Emerging markets: equities not surrendering to Trump’s trade war

Amid tariffs, supply chain reshuffling and geopolitical tensions, a look at the unexpected post-Liberation Day outperformance of emerging markets and Asian equities – and why we believe the investment case for the asset class remains in place.

14th May 2025 12:46

by Alex Smith from Aberdeen

President Trump’s “Liberation Day” tariffs have upended global markets, unleashing volatility.

Given the extent of its trade with the US, investors are worried about the fallout for Asia and emerging market (EM) returns.

Historically, these markets have been more vulnerable to external shocks, especially exports. The US's push to repatriate manufacturing could also result in EM job losses.

Time to throw in the towel? We think not. The outlook for EM remains positive – here’s why.

The dollar is weakening, exposing vulnerabilities in the US financial system

Following Trump’s tariff announcement, US equities, bonds, and the dollar fell simultaneously – a scenario more common in EM than in a powerhouse like the US. Whether this stems from the US’s dependence on foreign capital to fund its twin deficits or the policymaking excesses of this administration and others is unclear.

The important consequence is the US can’t fight on all fronts and is now focusing in on China. Indeed, the Trump administration is actively pushing other nations to decouple from China.

A reorganisation of supply chains will not result in an overnight switch to US production

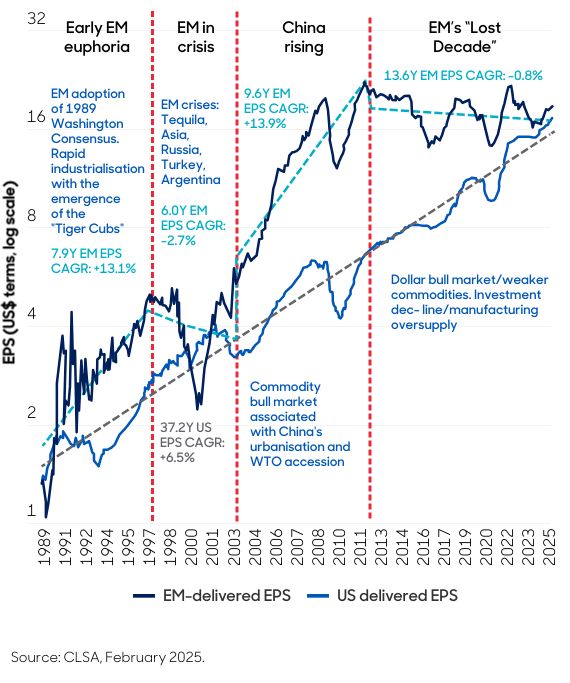

Reorganising supply chains will be a long and messy process. That said, this increased complexity could benefit nations focused on production. Asia and EM hold a significant comparative advantage in goods production. This dominance won’t disappear overnight, if at all (Chart 1).

Chart 1. EMs shine during investment cycles

Moreover, decoupling from China means rerouting goods through other countries. The US may have leverage in some areas, like Mexico, but has less control elsewhere. For example, without massive reciprocal tariffs, how can the US realistically prevent a Chinese-owned factory in Vietnam from exporting? It’s a logistical and bureaucratic nightmare.

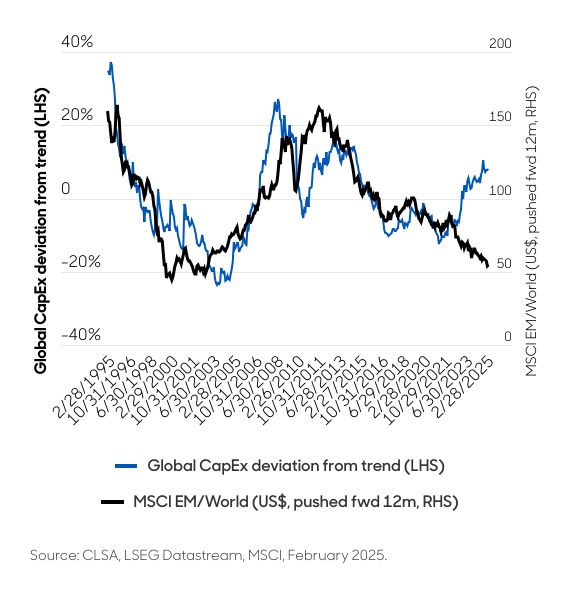

The US manufacturing base also faces serious challenges. These include high labour costs, a shortage of skilled workers, and infrastructure deficits. Remedying these issues requires significant capital expenditure (Chart 2).

Chart 2. Historically, as CapEx has struggled, emerging markets have lagged on declining earnings per share

It also ensures that the bulk of manufacturing will remain in various EMs.

Amid challenges, it’s not game over for China

The country has significant leverage

China boasts a dominant industrial base and leads the world in several key areas, including renewable energy, rare earths refining, and electric vehicles. It also has a competitive tech ecosystem and a vast domestic market. Importantly, China has both the capacity and willingness to make substantial foreign direct investments, giving it significant leverage should the US try to peel off trading partners.

The US is also dependent on China for a wide range of products. For instance, many Americans might have to celebrate this year’s Fourth of July without fireworks, as Walmart’s shelves could be empty.

China’s Premier Xi Jinping’s recent visits to Vietnam and Malaysia underscore his country’s formidable leverage in the Association of Southeast Asian Nations and its ability to foster global trading relations.

Domestically, China is ramping up policy support through trade programs, equity market initiatives, and property market loosening. With $10 trillion in consumer bank deposits, China can mobilise its elevated savings rates. The economy can also absorb some of the adverse effects of tariffs, with Aberdeen Global Macro Research estimating 4.2% GDP growth this year.

Final thoughts…

Initial reactions to Trump’s tariffs have been a mixture of shock and concern. However, beyond the first downside surprises, the long-term picture is more encouraging. Reorganising supply chains will require significant capital expenditure, much of which will still flow to Asia and EM. US capital markets appear to be the preferred funding source. This process will take years and require substantial US investment to improve its manufacturing competitiveness. Success is far from certain. China is a formidable economic power and has been preparing for this scenario for the last seven years. Finally, with the world’s two major economic titans decoupling, EMs can position themselves to benefit.

Alex Smith is head of equities investment specialists, Asia Pacific, at Aberdeen.

ii is an Aberdeen business.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.