From global recession to global divergence

8th February 2023 09:26

by abrdn Research Institute from Aberdeen

The US is still heading into recession; Europe should avoid a winter contraction but weaken later; China will grow strongly this year. The overall scenario risk distribution is improving.

US recession still baseline amid data weakness, but a narrow path to soft landing remains

Market pricing of a US soft landing has risen, but we retain our long-standing recession call. Admittedly, Q4 2022 GDP growth was solid at 2.9% annualised, but the details of the report were weaker. There are also broadening signs of weakness in the more timely data.

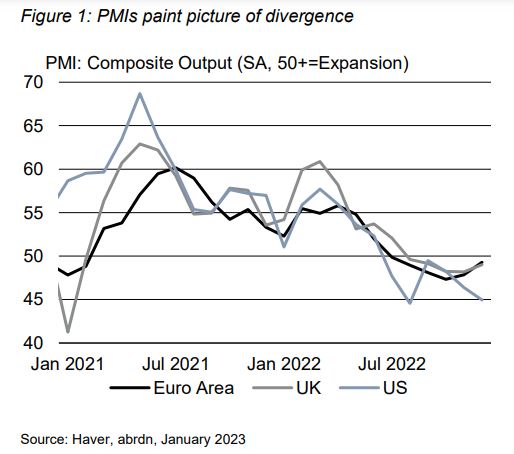

The composite PMI and ISM are in contraction territory (see Figure 1). Hard data show the housing sector in recession and manufacturing potentially joining it, while consumer spending declined at the end of 2022. A robust labour market continues to support income growth, but this is a lagging indicator. In any case, labour market overheating is precisely the imbalance that necessitates a recession.

Moderating core goods prices, reflecting global supply chain easing and the ongoing goods-to-services transition, is pushing down on inflation. Medical services prices are falling, however this is more a technical quirk than genuine deflation. Further out, falling house prices and rents suggest shelter inflation will moderate sharply next year. This might suggest a slightly smaller contraction is necessary to restore price stability.

We expect the Fed to shift to 25bps hiking increments, starting this week. We continue to forecast a 4.875% terminal rate, and then a cutting cycle beginning in H2, the size of which is still underestimated by market pricing.

Europe broadly flat over winter, but faces drag from tighter ECB policy and the US recession later this year

We now think the Eurozone can come through its winter challenges broadly stagnating. This is a meaningful upside relative to our earlier expectations of contraction. The large build-up of gas storage and the return of gas prices to pre-war levels have meant energy rationing will be avoided and consumer real incomes will be higher than otherwise. The high frequency data confirm this improvement, with the composite PMI back above 50.

But persistent core inflation means we have revised higher the ECB policy path. We think the deposit rate will rise from the current 2% to 3.25% come May (including a 50bps hike this week). Moreover, risks are to the upside given recent hawkish ECB rhetoric. Alongside negative spillovers from the US entering recession, tighter monetary policy should still mean a recession later in 2023. So although much better than they were, our Eurozone forecasts remain below consensus.

UK fundamentals remain weak

The UK probably narrowly avoided a technical recession at the end of last year, which, alongside a better European picture, led to upward revisions to our forecasts. But the fundamentals of the economy remain weak, with activity data deteriorating and the labour market overheating.

While headline inflation is now well past its peak, there is little evidence that underlying inflation is on a sustainable path back to target. This is likely to keep the Bank of England (BoE) tightening policy into Q2 this year, while we also now envisage the cutting cycle starting later.

China to be fastest growing major economy this year

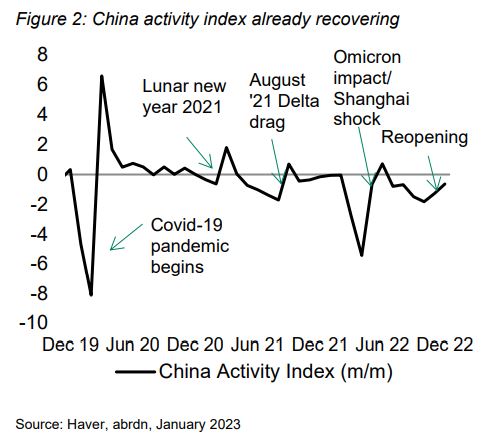

The very rapid spread of Covid through the Chinese population means the shift to endemic living can occur earlier than we had previously factored in.

While we are still operating in a Covid data vacuum, “anecdata” suggest 70-90% of the population in urban areas may now have acquired immunity. Subway traffic rebounded in January, showing many Chinese are comfortable “living with” the virus.

Indeed, our activity index is already improving, even if the flat growth reported for Q4 in the official GDP release doesn’t look believable (see Figure 2). Our 2023 forecasts are above consensus, and the risks are to the upside. China will be the fastest growing major economy this year.

That said, we are still concerned about the multi-year rebalancing of the real estate sector. And we aren’t as convinced as some about the pro-growth pivot in monetary and fiscal policy, given the need to contain imbalances.

International spillovers of Chinese re-opening will come through several channels, including tourism flows and commodities demand. But this is a double-edged sword, as stronger growth causes price pressures in an already capacity constrained global economy.

“Credible pivoters”, China beneficiaries, or countries with ongoing challenges: EMs are split

Divergence is also the central theme within broader emerging markets (EMs). We’ve revised up growth in China re-opening winners, mainly Asian tourist destinations like Thailand and Malaysia.

We also identify several “credible pivoters” where inflation has peaked and is now surprising to the downside (see Figure 3), and rate cutting cycles will shortly get underway – these include Brazil and Chile in LatAm, or Korea and Taiwan in Asia.

Most of the emerging markets in Europe are still dealing with exceptionally elevated inflation. Labour markets in Poland and Hungary are far too tight to warrant the pause by the Polish central banks or the monetary loosening at the edges done by the Hungary central bank. And many frontier markets face significant macro imbalances.

In Japan, macro fundamentals don’t justify a change in YCC, but market pressure may prove irresistible

Despite the current overshoot of inflation in Japan, underlying price dynamics are actually much weaker than elsewhere. Western core inflation is only 1.6%. This is low by global standards, but it is the fastest pace in Japan in four decades. And unlike most othe advanced economies, core services inflation is also still below the BoJ target.

Our baseline expectation is therefore that the Bank of Japan (BoJ) will fight a rearguard action to maintain yield curve control (YCC).

But intense market pressure, partly of the BoJ’s own making, means a high risk that the YCC policy is abandoned this year. Much depends on the appointment of the new governor, expected on or before February 10th . Masayoshi Amamiyais is the continuity candidate, while Hiroshi Nakaso or Hirohide Yamaguchi are more likely to drop YCC.

abrdn's Research Institute produces original research at the intersection of economics, policy and markets.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.