Go-Ahead's 18% surge short-lived

6th September 2018 12:25

by Lee Wild from interactive investor

After a rapid rally to multi-month highs unravelled quickly Thursday, Lee Wild, head of equity strategy at interactive investor, explains what's going on at Go-Ahead and at Melrose Industries.

Go-Ahead's mismanagement of its Southern rail franchise meant it's been making headlines for all the wrong reasons, but full-year results include more positives than we’ve seen for some time.

A massive rebuild of London Bridge station, timetable changes, and shrinking margins at its Southeastern franchise have scarred the rail division, while it took London to offset an ongoing decline in profits from regional bus routes.

It would be difficult to imagine the new financial year being any harder, and there is an optimistic tone from management. Profit from regional buses is tipped to creep higher and there are plenty of London bus routes up for grabs. Expect improvements in rail, but much will depend on whether Go-Ahead keeps the Southeastern franchise which ends in March,

Best news for shareholders is that free cash flow has underpinned the dividend and generous yield, and that this year should be strong, too. Unfortunately, there's no news on a replacement for finance chief Patrick Butcher who recently announced he'll be off to Capita in a few months' time.

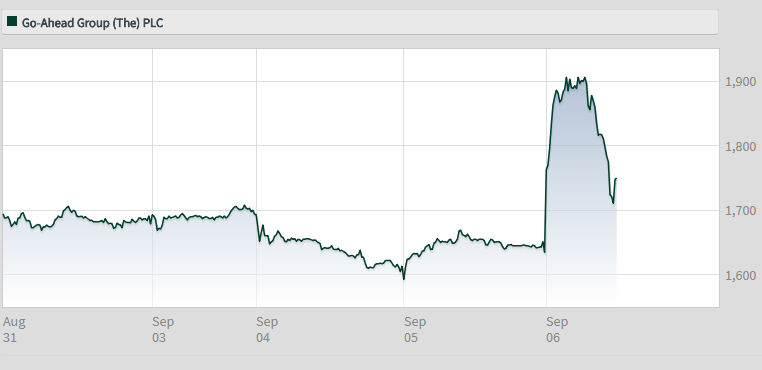

Go-Ahead shares traded as high as 1,923p early Thursday, up 18% on the day, but profit takers were quick to bank profits at prices not seen since May.

Source: interactive investor Past performance is not a guide to future performance

Melrose

Still fresh from a bitter months-long battle to wrestle GKN from its shareholders, there's not an awful lot to be gleaned from these half-year results in terms of the numbers. Substantial bid costs and just a couple of months of business from GKN lost Melrose £276 million in the past six months.

Melrose has had the keys to GKN for almost six months now, plenty of time to have a good look at what it’s bought. Crucially, previous management left no surprises, or 'black holes' and work is well underway on implementing an improvement plan.

We know Melrose has already been seeking bids for its powder metallurgy business and restructuring at Brush is on track, although its US Nortek operation, bought for £2.2 billion two years ago, is still struggling.

Melrose has a great track record of squeezing even more out of underperforming businesses and making sacks of cash for shareholders. It can do the same at GKN.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.