The hidden beneficiaries of the weight-loss drug boom

This craze is about more than just a couple of pharma stocks. Stéphane Renevier breaks down the stocks that stand to be the biggest winners – and the biggest losers.

26th April 2024 10:41

by Stéphane Renevier from Finimize

- With the majority of the world population expected to be overweight or obese by 2035, and an effective way to treat obesity now existing, the market for obesity drugs is expected to grow more than twenty-fold by the end of this decade, opening many opportunities for investors.

- Novo Nordisk and Eli Lilly dominate the market now, but there are plenty of other players that could enter the fray, such as Pfizer, AstraZeneca, and Roche, and innovative, earlier-stage firms like Zealand Pharma, Structure Therapeutics, Viking Therapeutics, and Amgen.

- The most interesting investment opportunities may be outside of pharma, though, with packaged foods companies, restaurants, beverage makers, retailers, gyms, lifestyle brands, health insurance, and even dating apps potentially winning big.

There’s a ravenous appetite out there for obesity drugs. This market is expected to expand to $105 billion by 2030, bloating to roughly 20 times the size it is now. That means plumper profits for pharma heavyweights Novo Nordish and Eli Lilly, and hefty opportunities for investors – some of them in unexpected places.

What’s the big deal about these drugs?

The obesity drug market could be your biggest and best investing idea, thanks to a global weight problem that just keeps expanding. Projections show that over half the world’s adults will be overweight or obese by 2035. And these injectable therapies can slim folks’ waistlines by 15% or more. They do this by mimicking a natural hormone (GLP-1) that makes folks feel full faster. As a result, people eat less and lose weight (and may see improvements on other medical conditions too). And that’s without having to resort to kale salads or 5 a.m. jogs.

The meds work so well, in fact, that Novo Nordisk’s Wegovy and Ozempic and Eli Lilly’s Zepbound are being hailed as “miracle drugs”. Not everything’s miraculous for their customers, though: these prescriptions are pricey, mostly not covered by insurance, and require a needle injection. Plus, they stop working when people stop taking them – meaning their users can easily put some of the weight back on – and the potential long-term side effects are still not fully understood.

Regardless, the appetite for these drugs is already reaching record levels. And Morgan Stanley says that by 2030, this market could reach $144 billion at best, and $55 billion at worst – and that’s only if supply can’t keep up. So it’s no wonder, then, that the firm sees this trend opening a lot of opportunities for investors.

So, which stocks are likely to benefit now?

Two companies are at the top of the class and have been building a strong competitive “moat” around this drug treatment trend. And that’s the two firms I’ve already mentioned: Novo Nordisk and Eli Lilly. They’re your most direct way to play this theme. They dominate the obesity prescription market and aren’t expected to lose their duopoly anytime soon. Morgan Stanley, for one, predicts that they’ll hold a hefty 84% share between them for years to come.

Other established biopharma companies with established commercial platforms like Pfizer, AstraZeneca, and Roche could potentially get in on the action in this field too, along with some more innovative earlier-stage players like Zealand Pharma, Structure Therapeutics, Viking Therapeutics, and Amgen. With so much demand, there’s plenty of financial incentive to shake up the market with cutting-edge innovative treatments – from pills that would replace injections to therapies that might tackle obesity at the metabolic level.

But here’s the thing: investing in biopharma stocks can be complicated. You’re looking at time-sucking regulatory hurdles, uncertainties from clinical trial outcomes, stiff market competition, and a lot of product launch challenges. And because drug companies tend to have their fingers in a few treatment pies, pharmaceutical success in one area doesn’t necessarily translate to a boost in overall stock performance.

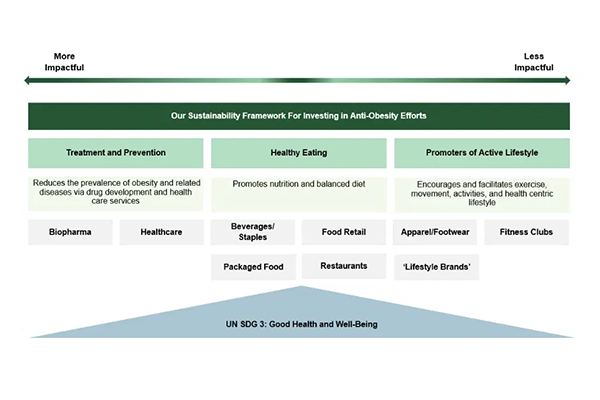

So it may be worth looking at the more indirect ways to invest in the battle of the, um, bulges. According to Morgan Stanley, this means focusing on two themes: firms that promote healthy eating (in other words, certain beverage and consumer staples, packaged foods, restaurants, and grocery stores), and firms that promote an active lifestyle (we’re talking: apparel and footwear names, so-called lifestyle brands, and fitness clubs).

Three ways to play the obesity theme: treatment and prevention, healthy eating, and active lifestyle. Source: Morgan Stanley.

OK, and which stocks are likely to benefit down the line?

These obesity meds are about more than just cutting calorie intake – they’re reshaping how people eat. Folks on these drugs are ditching high-calorie treats like ice cream and pies, and opting for healthier options like nuts and protein bars – and those choices often end up influencing the whole family’s diet.

This could have powerful ripple effects across industries:

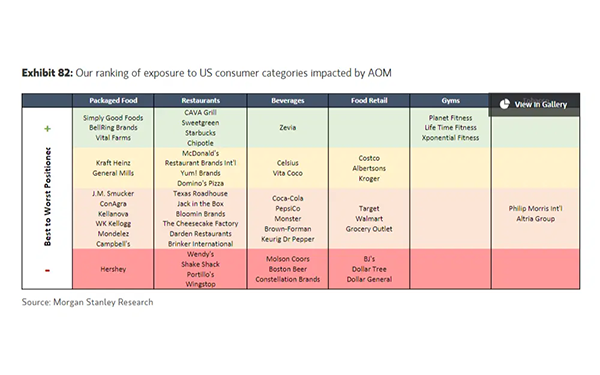

Packaged Food. Companies selling sugary junk like Hershey are likely to be put under pressure, while “better for you” brands like Simply Good Foods, BellRing Brands, Vital Farms, and Danone should benefit.

Restaurants. Fast food joints like Wendy’s and Shake Shack may need to overhaul their menus if they don’t want to risk losing patrons, whereas places like Chipotle and Sweetgreen that champion healthier choices might actually see a boost, along with hot-drink-focused Starbucks.

Beverages. Sales of sugary sodas and alcoholic drinks are expected to drop by 3% to 4% by 2025, and that’s not likely to go down easy for brands like Molson Coors and Boston Beer. On the flip side, makers of more virtuous beverages like Zevia may find the change refreshing.

Retailers. The impact on grocery sellers will vary greatly based on their customer demographics and product mix. Giants like Costco, Albertsons, and Kroger may be well-positioned to adapt, but others like BJ’s, Dollar Tree, and Dollar General could find the going gets tough – especially for those that don’t have pharmacies to offset their losses with sales of obesity drugs.

The US companies that are best and worst positioned in the battle of the obesity bulge. Source: Morgan Stanley.

Gyms. This trend goes beyond food: Morgan Stanley’s research found that people are ramping up their exercise routines, sometimes kicking off their fitness journeys for the first time as a result of these medications. This trend could pump up foot traffic for big gym chains like Planet Fitness, Life Time Fitness, and Xponential Fitness.

Apparel, footwear, and lifestyle brands. As those new gym-goers flex their muscles, they’ll find themselves wanting to refresh their wardrobes. No one wants to be the smelly, frumpy one at the gym, and a changing body shape necessitates new sizes and styles. That’s good news for activewear brands: 30% of consumers said they upped their purchases in athleisure apparel and footwear since starting on obesity meds, according to Morgan Stanley – the biggest growth across all categories. Brands like Lululemon, Nike, On, Skechers, and Under Armour could run a few victory laps on that.

Mind you, plenty could change. Stocks in leading positions could get dragged down by other factors. Badly positioned stocks could adapt and spring forward. But the ones with a headstart today are arguably a lot more likely to win in the medium term. And, personally, I’d add two other categories of potential down-the-line winners to the list.

Health insurance companies. Unlike life insurance companies, health insurance companies can’t legally deny you coverage or charge you higher premiums based on your weight. If obesity drugs lead to better overall health for people, these companies could see significant cost savings in the long run and emerge as major winners. Companies like Cigna, UnitedHealthcare, Humana, and Centene could be particularly interesting to watch.

Dating apps. This may seem like a bit of a leap, but stay with me here: health improvements tend to lead to better confidence and that could spur more activity in the dating scene. This kind of uptick might benefit platforms run by Match Group and Bumble, as more people feel motivated to put themselves out there.

So what’s the, ahem, bottom line?

Here’s the snag if you’re looking for an all-encompassing, easy play: there are no tailor-made obesity-drug ETFs that really cut the mustard. Most are underwhelming, poorly structured, or just cluttered with irrelevant stocks. You’d be better off building your own blend.

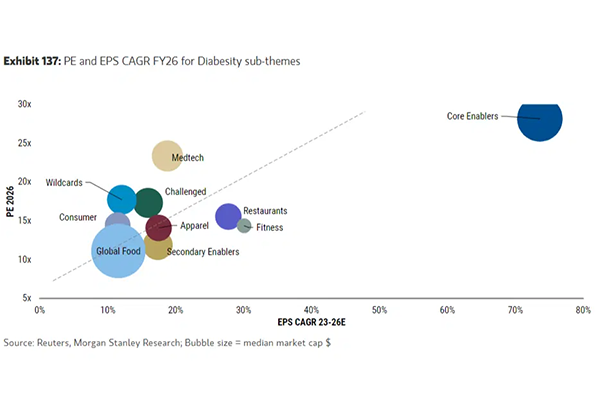

To do that, I’d start with the heavyweights: Novo Nordisk and Eli Lilly. These core enablers of the anti-obesity movement are pivotal players and should form a substantial portion of your investment mix. They’re not just direct bets on the theme: they’re also robust companies with strong market positions. Yes, their stock prices might seem steep, but when you stack them up against their potential earnings growth over the next couple of years, the numbers start to make more sense.

Core enablers Novo Nordisk and Eli Lilly aren’t so expensive relative to their expected earnings growth. Restaurant and fitness stocks also appear cheap. Source: Morgan Stanley.

Then, if your portfolio can handle the transaction costs associated with a broader stock selection, consider an investment in heavyweight pharma players like Pfizer and AstraZeneca and emerging contenders like Zealand Pharma and Viking Therapeutics.

Then, consider diversifying into the arena of indirect beneficiaries. These sectors – think: gyms, active apparel, and lifestyle brands – are more straightforward investments than biotech and pharma companies, and they’re less at risk from litigation or adverse drug side effects. And the icing on the cake is this: these industries stand to gain even if the obesity treatments underperform. Obesity is one of the world’s most pressing health issues: it’s at the forefront of global initiatives, including the United Nations’ Sustainable Development Goal to “ensure healthy lives and promote well-being for all at all ages”. That groundswell of support could drive momentum, no matter what happens with the obesity drug trend.

If you’re a more seasoned investor and you want an even cleaner exposure to the theme, you might consider playing both sides of the trade with a long-short strategy, betting for the likely winners and against the likely losers.

Finally, keep in mind that the fight against obesity is a long-term one, and as any seasoned dieter will know, progress often seems more like a yo-yo than a rocket. So consider using dollar cost averaging to pace your investment, committing a set amount of money at set intervals. And make sure you don’t put in more than you can afford to lose – because ups and downs are likely to happen along the way.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.