Facebook, UNICEF and the crypto challenger bank

Our award-winning crypto analyst discusses the latest bitcoin price moves and Facebook's Libra problems.

11th October 2019 10:20

by Gary McFarlane from interactive investor

Our award-winning crypto analyst discusses the latest bitcoin price moves and Facebook's Libra problems.

Bitcoin has been becalmed around $8,200 after some jittery visits to the $7,700 level, but bounced to as high $8,700 Thursday as uncertainty around the US-China trade war rumbles on.

The drop below $10,000 two weeks ago had failed to trigger more dip buying from the bulls, but it looks like that has changed.

Bitcoin's rangebound trading since the big drop a fortnight ago has been variously interpreted as representing a consolidation period before a recovery to $10,000 or, alternatively the prelude to a return to prices last seen at the end of 2018 when bitcoin bottomed around $3,200.

The latter is unlikely, with the latest move higher underscoring that view, but there is undoubted brittleness in the market, so it is fair to say this correction may not be done just yet.

Bitcoin bulls eye $9,000

Market participants should not be too surprised if there is another 20% decline in the offing, but for now the tug of war between buyers and sellers favours the bulls who eye $9,000.

(BTC/USD 1-day candles, Bitstamp, 10 October 2019. Source: TradingView)

For future direction we need to pull out and look beyond the technicals.

Recent price softness of the leading crypto is in stark contrast to some of the action among the altcoins (all cryptoassets other than bitcoin).

Although it is too early to call the return of the alt season, a number of top coins are seeing renewed buying interest.

Ripple's XRP and other altcoins lead market higher

The most notable example is probably Ripple's XRP token, which is credited with leading the market higher over the past few days on the back of adoption progress and some significant corporate activity.

Currently priced at $0.2728, it has given up some gains but is well clear of near-term lows at $0.2058

At the end of September, Ripple company Xpring purchased payments platform Logos Network. That follows an earlier investment in Kava, a builder of solutions for Interledger, which is working to facilitate direct transactions between different blockchains.

A report in City of London newspaper City AM, posited that both developments indicate Ripple is making a concerted move into Decentralised Finance (DeFi), and that is "supporting the sentiment".

Ripple is also, perhaps, an indirect beneficiary of two big news items elsewhere in the sector.

Block.one settles with US regulator

First off there was the settlement of the charges brought by the US Securities and Exchange Commission (SEC) against Block.one, the inventors of the EOS protocol.

The SEC had charged Block.one with running an unregistered securities sale after it raised $4 billion in last year's EOS initial coin offering (ICO).

A $24 million fine has been slapped on the company but that is small beer compared to the amount it raised in the ICO.

This could have implications for Ripple, which is also caught in the crosshairs of the SEC, as it looks into whether XRP is a security. Hopes have risen that Ripple could reach an accommodation with the regulator that is arguably as lenient as the Block.one settlement.

PayPal pulls out of Libra – more Facebook partners to exit?

The other major news that may have impacted the XRP price – and certainly has much wider ramifications for the industry as a whole – is the continuing problems facing Libra, which resulted at the end of last week in PayPal leaving the project.

On 4 October the Financial Times quoted a source at PayPal complaining about Facebook's supposed lack of preparation for dealing with regulatory pushback. "It doesn't seem that there was a lot of pre-work done with the regulators", said the unnamed person, who added that payment firms were worried about allowing regulatory scrutiny "to bleed into their businesses”.

Referring to a similar report two days earlier by the Wall Street Journal that said PayPal, Mastercard and Visa were all considering their position, Facebook's David Marcus, who is in charge of the project on behalf of the social media giant, felt forced to respond in a tweet thread, which is worth quoting in full:

"Change of this magnitude is hard and requires courage + it will be a long journey. For Libra to succeed it needs committed members, and while I have no knowledge of specific organizations plans to not step up, commitment to the mission is more important than anything else...The part of this article suggesting we weren't on top of, or didn't share detailed information about how to secure Libra and protect the network against illegal activity is categorically untrue; (worth calling BS)... The tone of some of this reporting suggests angst, etc... I can tell you that we're very calmly, and confidently working through the legitimate concerns that Libra has raised by bringing conversations about the value of digital currencies to the forefront."

On Tuesday, it also emerged that Libra Association's head of product Simon Morris left the Swiss-based organisation in August, according to the Daily Telegraph, which based its report on updates on Morris's LinkedIn page.

Morris was a key developer of BitTorrent's blockchain efforts after it was bought last year by Justin Sun's Tron crypto platform. BitTorrent, founded in 2004, is still the go-to application for peer-to-peer file sharing and now boasts a native token operating on its own blockchain – BTT.

Commenting on the apparent difficulties at Libra, Felix Shipkevich, a leading New York corporate lawyer specialising in derivatives, told interactive investor: "Obviously this is bad news for Libra's efforts- it's way too soon and too fast to lose its first partner. With Visa and Mastercard reconsidering their participation as well, Libra may need to go back to the drawing board. It cannot afford to losing any more strategic partners in such short-time frame."

Key European Union member states Germany and France have both said Libra would not be allowed to operate in their jurisdictions and the US Congressional committees calling for Facebook to halt development.

On Monday, the European Commission asked Facebook to clarify how it intended to handle financial stability risks, money laundering, counter-terrorism, data privacy and tax evasion.

Facebook co-founder and chief executive Mark Zuckerberg is due to appear at the US House of Representatives to face questions about Libra on 23 October.

The Bank of England's Financial Policy Committee in a statement has warned Facebook that Libra is "systemically important" and therefore can expect to be subject to rigorous oversight, with the need to "ensure end-to-end resilience" between the Calibra wallet, the Libra Reserve and the partner firms that will be acting as validators.

UNICEF accepts crypto, Electroneum's "green" blockchain to benefit

UNICEF, the United Nations agency for children's welfare, announced this week it is accepting crypto, with the first donation to come from the Ethereum Foundation.

This turns out to be extremely good news for crypto project Electroneum, which is tailor-made for NGOs [non-governmental organisations] who are the validators of choice on its unique Proof of Responsibility consensus mechanism layer, introduced in a major upgrade to the network this year.

Electroneum announced a couple of weeks ago that it has struck a deal with major Telcos in Turkey to allow customers to top up their phones using the ETN token.

Following a successful e-commerce pilot in South Africa and another mobile top-up deal in Brazil, Electroneum looks to have timed its alignment with NGOs to perfection as it focuses on gaining traction in the developing world.

The 92nd-placed coin by market capitalisation ($38 million), ETN is among the first of the UK's home-grown blockchain projects and its green credentials are certainly on message, given the heightened awareness of climate change issues.

Checkout the interactive investor crypto podcast with Electroneum chief executive Richard Ells available here.

Chainlink roars and Baanx positions as a white label crypto challenger bank

Chainlink is another altcoin that has caught the eye. It already has a partnership with Google Cloud, announced in June, but really got the juices going when it revealed it was a member of the new Trusted Computation Framework, along with Intel, Hyperledger and others.

Chainlink's technology allows for off-chain processing of data feeds used as inputs for blockchain smart contracts, known in the lingo as oracles. Chainlink helps to guard privacy and enable the necessary scalability for real world enterprise usage.

On 13 September, Chainlink's LINK token was trading at $1.57, and peaked at $2.85 yesterday, although it was off 10% Thursday on profit taking.

UK-based crypto project Baanx, a blockchain-based white label bank platform, is looking to raise $2.5 million in its pre-Series A founding round, valuing the company at £10 million.

The challenger bank space is one of the hottest in fintech, with Revolut valued at $1.7 billion leading the way in the UK.

The project qualifies for tax breaks under the UK Enterprise Investment Scheme (EIS), with the round closing in 45 days. It has a Visa Card product available in over 30 countries and is raising the money to fund further international expansion.

It aims to have two million users on board by the end of next year and says it already has commitments already in place based on "signed and pending contracts".

SEC reject crypto ETF proposal, Baakt volumes march higher

In other news the US Securities and Exchange Commission (SEC) this week rejected the latest proposal for a crypto exchange traded fund from Bitwise Asset Management.

The SEC noted that Bitwise reckons that 95% of bitcoin trading volume reported on exchanges is fake "but has not established that it has, in fact, identified the 'real' bitcoin market, or that the 'real' bitcoin market is isolated from the fraudulent and manipulative activity".

Hopes for an ETF to open up crypto markets to mainstream investors have been repeatedly dashed, but the latest disappointment has not affected the market as participants, except that the surveillance and supervision of exchanges has a long way to go before the US SEC would consider approving a crypto ETF product.

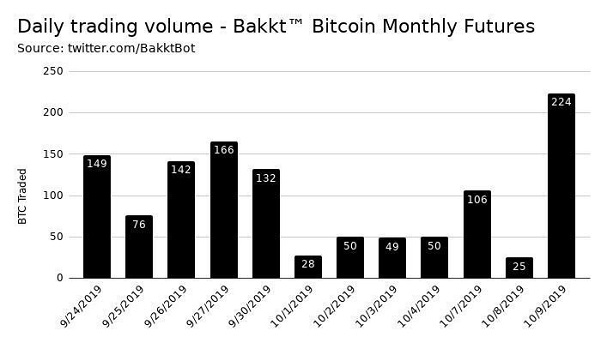

Elsewhere, after a slow start, the physically settled bitcoin futures product offered by Intercontinental Exchange's Baakt ecosystem are starting to see meaningful trading volumes.

At the time of writing 224 contracts have been traded compared to 71 on the 23 September launch day.

(Source: Bakkt Volume Bot, not affiliated with Bakkt)

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.