Here’s where you think the FTSE 100 will finish in 2020

Will stocks rally in 2020? US or UK? How would you invest £50,000? Our new poll has the answers.

17th December 2019 13:54

by Jemma Jackson from interactive investor

Will stocks rally in 2020? US or UK? How would you invest £50,000? Our new poll has the answers.

With the election of a Tory majority Government giving UK markets the boost that many investors were hoping for - to date at least - interactive investor customers are bullish on the outlook for domestic stocks in 2020.

A poll of 787 customers between 13-16 December 2019 shows there is greater optimism that the FTSE 100 will reach record highs by the end of 2020.

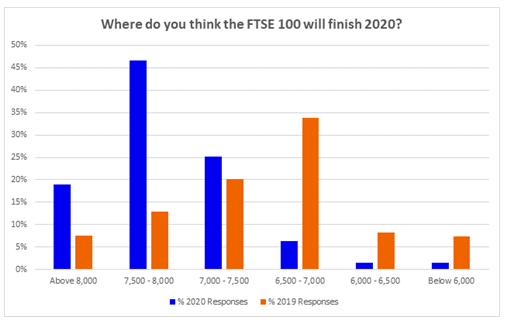

Some 19% of respondents think the FTSE 100 will break 8,000, exceeding its highest ever value of 7,903.50, which was reached on 22 May 2018. Almost half (47%) of investors think the FTSE 100 will end next year around its record value at 7,500 - 8,000, while only 3% predict a dip in the index to 6,500 or below.

This contrasts to last year’s instalment of the survey, which took the views of 699 customers, when only 8% thought the FTSE would break 8,000, while the majority, 34%, guessed that the value of the UK’s blue-chip index will be 6,500 – 7,000 by the end of 2019. One-fifth guessed 7,000 – 7,500 and 13% went for 7,500 – 8,000.

This year’s poll coincided with the FTSE 100 being about 500 points higher than it was when we polled customers in 2018.

Lee Wild, Head of Equity Strategy, says: “The UK election result and US-China trade deal remove two major obstacles for UK investors who now have every right to feel more optimistic about 2020. The Conservative’s overwhelming election victory is a game changer for investors in domestic assets given it brings certainty on Brexit policy. Certainty should breed confidence among businesses here and overseas to invest in the UK.

“Talk of a ‘wall of money’ waiting to invest in British business is not just wishful thinking. UK domestic stocks have already surged in value following the General Election result, but institutional cash and international investment will arrive in the months ahead, and politicians have promised billions to turbocharge the UK economy during the next parliament.”

UK most favoured region for 2020

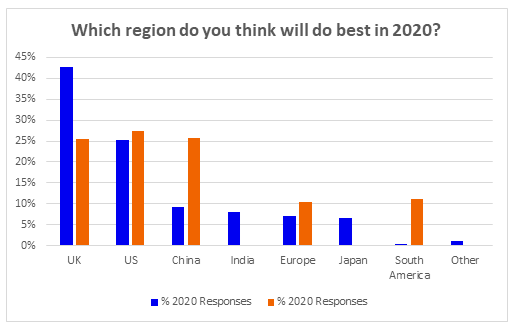

Many investors are also shrugging off Brexit and trade war fears, with the UK the most favoured region for 2020 for 43% of investors, echoing a recent poll of fund managers by the Association of Investment Companies. This is followed by the US and China (25% and 9% respectively), India (8%), Europe and Japan (both 7%). The US topped the list in last year’s poll with 27% of votes, slightly ahead of UK and China in joint second (both 26%).

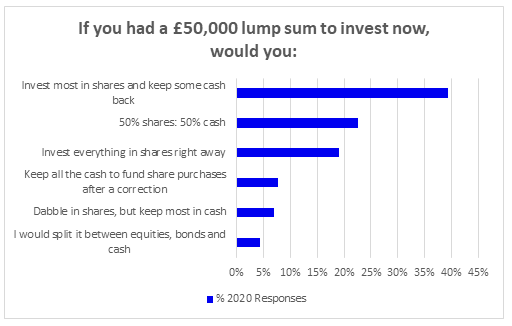

Asked what they would do if they had a £50,000 lump sum to invest now, 39% of respondents said they would put most in shares and keep some cash back, while almost a quarter (23%) would split the money equally in stocks and cash.

Some 19% would adopt a more bullish approach and invest the entire sum in shares right away.

That's not to say there aren't some bears out there – 8% said they would keep all their cash to fund share purchases after a correction, while 7% said they would dabble in shares but keep most in cash. Only 4% would opt for a more diversified approach by splitting it between equities, bonds and cash.

Lee Wild continues: “While Brexit trade negotiations with Europe are unlikely to be without their problems, the relief that a decision has finally been made is palpable. Similarly, the US-China trade spat has demonstrated clear progress toward a final trade deal, which President Trump will no doubt unveil some time before the US presidential election in November.

“This confluence of positive events significantly increases the odds that the FTSE 100 will break above 8,000 for the first time at some point during 2020, although as ever, anything can happen.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.