ii Flash election poll: Your hopes and fears revealed

Just three days before Brits go to the polls, we reveal what investors might do once the result is in.

9th December 2019 13:50

by Jemma Jackson from interactive investor

Just three days before Brits go to the polls, we reveal what investors might do once the result is in.

Since the UK referendum three and a half long years ago, investors have been steadily increasing their cash levels – and Brexit uncertainty is likely to be part of the story.

The latest interactive investor flash election poll, conducted between 6-9 December 2019 amongst 615 customers, suggests an election ‘bounce’, if there is one (and anything’s possible), might see more cash balances being put to work.

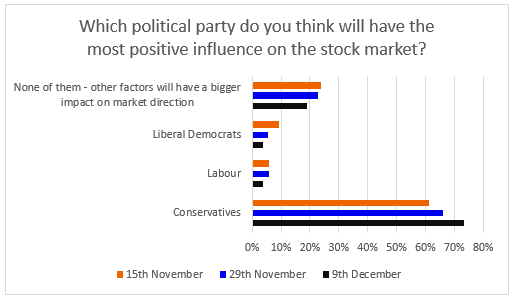

More customers than ever (73%) think a Conservative victory would have the most positive influence for markets, up from 66% on 27-29 November and 61% on 14-15 November 2019.

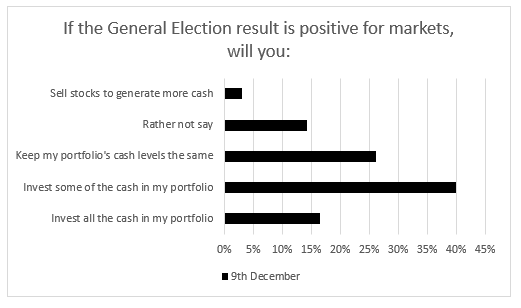

This is by no means an illustration of voting intensions or political affiliations, but, if the result is a positive one for markets, cash holdings could start to change. Some 16% of interactive investor customers polled say they will invest all their cash holdings on a positive result for markets, whilst 40% say they will invest some of it. Some 26% say they will keep their cash levels the same, whilst only 3% say they will sell stocks to generate more cash.

UK election weighs heavier than Brexit

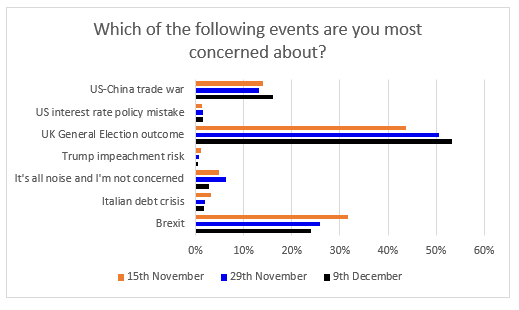

The outcome of a UK election result remains the biggest concern for investors at 53%, up two percentage points on 27-29 November and up from 44% on 14-15 November. Brexit concerns are down two percentage points to 24% in the latest poll, but it is still by far the second-greatest worry for investors. Concerns about a US/China trade war have jumped three percentage points but are still way behind at 16%.

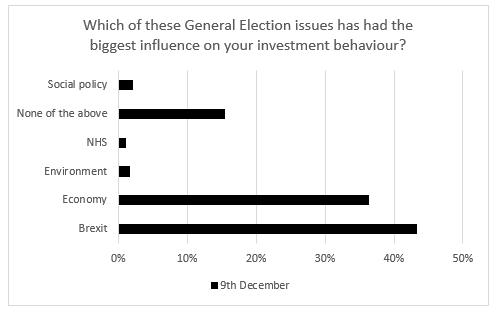

Lee Wild, Head of Equity Strategy, interactive investor, says: “Our final election poll is a great indicator of investing behaviour in the run up to the vote on Thursday. The election outcome has been by far the biggest concern for investors since it was called by Boris Johnson a month ago, increasingly so the nearer we get to polling day. And it’s clear from the results that, for many, this election is all about Brexit. A UK departure from the EU has had the biggest influence on investment behaviour for 43% of our clients, while the economy is the number one issue for 36%.

“If there is to be a Santa rally in 2019, a Conservative majority is the only outcome City analysts want to see, believing that a conclusion to Brexit will introduce certainty. Political clarity could attract money from overseas, and any positive market reaction to the election result might convince domestic investors that it’s finally time to put their cash to work.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.