Hollywood Bowl shares: Heart says 'buy', but what about the head?

11th January 2019 15:18

by Richard Beddard from interactive investor

Ten pin bowling does not strike Richard Beddard as a license to print money, but our analyst thinks Hollywood Bowl has a winning formula.

Last year I described Hollywood Bowl as a slick operator, an awful cliche reinforced by reading this year's annual report. In a desperate bid to be original I’ve settled on smooth operator this year. Ugh.

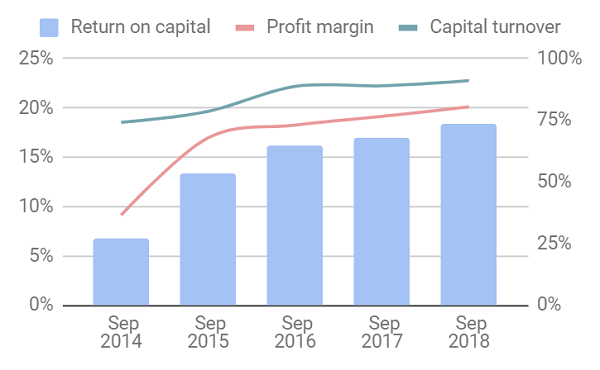

The company fell just short of a recommendation, though, because I could not convince myself it would prosper through thick and thin, a judgement I am beginning to question. It is very prosperous now, but has a short record trading as a public company:

Source: interactive investor Past performance is not a guide to future performance

Hollywood Bowl floated in 2016. Private equity owners tend to float businesses on the stockmarket at auspicious times to achieve a high price for their shares, and it would not be unusual if profitability waned, especially as it has been lower in the past. In 2014, return on capital was just 7%.

Winning formula

But Hollywood Bowl is a different company now. In 2014, it was only about three years into a strategy precipitated by its divestment from Mitchells and Butlers (a pub, restaurant and hotel group), its merger with AMF (another bowling center operator) in 2010, and the appointment of Stephen Burns as business development director in 2011 (he was promoted to chief executive in 2014).

Burns has focused the business on families and prime locations, next to cinemas on edge-of-town leisure and retail parks. The company developed a model based on the size of the local population and co-location with a town’s most popular cinema, other leisure activities, and restaurants. It also used technology to make scoring easier and lure people back to beat their best scores. In 2017, the company adopted dynamic pricing, adjusting how much bowlers pay to demand (like airlines).

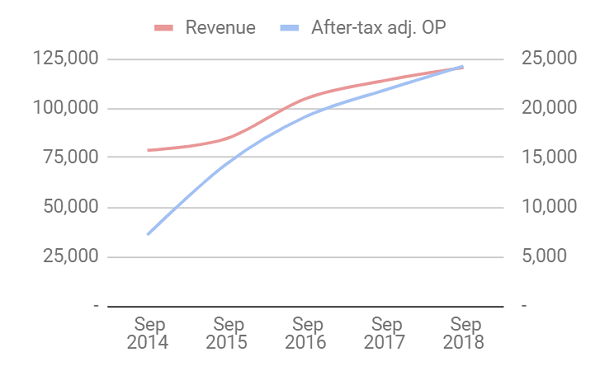

So far, the strategy, which is reinforced through the refurbishment of each bowling center every seven years or so, has driven profitable growth:

Source: interactive investor Past performance is not a guide to future performance

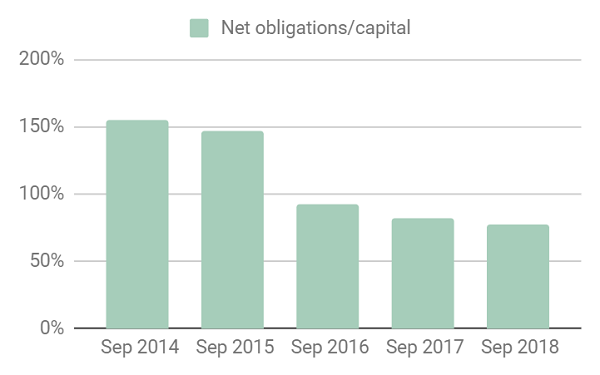

Proceeds from the flotation and strong cash flows have allowed the company to pay off debt to the point where, in September 2018, borrowings were almost matched by cash deposits. The remaining financial obligations in my chart below are leases on the bowling centres:

Source: interactive investor Past performance is not a guide to future performance

By acquiring and rebranding 11 Bowlplex centers in 2015, and opening new centres (as it did in 2018 Hollywood Bowl aims to open two a year) the company has reinforced its market leadership. It operates 25% of the nation's alleys in 59 centres (out of 309 nationwide), more than any other firm. The next biggest rival is Tenpin, which operates 43 centres. Tenpin listed in 2017, is less profitable, has a more chequered history, and a growth strategy dependent on acquiring centers from other operators, which reduces its choice of sites.

The developments at Hollywood Bowl probably mean it has a better chance of coming through recession unscathed. High footfall locations are likely to suffer least in recessions, and though it is not a good thing if nearby shops and restaurants shut, it would mean landlords try even harder to accommodate reliable tenants who will attract more people to their parks.

As market leader, Hollywood Bowl says it is the "go-to" bowling operator, which gives it access to the best locations and allows it to achieve attractive rents. Relatively low rents may be one factor explaining Hollywood Bowls' high profit margins, and high margins mean revenue could fall some way before testing my lower level for profitability.

Customer first culture

The company's collaborative relationship with developers and landlords depends on its reputation for growth and stability, which in turn depends on its corporate culture. Like other operators, Hollywood Bowl earns almost half of its revenue from food, drink and amusements. Success depends on customers having a good time and spending longer in the centres. Motivating staff, the face of the business, to make bowlers happy is the top priority. The loss of center managers is the most likely risk it faces.

The company gives managers the autonomy to run their centres "as their own businesses". It trained over a hundred potential centre managers and assistant centre managers in 2018 and they earn substantial bonuses if they perform well. In 2017, I am told, the company paid them an average bonus of £16,000, or 41% of their £35,000 to £40,000 salaries. "Centre Managers in Training" (CMiTs) may be required to step in and run centres at short notice under the guidance of regional managers and other experienced center managers. In 2018, the company encouraged all staff to become shareholders by launching a Save as You Earn scheme.

The incentives are much higher at board level of course, and a big pay rise in 2018 means the chief executive earns a base salary of £385,000, well in excess of my arbitrary and somewhat idealistic benchmark of 10 times national median pay. Though the board treats itself well, generally it treats customers, employees and suppliers well too.

As for shareholders, Hollywood Bowl has one eye on current returns and one eye on the future. It paid a special dividend in 2017 and, subject to shareholder approval, will pay another another in 2019. It has a pipeline of new centers under development that will keep it busy until 2022 and though there's scope for many more, it believes it can adapt the business model to other indoor leisure activities. In 2020 the company will open an an indoor "putting concept" in York.

The accounts are so clean the auditor failed to find anything risky to focus its report on, and the annual report explains the business very well, disclosing a wide range of revealing non-financial performance statistics.

Scores

One stat. the directors could improve though, is their bowling scores, which are not that high. Chairman Peter Boddy remains the champ with a best of 220, but finance director Laurence Keen has shimmied past chief executive Stephen Burns in the league, improving his score during 2018 from 178 to 180. Burns is stuck on 179.

As usual I have scored Hollywood Bowl to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Hollywood Bowl is profitable (2), it has a coherent strategy (2) and customers, staff, and shareholders should all benefit (2) but the business hasn't been tested in a recession, so I only score it (1) for resilience. A share price of 225p means the company is just shy of what I consider to be fair value, though (-0.2). It values the enterprise at about 18 times profit in 2018, adjusted for debt.

The problem with a scoring system is you have to draw the line somewhere, and a total of 6.8 is fractionally below the line, which I draw at 7. My heart says 'buy' but currently, and by the narrowest of margins, my system says Hollywood Bowl is not a strike, or a spare, it is bed posts for the second year running.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.