FX Focus: Will the USD story continue?

10th September 2018 16:41

by Rajan Dhall from interactive investor

Foreign exchange analyst Rajan Dhall runs through the big issues that will drive the major currency pairs this week.

Coming off the back of a strong jobs report in the US, one can assume that the strong USD story looks set to continue. For now, the response to Friday's data showing signs that wage growth is picking up has been a tame one.

Looking into the positioning data, the market remains heavily long USDs, albeit with minor adjustments to its major counterparts across the spectrum.

As for the data itself, continued job gains keeping unemployment below 4% are all signs that the Federal Reserve will press on with its tightening program later on this month, with the FOMC fully expected to hike rates by another 25bps to lift Fed funds to 2.25%.

Ever closer to the neutral rate, a fourth hike in December - which is currently priced in to the tune of close to 70% - will see us pretty much there or thereabouts, with another two hikes (at least) anticipated through 2019.

Beyond the September FOMC, the balance of expectations will be highly dependent on the data. For all the hawkish projections in the market, the Fed has its fair share of members still leaning towards three hikes in total in 2018 - Bostic for one reiterating this a week or so ago alongside non voters Kashkari and Bullard who continue to peddle the cautionary line.

There may be some merit in holding back until we get a series of strong numbers rather than taking each monthly set of stats at a time.

Friday's rise in earnings of 0.4% can easily be revised lower, and at an annualised rate of 2.9%, real earnings remain flat given inflation is at similar levels.

Consequently, there is reason to be cautious on the USD at current levels.

The trade wars which have escalated have been to the benefit of the USD, based on yield for the most part but also on the premise that tariffs will hit the trading partners harder than the US.

This is an assumption alone, and judging by the rising trade deficit in the US - and record surplus in China (as reported this weekend) - we wouldn't count on it.

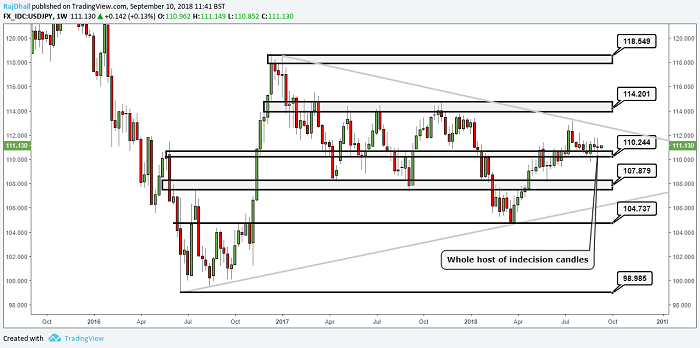

For now though, markets seem to be relaxed on how this may impact on the world's leading economy. This is very much reflected in the USD/JPY rate which remains buoyant above the 110.00 mark.

We note some strong support at this level, and will use this as a barometer for a change in how and where the market views safe haven destinations, with gold still under the cosh and struggling to gain a foothold above the $1200. Gold and JPY (USD) seem to be moving hand in hand at the moment.

Past performance is not a guide to future performance

Looking ahead, we see little other than potential position trimming that can hurt the USD.

Job openings on Tuesday should remain elevated to keep the labour market view positive - if only for actual headline employment.

Wednesday and Thursday offer up producer prices followed by CPI, which will then put real earnings in perspective as we have mentioned above.

Then on Friday comes retail sales to add further colour, though industrial production numbers seem to have less of an impact though relevance will come with time should the trade wars impact.

This is still a relatively healthy schedule considering what we have to look to elsewhere.

The ECB meeting this week is the main event in Europe, yet it is hard to see the governing council changing any of its forward guidance on rate normalisation.

The consensus is for a move not until after the summer of 2019, though President Draghi underlined the fact that they will tighten next year.

The only surprise then can realistically be to the upside (ie hawkish), though we see a low risk of this at this month's meeting.

The EUR may find some support as a result. Italy's budget delivery is in focus here where Five Star leader Salvini's promises of moderating spending to remain inside EU limits has eased some of the pressure on the single unit, though politically, this may prove destabilising given how and on what basis the electorate voted.

Even so, pre 1.1500 looks to be holding up in EUR/USD, and the longer this continues, the more traders will feel the breach of this level last month, which then led to a move to 1.1300 was a result of opportunism over the summer.

We still feel a move to 1.1000 or under will be a result of deeper existential concerns - revived in no small part to Italy's run in with the EU.

ZEW sentiment on the EU and Germany along with industrial production and employment are the leading releases ahead of the ECB, though there's greater interest on trade data which comes out on Friday.

Past performance is not a guide to future performance

Along with EUR/USD, we are seeing Cable showing similar resilience to the downside. Over the weekend, the interest in Boris Johnson's private life as well as unsavoury language on what he thinks of PM May's Chequers plan have revived divisions in the Tory party again and it seems this more than the likelihood of a Brexit deal could potentially weigh on UK sentiment and the Pound accordingly.

Even an agreed deal between the negotiating teams will need to come back to the respective parliaments for ratification and the pro Brexiteers are showing little sign that they are going to give the PM an easy pass.

There is a long way to go before the market can feel comfortable on GBP again. Earlier in the year, the optimism which drove Cable to highs around 1.4300-1.4400 were all too easy given the time left for talks to resume, but we are in the thick of it now and confidence is not so easy to come by!

Past performance is not a guide to future performance

EUR/GBP will reflect the greater view on the Pound. Above 0.8880-0.8930, the cross rate remains well placed to retest the highs should the mood in the Brexit talks and/or parliament deteriorate.

From a data perspective, growth and trade in July showed a resilience to the economy which has allowed the BoE to tighten rates. When they meet again this week, there will be no press conference or projections, though expect the statement to reflect some of the positive developments.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.