Five fund managers give buy, hold and sell tips

14th September 2018 13:55

by Holly Black from interactive investor

Our multi-manager panellists have taken a cautious approach in their recent fund investment choices, but now tell Holly Black about some future big winners.

Diversification and defensiveness are on the minds of professional investors at the moment. Stockmarket volatility has crept up recently and there are many macro issues to be concerned about: the trade war between the US and China, and the ongoing uncertainty around Brexit to name two of the biggest.

However, uncertainty and volatility can create opportunities. So while our panellists are looking to incorporate some protection into their portfolios – through fixed-income and absolute return strategies – they are also ensuring they have holdings that can benefit from a turning tide. Some are looking for ways to profit if fast-growing technology stocks fall out of favour, while others seek opportunities in smaller UK businesses. With so much up in the air across the globe, the mantra of many professional investors at the moment is simple: be prepared for anything.

This month we have slightly changed our panellists' mandate and asked them to talk about a fund they have recently bought, another they are retaining or adding to and a third where they have reduced their position.

Past performance is not a guide to future performance

Ayesha Akbar

Fidelity Investments

Buying

In the current environment, it makes sense to look for funds that are uncorrelated to other assets. Alternatives - a broad asset universe that includes infrastructure, wind farms and hedge funds – can provide this diversification. Tha'’s why we have invested in Doric Nimrod Air Two, a company that invests in aircraft leasing, in recent months.

It offers an attractive yield of more than 8% and strong total return prospects. We took advantage when shares were hit earlier this year after negative headlines about the resale value of the A380 planes the firm leases.

Holding

It also makes sense to retain some defensiveness, and we like high-quality fixed-income assets for this. I continue to hold Richard Woolnough's M&G Corporate Bond fund, which invests in corporate bonds and aims to deliver a higher total return than gilts. The fund draws on the research of a team of 'workout specialists' who analyse bonds close to or in default, looking for those with better odds of recovering investment in the event of a default.

Underweight

Some regions are giving particular cause for concern at the moment and we expect volatility in coming months. We are keeping our allocation to the UK contained. Majedie UK Equity has a disciplined strategy, which involves holding a mix of FTSE 100 stalwarts and smaller UK companies. It offers good, broad exposure to UK markets, but as the path to Brexit continues to spell uncertainty, we remain cautious.

Jordan Sriharan

Thomas Miller Investments

Buying

One new addition to our portfolio is the Fidelity Global Demographic fund, a thematic fund focused on firms set to benefit from long-term demographic trends such as ageing populations. Demographic trends tend to be slow, long in duration and predictable, so companies whose businesses rely on such trends tend to have dependable revenue streams. This fund has outperformed the MSCI All World index over the past three years. It taps into three main themes: population growth, ageing populations, and growth in both the middle classes and emerging market wealth.

Holding

We have not trimmed any positions recently, but we have increased our holding in the AQR Systematic Total Return fund, which aims to deliver returns equivalent to cash plus 6 per cent. One big attraction of the fund is its low correlation with global equities, which provides much-needed diversification in a typical portfolio of equities and bonds. It attempts to spread risk by investing across assets and styles that behave independently of one another.

The fund had a pretty torrid start to the year, and at the end of June it had suffered its greatest falls since inception in 2012. However, it has outperformed its target and a revival in its fortunes seems likely. We believe its approach may reward investors in the long run.

David Hambidge

Premier Asset Management

Buying

We have recently been taking advantage of the emerging market debt space, where the Fidelity EMD Total Return fund offers attractive income and the possibility of modest capital growth for patient investors.

Holding

We added the Teviot UK Smaller Companies fund to our portfolio earlier this year. The manager has an excellent pedigree and focuses on the smaller, value-oriented firms we like. Performance so far has been excellent.

Selling

We have been taking profits in Baillie Gifford American after gains of 37% so far this year, way ahead of the FTSE North America index, up just 10% over the period. It has a bias toward growth stocks and thriving technology firms. However, we think the market has noted the ability of such stocks to deliver, so a lot of their growth is now priced in.

Peter Walls

Unicorn Mastertrust

Buying

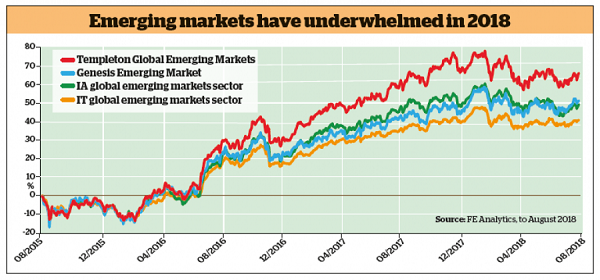

Investing in value-oriented funds can lead to periods of underperformance, particularly when markets are being driven up by a narrow range of stocks and sectors. Disruptive enterprises continue to prosper, but I worry that their merits are becoming too widely recognised. I recently invested in Genesis Emerging Markets, which is underweight technology and overweight in consumer franchises. Its board recently announced a 10% tender offer and promised to return a further 25% if the NAV total return does not beat the benchmark in the five years to 30 June 2021.

Holding

I've added to an investment in HarbourVest Global Private Equity, which has been trading at a discount of more than 22%, despite delivering the best NAV returns among its peers over the past five years. The underlying portfolio has potential for more profits.

Selling

Elsewhere in emerging markets, I have sold Templeton Emerging Markets Investment Trust. It has produced strong returns over the past three years, but given my tilt towards value, the decision to sell was primarily driven by its high weighting to the IT sector.

Peter Hewitt

Buying

The performance of Woodford Patient Capital – which invests in early-stage growth companies, especially healthcare and biotech firms – has been disappointing and shares are trading at a 10% discount. However, manager Neil Woodford insists it will take up to five years for many holdings to start producing exciting returns. There is widespread scepticism about this trust and its rating reflects past setbacks, but these are precisely the circumstances in which investors with a longer-term view can capitalise on the fund's potential.

Holding

We are holding Fidelity Asian Values, as the Asia Pacific region underperformed in the first half of the year amid concerns about a stronger dollar and a trade war between the US and China. The trust has become concerned about some company valuations and now has 13% of its assets in cash, while 25% of the portfolio is protected by derivatives in the event of a big market fall. The portfolio is defensive and short-term performance has lagged, but its long-term record is strong, and it is well-placed to benefit from any future market dislocation.

Selling/Underweight

Templeton Emerging Markets trust may find performance flagging next year, due to the escalating trade war between China and the US.

Multi-manager biographies

Ayesha Akbar is a portfolio manager in Fidelity's multi-manager team. Prior to joining Fidelity, she worked at Barclays Wealth, where she was instrumental in helping establish the firm’s multimanager business.

Jordan Sriharan is head of the collectives research team and senior portfolio manager at Thomas Miller Investments. Prior to that, he worked at Mercer, Fidelity Investments and the Wellcome Trust.

David Hambidge is head of multi-asset investment at Premier Asset Management. He helped set up Premier's fund-of-funds operation in 1995 and is regarded as one of the UK's most experienced multi-managers.

Peter Walls manages Unicorn Mastertrust, an open-ended fund of investment trusts. Before he joined the Unicorn investment house in 2001, he was an investment trust analyst and commentator for nearly 20 years.

Peter Hewitt is a director and investment manager with the F&C global equities team, and fund manager of the F&C Managed Portfolio Trust, where he specialises in investment trusts. He joined the firm in 1983.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.