How to trim tax on pension pot withdrawals

In Steve Webb’s Pension Clinic, he explains how to steer clear of costly tax traps.

19th December 2019 09:55

by Steve Webb from interactive investor

In Steve Webb’s Pension Clinic, he explains how to steer clear of costly tax traps.

The ushering in of an era of pension freedom by George Osborne four years ago was a revolutionary change. Retirees were no longer compelled to use their pension pot to buy an annuity that would provide them with an income for life; instead, they could leave their money invested and dip into it at will.

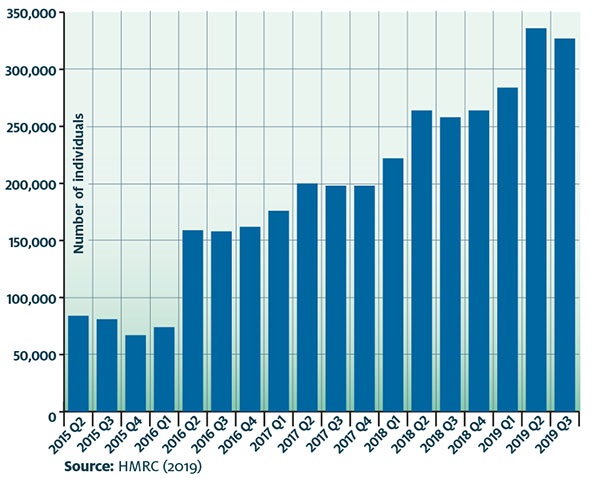

This freedom is now taken for granted and widely used. The latest figures from HMRC show that in any given quarter hundreds of thousands of people are taking advantage of the pension freedoms. The average quarterly withdrawal now stands at just over £7,000.

However, the way a withdrawal is taxed can trap the unwary. A pension withdrawal in excess of the 25% tax-free allowance is treated as income for tax purposes. The amount of tax you pay on such a withdrawal will depend on how much other income you earn in the year in which the withdrawal takes place.

Perfect timing

If you withdraw money from your pension in a year when you are still working, you will probably find that your salary mops up your entire tax-free allowance for the year and that the whole withdrawal is taxed as a result, potentially at the higher rate. However, if you withdraw money from your pension in a year when your other income is minimal, you may find that some unused personal allowance can be used to reduce the tax payable on your withdrawal.

The latest figures on flexible withdrawals from pensions show that people hold back on withdrawals in the first quarter of the year (the fourth quarter of the financial year) and that a burst of withdrawals follows in the second quarter (at the start of a new financial year).

For those considering taking larger amounts out of their pension, spreading withdrawals over two tax years or more can make a big difference to the amount of tax they pay. Consider, for example, someone who has £100,000 left in their pension pot after they have taken their tax-free cash. To keep things simple, let’s assume they have no other taxable income. We will also assume that English income tax rates apply, although the same principle would apply throughout the UK.

One option would be to take the full £100,000 in one go in a single tax year. In this scenario, tax would be payable on £87,500 (£100,000 less the annual personal allowance of £12,500). In the 2019/20 tax year £37,500 of this would be taxed at the basic rate of 20% and the remaining £50,000 at 40%, giving a total tax bill of £27,500, so half of the total pension pot would be taxed at the higher rate.

Withdrawals surge with the new tax year in Q2

Optimal option

Compare this situation with one where the £100,000 is taken out in two £50,000 chunks in each of two consecutive tax years. The first £12,500 of each chunk is exempt from tax, as it is covered by the tax-free personal allowance, and the whole of the remaining £37,500 withdrawn is taxed at the basic rate. Two lots of 20% tax on £37,500 amounts to a total tax bill of just £15,000. This strategy yields a huge tax saving compared with that of withdrawing the whole pot in one go in a single year.

Spreading withdrawals over more than one tax year makes even more sense for those with larger pots. Everyone is entitled to a tax-free personal allowance of £12,500 a year, but anyone with an income of £100,000 or more will see their personal allowance gradually reduced, until it reaches zero for those with incomes of £125,000 or more. If your pension withdrawal combined with your other taxable income in a year amounts to £125,000, your personal allowance will be wiped out and you will pay tax on all that income.

In general, taking money out of a pension slowly and steadily will help you manage it well and make it last as long as possible. Moreover, you will pay a lot less tax than you would if you were to raid your entire pension pot in one go.

Steve Webb is director of policy at Royal London.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.