Equities: why invest in Europe's smaller companies amid US uncertainty?

European small caps are positioned to benefit from US uncertainty. Could this overlooked asset class be the smarter way to invest in Europe right now?

22nd July 2025 09:17

by Graham McCraw from Aberdeen

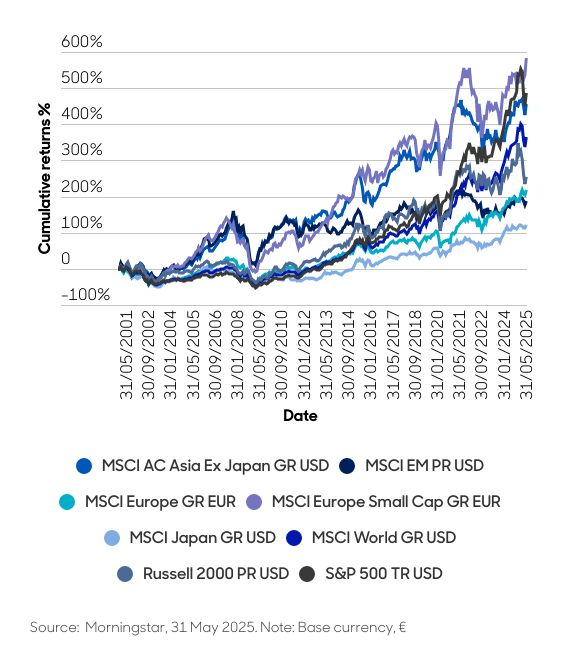

Did you know that European smaller companies have outperformed many of the major equity asset classes this century?

It’s a surprising fact, especially given how often the US S&P 500 is held up as the gold standard for long-term equity performance.

But recent market dynamics suggest that investors may want to revisit this underappreciated segment of the region’s equity market and take a closer look (see Chart 1).

Chart 1: European smaller companies lead the pack, 2001- 2025 (%)

Why now?

One of the biggest stories in global equities this year has been the rotation out of US assets and into European stocks.

US political volatility, the sustainability of government debt levels and questions around future earnings growth in the US have clouded the outlook for American equities and the US dollar. As a result, investors are increasingly turning to Europe – and not just for diversification, but for value.

Yet most of the capital flows have gone into the stocks of larger European companies. That’s understandable, especially for overseas investors who may be less familiar with the nuances of the region. But it may also be a missed opportunity.

Here are four reasons why European smaller companies deserve a closer look:

Valuations that make sense

US equities near record levels and recent political developments are two of the reasons that have prompted investors to reassess whether those valuations are justified.

By contrast, European equities offer exposure to companies trading at significantly cheaper multiples. For example, the MSCI Europe Index trades at 15.8 times 12-months forward earnings (compared to 22.8 times for the S&P 500). This represents a 31% discount.

But the real value lies in many of the region’s overlooked smaller companies. The MSCI Europe Small Cap Index trades at just 14.4 times – a 37% discount to the S&P 500.

In fact, the relative valuation of European smaller companies, compared to their large counterparts, is now lower than it was during the depths of the 2007/8 global financial crisis.

Diversification benefits

Europe’s diverse cultures, political systems and economic profiles offer differentiated returns compared to US or even global equities.

Historically, relative to their larger peers, European smaller companies have demonstrated lower correlation with US and global markets, making them a powerful tool for portfolio diversification.

And while Europe’s lack of a dominant technology sector has often been seen as a drawback, it may now be a strength. Investors who feel overexposed to expensive tech stocks may find European small companies a refreshing alternative.

Domestic growth tailwinds

While it feels like all the headlines have focused on developments in the US, it’s worth remembering that Germany has announced a major spending initiative that is expected to boost European growth.

This could be particularly beneficial for smaller companies, which tend to be more domestically focused and better positioned to benefit from homegrown growth.

In a world of rising tariffs and global trade tensions, high-quality European smaller companies may also offer a degree of shelter from international volatility.

Long-term outperformance

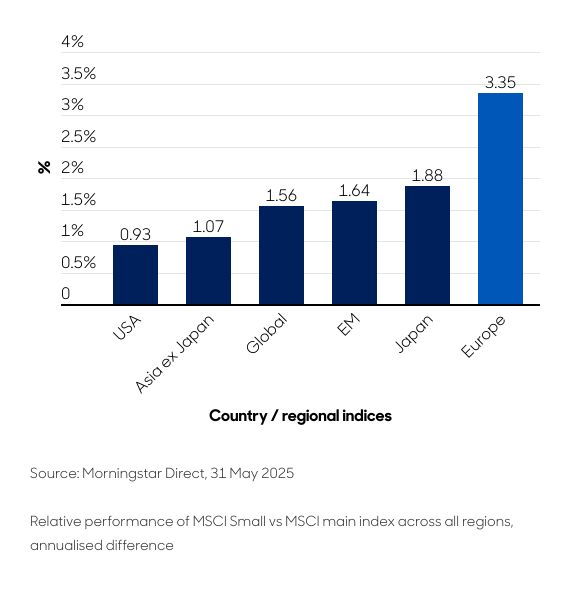

The ‘smaller companies effect’ – the tendency for the shares of smaller firms to outperform over the longer term -- is well documented.

For example, Europe’s smaller companies have outperformed their larger peers by some 3.4% each year since 2001 (see Chart 2).

Chart 2: Smaller companies outperformance (% per annum since 2001)

Notably, their strongest period of performance was between 2003 and 2007, which coincided with the last time Europe materially outperformed US stocks.

Why you should care

If you’re already considering European equities, it’s worth asking: ‘are you investing in the right part of the market?’

European smaller companies offer compelling valuations, strong diversification benefits and a track record of long-term outperformance.

In today’s volatile investment environment – in which the outlook for US assets looks increasingly uncertain – they may offer a smart way to diversify.

Final thoughts

European smaller companies have quietly outperformed major equity markets over the past two decades. This long-term track record is often overlooked, but it’s especially relevant now as investors reassess their exposure to US assets.

Recent political and economic uncertainty in the US has made Europe – and particularly its smaller firms – a more attractive destination for capital. These businesses offer compelling valuations, strong diversification benefits and a unique sensitivity to domestic growth trends.

For investors seeking value and resilience in a shifting global landscape, European smaller companies may offer not just an alternative, but a timely and compelling opportunity.

Graham McCraw is senior investment specialist, equities, at Aberdeen.

ii is an Aberdeen business.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.