Have we hit peak China pessimism?

Are fears about China’s economic problems overblown? Bob Gilhooly weighs into the heated debate.

18th October 2023 11:31

by Bob Gilhooly from Aberdeen

It’s a rare day when I don’t see a negative headline about China's economy in my newsfeeds.

The long list of interrelated concerns include: deflation, pressures in the real estate sector, falling exports, consumers’ unwillingness to spend, high youth unemployment, stress in ‘shadow banks’, the state of local government finances, geopolitical tensions and a light-touch approach to policy support.

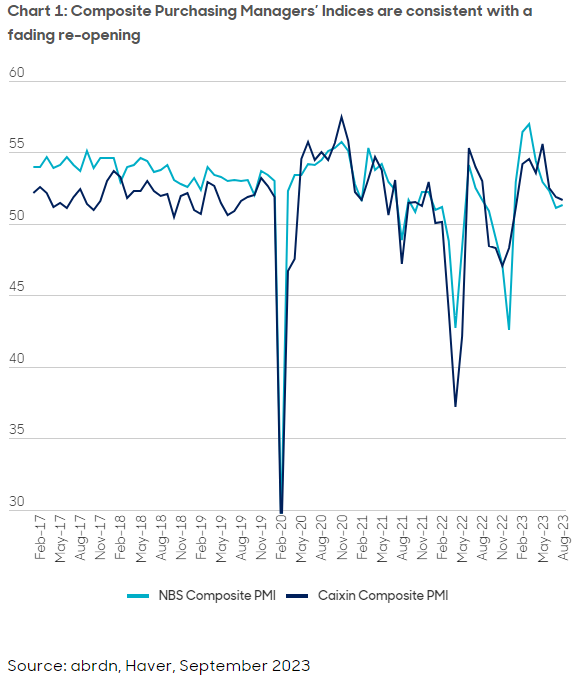

China’s post-lockdown reopening rebound has certainly faded much faster than we had hoped (see Chart 1), leading us to mark down our 2023 gross domestic product (GDP) forecast for the country.

High-frequency gauges of where things are heading – such as subway traffic data – still suggest that some parts of consumption and services are recovering. This could be consistent with so-called ‘revenge’ travel following three years of pandemic restrictions.

But it’s difficult to escape the conclusion that Chinese consumers are, on the whole, still cautious. Households are accumulating savings – spending the savings pile that has built up since 2020 seems a step too far.

There’s a risk that China’s saving rate has shifted higher permanently because of people’s experiences of living through zero-Covid restrictions that were among the harshest in the world.

Households (particularly those headed by the self-employed) may want to save even more to protect themselves against a less-benign world that contains a greater number of negative shocks.

On a related note, household sentiment may have been damaged by the ongoing stresses and uncertainties linked to the property sector, including the ability of developers to deliver homes for which buyers are already making mortgage repayments.

Falling house prices and the trouble at developer, Country Garden, may keep other buyers out of the market in the near term, even as purchase restrictions are eased and mortgage rates are pushed lower.

Japanification fears overdone

It’s perhaps no surprise that comparisons with Japan’s ‘lost decades’ are everywhere.

Similar to its island neighbour, China potentially has a large property bubble, is aging rapidly and is feeling the pressure from geopolitical tensions with the West.

There are, however, reasons to think that these so-called 'Japanification' risks are overstated, both in terms of their strength and in their timing.

China’s shrinking population does not signal an impending collapse in underlying demand -- urbanisation still has room to run; upgrading needs haven’t gone away; and a lack of alternative investments could sustain a high rate of property vacancies.

Japan was an advanced economy when its own asset bubble burst in the late 1980s. By contrast, China’s GDP per capita still implies substantial growth potential, even if it is being challenged by US actions aimed at limiting the country’s access to high-end technology.

Even though we have marked down China’s near-term growth outlook – pencilling in 4% growth for 2024 – and we’ve accounted for a 10% hit to potential GDP from lingering pandemic effects, we maintain our relative optimism about China’s long-term prospects.

Policy easing gaining traction

It may be difficult to express full confidence that the plethora of incremental policy-loosening measures so far will be enough to drive growth materially higher and revive market confidence in the immediate future.

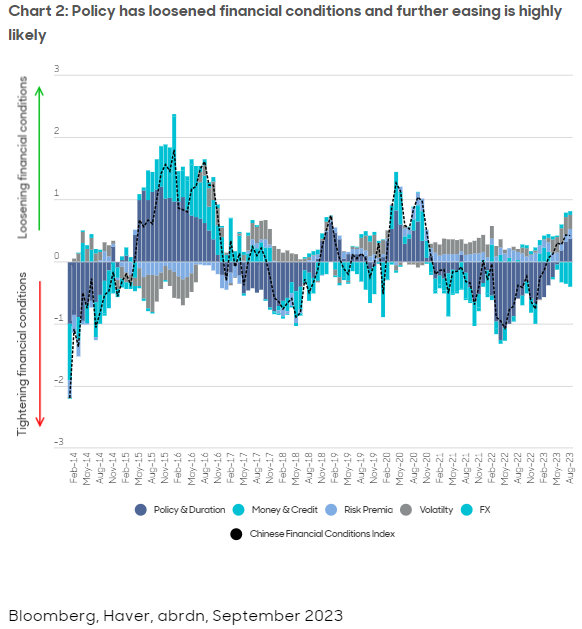

But our China Financial Conditions Index has been pushed into a position of modest accommodation, implying that the cumulative effects of China’s cautious easing should start to support growth more consistently (see Chart 2).

Further policy easing is expected and this should reduce the risk of a recession taking hold. A ‘big bang’ approach still seems unlikely but, like the difficulty of judging the combined effects of pulling so many policy levers, multiple small steps could still add up.

Indeed, should market and household confidence be unleashed, excess savings remain a route to an upside surprise.

Even if only half of all the excess savings is spent by end-2024, consumption growth could accelerate from 11% this year to 12.5% next year (rather than easing from 10% to 8% based on our baseline forecasts).

This implies that, while downside risks are easy to speculate on, upside risks have also risen.

Bob Gilhooly is Senior Emerging Markets Economist at abrdn

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.