Here’s how to figure out what’ll happen to the S&P 500 next year

9th December 2022 11:21

by Stéphane Renevier from Finimize

And how much you might make, or lose, in stocks.

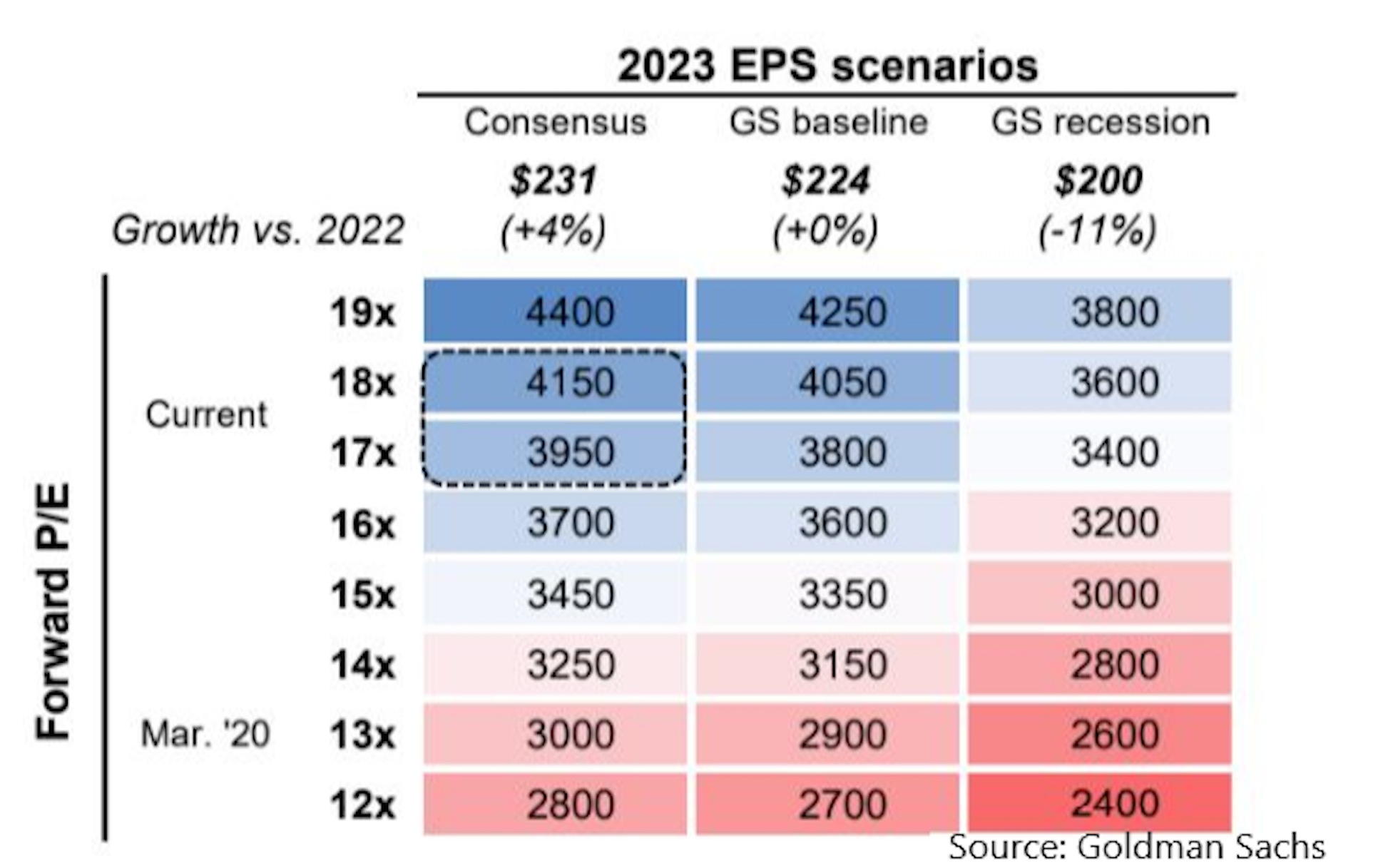

To forecast where the S&P 500 will trade next year, you need to know just two things: 1) how much earnings will grow next year, and 2) at what price-to-earnings (P/E) multiple it will trade at. When you multiply one by the other, you can estimate its future price – and how much you might make or lose in stocks. That’s because S&P price = (price/EPS)*EPS.

The beauty of this simple formula is that it allows you to test different scenarios and see how they’d impact the price. It also shows what different price forecasts imply in terms of earnings growth and multiple expansion. Here’s how that works in practice: the S&P 500 currently trades at around $3,930. Given the current P/E is around 17x, this assumes that investors expect earnings to grow by about 4% next year (left-hand column).

But what if earnings don’t grow? Assuming that valuations remain at similar levels, you can expect the index to trade at $3,800, about 4% below today’s price (middle column).

What if we get a recession? In this case, earnings could fall by 11% and the P/E could drop to around 15x. And that would mean the S&P 500 could fall by 24% to $3,000 (right-hand column).

So, now, what would it take for the S&P 500 to reach $4,400 – an almost 12% gain from here? You need earnings to grow by 4% and multiples to rise to 19x.

You can make your own assumptions to see what range or returns they imply. If you’re not sure how to forecast earnings, our analyst Paul Allison recently wrote a great piece on how to do just that, here (his conclusion: expect earnings to fall by 8.5%). By making a few educated guesses, you’ll be one step ahead of those using the good old finger-in-the-air approach. And while this approach works great for the whole index, you can also deploy it to forecast a single stock.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.