Forget dividends, this US tech stock is all about growth

Up almost 150% since April, our overseas investing expert has great technology and cash in the bank.

7th October 2020 12:40

by Rodney Hobson from interactive investor

Up almost 150% since April, our overseas investing expert has great technology and cash in the bank.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

An online retailer that has turned the use of technology into a fine art ought to have been a sure-fire winner during the coronavirus crisis, but Stitch Fix (NASDAQ:SFIX) has disappointed somewhat this summer. Better times could still be just round the corner.

The company uses algorithms and data science, supported by 150 data scientists and nearly 5,000 stylists, to target the sale of clothing to meet its clients’ specific needs in terms of taste and budget. It keeps a digital inventory of customers’ purchases and sends its own clothing and other brands to their homes.

Stitch Fix is growing quickly, with client numbers rising from 2.2 million three years ago to more than 3.5 million now. Each client spent on average $486 in the latest three months, up 2% year on year. Revenue is also rising, up 11% year on year, and sales are generating positive cash flow. The group has no debt – indeed, it has best part of $400 million of cash and investments.

This is a remarkable performance considering the company scrapped advertising from late March to the end of May with a knock-on effect on recruiting new customers.

- Ant Group: how to access this massive IPO

- Want to buy and sell international shares? It’s easy to do. Here’s how

Sales are admittedly still quite small compared with other major clothing companies, so it is possible for Stitch Fix to be outmuscled by larger rivals. However, no other company seems to have got the technology so well refined and Stitch Fix could grow much larger before it faces a directly comparable rival.

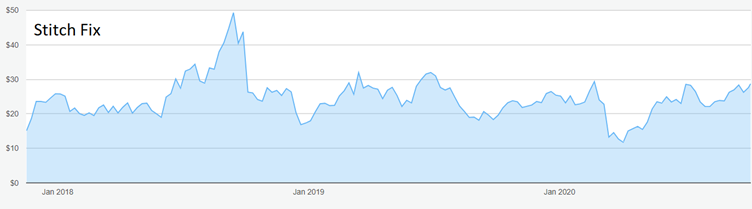

Source: interactive investor. Past performance is not a guide to future performance.

For the fourth quarter to 1 August, Stitch Fix reported a disappointing net loss of $44.5 million, helping to produce a net loss of $67.1 million for the full year. Covid-19 has taken a toll, with the worst impact in the third quarter, and any economic setback in the US would have a further impact on profitability.

However, online sales look set to grow as a whole new audience has learnt during lockdown the convenience of shopping online. Stitch Fix should easily be able to increase its market share in the coming months and years, given that it has increased sales during the past few months when many clothing retailers have reported falling sales.

Such is the demand for Stitch Fix’s offering that during July delivery times had to be lengthened. That doesn’t seem to have had much, if any, adverse effect, as customers come straight back with repeat orders and return rates are half the level experienced by other online clothing retailers.

Management reckons $20 billion of retail sales will switch to e-commerce over the next 18 months and, while that figure can be no more than an educated guess, the actual figure is going to be many times more than the company’s current turnover.

Certainly, Stitch Fix is making the most of its chances. In June, it rolled out Trending For You, a new feature that widened the selection of items that customers can choose from. Another initiative is to link up with little known but promising designers from minority ethnic groups to widen the ranges on offer.

Stitch Fix was founded in 2011 and its shares started trading on Nasdaq at $15.15. I first recommended them at $27 in February 2019 with a warning that they were not for the fainthearted.

- A fashion trailblazer worth watching

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It has been an up and down ride since, but the shares are now above my tip price and look to be back on the rise.

Hobson’s Choice: Buy at up to $30. This has been a ceiling in the past, one that may prove hard to break, but the shares have been as high as $50. If that happens again, consider taking profits. There is no dividend and no prospect of one in the foreseeable future as all cash will be ploughed into growing the business, so any investment is purely for share price gains.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.