Hold, fold or buy? How real investors are reacting to coronavirus

We polled our customers with regards to the latest stock market crash. Here's how they responded.

3rd March 2020 09:09

by Jemma Jackson from interactive investor

interactive investor polled customers with regards to the latest stock market crash. Here's how they responded.

interactive investor, the UK’s second-largest direct to consumer investment platform, polled customers on Friday 28 February until 2 March, to gauge how they are managing their investments in light of last week’s market sell-off and the coronavirus. Some 2,337 investors responded.

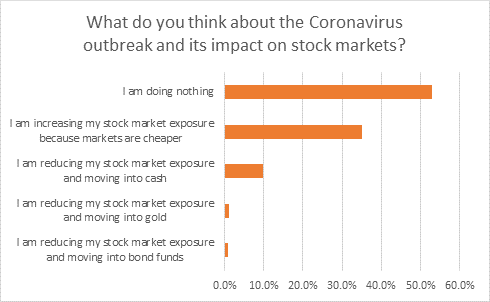

While over half (53%) said they are doing nothing, over a third (35%) have been taking advantage of buying opportunities, and 10% said they have reduced some of their stock market exposure and gone into cash. Only 1% said they were reducing stock market exposure in favour of gold, and this was also true when it came to bond funds.

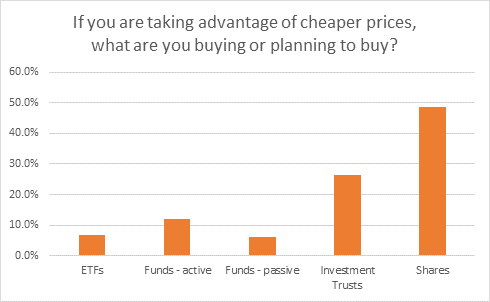

Putting money to work – direct shares and investment trusts take centre stage

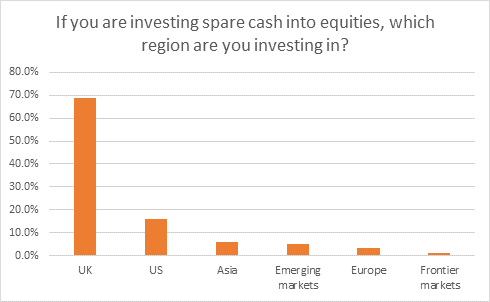

Those putting more money to work after market falls are predominantly favouring shares (49%), followed by investment trusts (26%). The UK was the most favoured region for those increasing their stock market exposure (69%), followed by the US (16%) and Asia (6%).

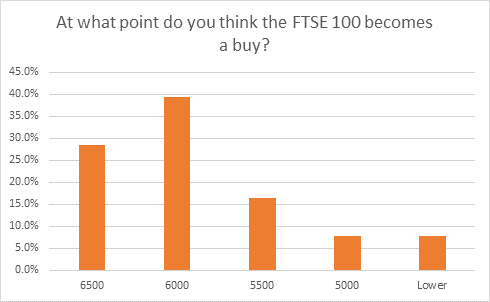

As for at what point the FTSE 100 becomes a ‘buy’, 28% said 6,500; some 40% said 6,000, and 17% said 5,500.

Lee Wild, Head of Equity Research, interactive investor, says: “Until we know the limits of this coronavirus outbreak, global equity markets will remain hugely volatile. Stocks are considerably cheaper than they were a week ago, and it is understandable why both long-term investors and short-term traders are picking up bargains at current levels.

“But there are a considerable number of investors sitting on their hands, waiting for stocks to get even cheaper before committing extra cash to the market. As a measure of sentiment, our survey shows that almost 72% of respondents think the FTSE 100 index is only a buy at 6,000 or lower. The numbers imply that the main index will have to fall by a further 500 points before another wave of buying emerges.”

Rebecca O’Keeffe, Head of Investment, interactive investor, says: “Amid market corrections, many investors are keen to buy on dips to pick up a bargain. As well as focusing on individual equities, investors should also look closely at moves in investment trusts. During sharp corrections, investment trust prices are not only affected by the decline in the value of their underlying investments, but they may also experience substantial shifts in the premium or discount to their underlying NAV. In volatile markets, investment trusts can present an opportunity to pick up more of what you love at a cheaper price, and that may well be what we have seen happening.

“Investors have a choice to make in volatile markets, whether to be brave and buy, whether to take a wait and see approach, or whether to be cautious and cash out. Historically, those who have been brave have typically been rewarded, as markets often recover, and what appears to be a dramatic fall at the time is, with hindsight, little more than a minor blip in a long-term trend.

“The difficulty with the Covid-19 issue is the sheer scale of uncertainty we face. Is this the start of a pandemic, and if so when might we find a cure? What economic impact will the virus have, on both demand and supply across a vast swathe of different markets and industries? Past episodes of a similar nature (SARS, MERS, swine flu) had little more than a transitory effect on markets, but the world is now more interconnected than ever before, not least in terms of travel and supply chains. All of this makes it very difficult for investors to know what to do. Either the market will continue to go down hard, or it will bounce – with the VIX* above 40 anything could happen.”

Notes:

2,337 interactive investor website visitors completed the poll between 12:45pm on 28 February – 11.15am on 2 March 2020

*The VIX is an index used to measure stock market expectation of volatility. It is often referred to in the media as the Fear Index.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.