Global markets: the best and worst recoveries

Global markets are in recovery mode, prompting our overseas investing expert to compare progress.

27th May 2020 10:03

by Rodney Hobson from interactive investor

Global markets are in recovery mode, prompting our overseas investing expert to compare progress.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

East is East and West is West, but New York and Tokyo have something in common. Shares traded on stock exchanges around the world lost roughly a third of their value in the Covid-19 bear market but it is in America and Tokyo that they have pulled back most lost ground.

The opportunity to buy while shares are comparatively cheap may not last much longer on the world’s three largest exchanges.

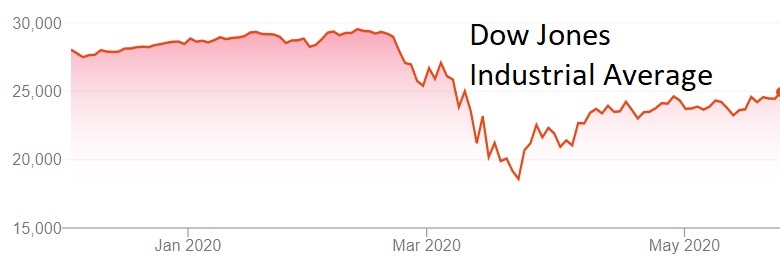

The Dow Jones Industrial Average, probably the most followed US index, plunged from over 29,000 in mid-February to a low of 18,600 a month later, yet it is already back up to 25,000. The more widely-based S&P 500 index dropped from 3,380 points to 2,240 over roughly the same period. It has recovered to 3,000 points.

So those indices have recovered well over half the losses. There is no guarantee that the recovery will continue at the same pace, or indeed at all, and even if the upward path holds it will undoubtedly be interrupted by sharp intermittent falls.

However, American stocks will, at the current rate of improvement, be back where they were before the summer is out.

Source: interactive investor. Past performance is not a guide to future performance.

The FTSE 100 index in London also lost a third of its value, falling from 7,500 points to 5,000, but it has struggled to get back above 6,000 points, which is only a 40% recovery, and one that looks to be stalling.

The CAC 40, the main measure on the Paris section of the Euronext market, saw a more severe fall of 40%, from 6,100 to 3,700, and it too has seen the upturn stall around 4,600 points with less than half the deficit recovered.

Source: interactive investor. Past performance is not a guide to future performance.

The recovery of the DAX, covering the 30 largest companies on the Frankfurt section of Euronext, is more promising. The drop from 13,800 to 8,450 was almost as severe as for the CAC 40, but the upturn has been more confident, with a steady rise to around 11,500.

Further afield, the S&P/ASX 200 index, the benchmark for Australia, shows a remarkably similar pattern to the Frankfurt index.

The fall was particularly steep but the subsequent pattern has been more steadily upward than elsewhere.

Source: interactive investor. Past performance is not a guide to future performance.

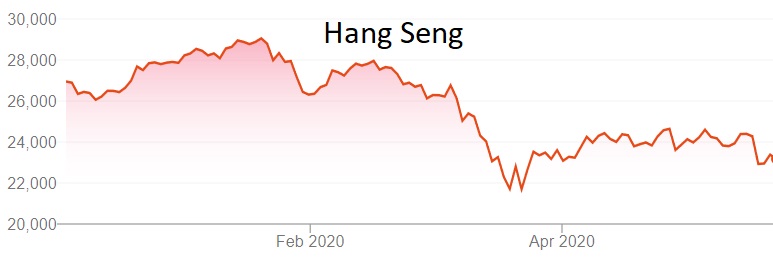

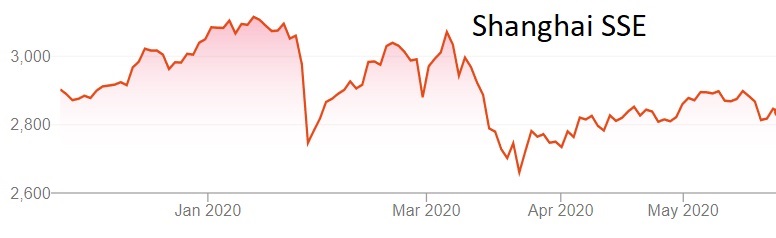

Asian markets, being closer to the centre of the source of the pandemic, reacted sooner. Falls there started in January and became steeper a month later, four to eight weeks before the Western world.

The recovery was already starting when markets in Europe and North America were beginning the plunge.

The Hang Seng Index in Hong Kong dipped from 29,000 points in January through to 21,700 in mid-March. The subsequent recovery has shown alarming signs of petering out at a comparatively low level.

Source: interactive investor. Past performance is not a guide to future performance.

Shanghai stocks have been the most erratic, with a collapse in January followed by a full recovery in February then another decline to an even lower level in March. The SSE index is still reeling from the double shock.

The crown for best recovery goes to Tokyo, where the Nikkei 225 dropped from 24,000 points in January to 16,500 in mid-March, a loss of about a third in line with other major bourses. However, the index has been rising steadily since to 21,000.

Source: interactive investor. Past performance is not a guide to future performance.

Source: interactive investor. Past performance is not a guide to future performance.

Stocks for the more cautious investor

Clearly, investors everywhere were caught out by the coronavirus outbreak, and by the extent of its impact, despite prior mutterings that the bull market had already run on too long to be sustainable.

Bull markets run until there is some serious setback, such as coronavirus or the financial crash.

There is no set length to them and they tend to last longer than bear markets, which are shorter and more severe. It would be no surprise if the Covid-19 setback is effectively over in most stock markets in a couple of months, albeit with many rebased to a lower level than last year.

Stock markets may need sharp corrections from time to time but on the whole they tend to catch up with events fairly quickly and accurately. The American economy looks set to come out of the economic setback better than most.

It was already performing more strongly than other developed nations and although the main financial centre of New York took the biggest hit from the virus there are large parts of this vast country that escaped relatively unscathed. Stocks there still look tempting for the more cautious investor.

Germany has been the powerhouse of Europe and that is unlikely to change, given that the country has a low rate of infections and deaths compared to other European nations. Australia with considerable natural resources should benefit from the reopening of China with its insatiable desire for minerals.

Hong Kong looks far riskier. It has been beset with troubles relating to its relationship with Beijing for more than a year and the situation has recently taken a turn for the worse.

Its status as a semi-independent enclave is at stake and it is hard to see the Communist regime on the mainland backing down now. The impact of an effective takeover from Beijing could be catastrophic.

Japan is equally problematic. Its economy has stagnated throughout the emergence of Asian tigers such as South Korea and Taiwan and has been impervious to stimuli for several decades. It is hard to see the country’s aging population seizing the initiative now.

China should return to strong economic growth, but probably at a more subdued level than the 6% prevailing before the crash.

Western companies are now alert to the dangers of being heavily reliant on a single source of supplies and the trade row with US President Donald Trump rumbles on.

If lessons are quickly forgotten, as they so often are, the Shanghai Stock Exchange offers opportunities for those most willing to take huge risks.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.