrepancies can and do happen due to the timing of cash flows, the impact of non-cash (items like depreciation and amortization), and other factors. For example, think about a company that spends cash on inventory or building a new factory. That cash goes out, but it's not reflected in earnings immediately – it first shows up as an asset. Or, consider when a company sells stuff on credit. The earnings will assume the cash is in hand, while in reality, the check is still, figuratively or literally, in the mail. This gap between reported net income and actual cash flow stems from the delay between when expenses are made and when they're recognized in the earnings.

Now, if earnings are on a growth spurt but the cash on hand isn't, your alarm bells should ring. Sure, it could simply mean that the company’s making strategic investments that will later translate into strong cash inflows. But when the two deviate by more than usual, it probably means the company is handling its cash badly, is having unusual non-cash adjustments, or worse, is over-egging its earnings. Either way, it's a red flag and it suggests those bumper profits might not last. Remember, earnings and cash flow are BFFs in the long run.

So, how bad is earnings quality right now?

Whether you're checking out net income over free cash flows (blue line) or looking for a deeper dive into operations, net income plus depreciation, and amortization over cash flow from operations (yellow line), the memo is the same: with net income straying this far from cash flows for the first time in more than two decades, the quality of earnings is definitely raising eyebrows.

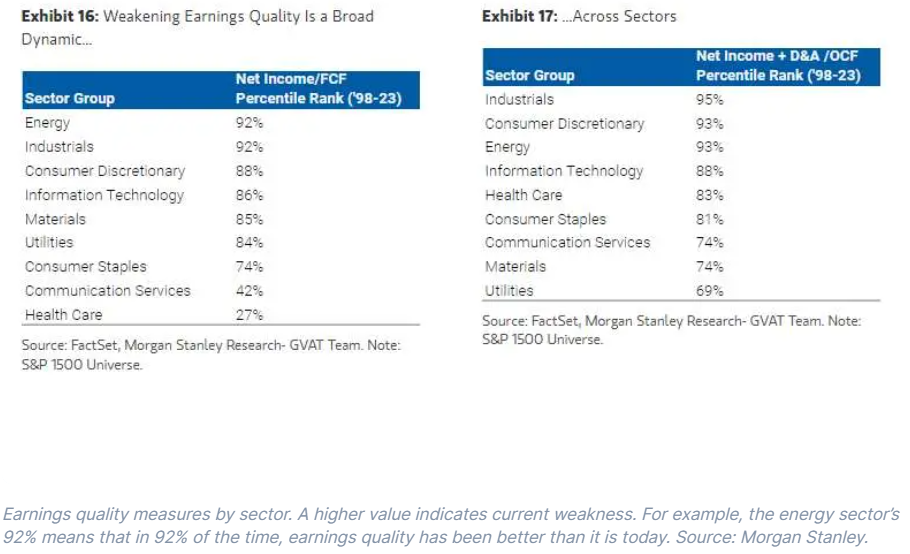

And it's not just one bad apple: almost all sectors are displaying the same trend. This next chart shows that the difference between net income and cash flows is much higher than it has historically been.

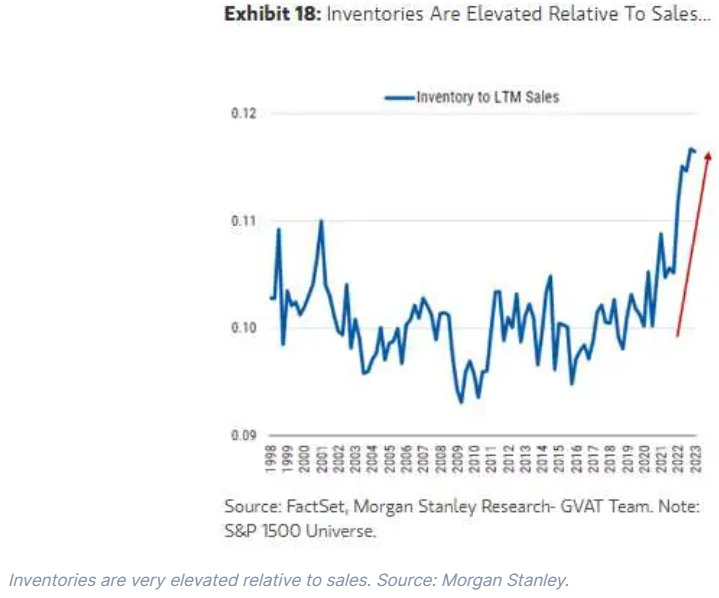

The culprit here might be excess working capital – think of this as the extra goods and money tied up in the company's day-to-day operations. Specifically, these could be a heap of excess inventory or a pile of costs that have been capitalized (i.e. they appear as assets rather than costs) but haven't yet been deducted from profit. Here’s a current example: supply chain hiccups during the pandemic forced companies to boost their orders and accumulate huge inventories – and all at higher prices. The issue is, many misjudged the demand and are now left with much higher inventories than they’d like.

Now, if demand kicks into gear, this might not be a big deal: companies can just offload those inventories at inflated prices. But if the economy slows and demand softens, companies might have to slash prices to get rid of their stockpiles. Sooner or later, this surplus of goods will march its way into the income statement as a cost, weighing down those lofty earnings forecasts.

So what’s the opportunity?

Investors are seeing rainbows right now, and expecting that earnings will bounce back. And, sure, don’t get me wrong, it's a plausible outcome. And, anyway, just because earnings quality is sending out a warning signal doesn’t mean it's time to abandon ship.

But investing is about anticipating and responding to different scenarios and odds. And given the market’s current optimism, you might do well to keep the life jackets handy. If the economy downshifts more significantly in the coming months (and there’s a fair chance it will), earnings might take more than just a casual hit. They may tumble, not just because revenues are slowing, but also because companies may have to sell their inventories at lower prices, plus account for some of the costs that haven’t been accounted for yet. To put it bluntly, there’s a fair chance that the earnings dip might be steeper than the market is banking on.

So keep your portfolio diversified, retain some cash on hand, and ensure you're prepped to tackle a possible market downturn.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.