General Election poll: Over half fear vote results

As the UK counts down to election time, we reveal further significant shifts in investor sentiment.

2nd December 2019 13:30

by Jemma Jackson from interactive investor

As the UK counts down to election time, we reveal further significant shifts in investor sentiment.

With just ten days to go until the UK General Election, and some polls suggesting the Conservative lead over Labour is narrowing, a poll of 792 interactive investor customers between 27-29 November 2019 shows the election is even more of a concern than it was just two weeks ago, when 484 customers were polled between 14-15 November 2019.

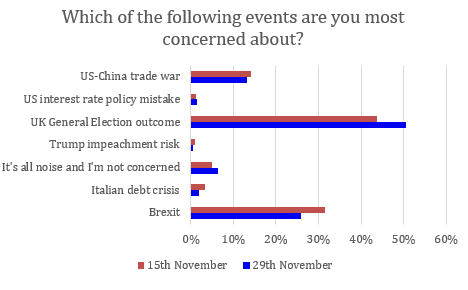

The most recent poll shows that the election result is still investors’ biggest concern, and it is up seven percentage-points to 51% as the number one concern among investors. Brexit remains the second-largest concern, but is down from 32% to 26%, followed by US/China trade war fears (13%).

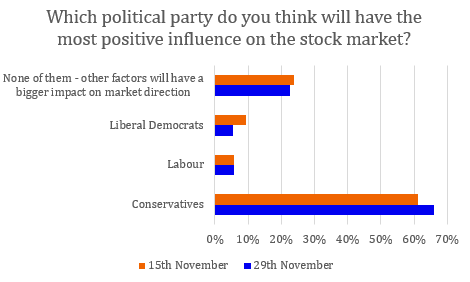

There has also been a five percentage-point increase in those thinking a Conservative government would be positive for the markets, to 66%. Most of that shift came from LibDems (down from 9% to 5%), with Labour staying at 6%.

Lee Wild, Head of Equity Strategy, interactive investor, says: “Just 10 days to go to the General Election and the two major parties have it all to play for. Latest opinion polls showing Labour closing the gap to the Tories have clearly sharpened the mind, and it’s no surprise that the election is the top concern for increasingly large numbers of investors in the countdown to 12 December. Investors are clearly less convinced by the LibDem’s plans for the economy than they were a fortnight ago, and more investors than ever now think the Conservatives are the best party to boost share prices after the election.

“Whether UK stocks will experience a Santa rally this December could be dependent on the outcomes of two events: the US-China trade dispute and the UK General Election.

“In the UK, the General Election is seen as a proxy for a referendum on EU membership, and the choice is binary. Regardless of your personal political affiliation, a Boris Johnson majority and the perceived certainty around Brexit that it brings, could potentially trigger a rally in UK-focused equities.”

Wall of cash?

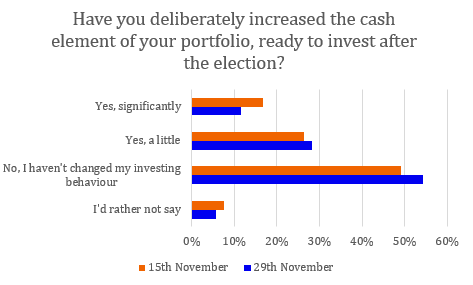

Despite General Election uncertainty being the big concern, there has been little change in the proportion of customers saying they have deliberately increased their cash, ready to invest after the election. However, this was already from a high base, from 43% on 14-15 November, to 40% on 27-29 November.

Almost a quarter of customers polled (23%) think none of the political parties will have much of an impact on markets, thinking other factors have a bigger impact, and this is in line with views taken on 14-15 November (24%).

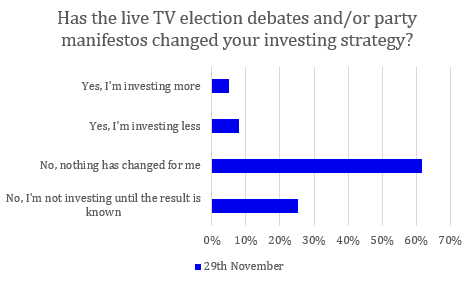

After the TV election debates and publication of party manifestos, 87% of investors are unaffected by the live TV debates and party manifestos, whilst 5% are investing more, and 8% investing less.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.