ii view: Halma enjoys growth across all sectors

Life-saving technology company Halma – a reputation for steady growth.

25th September 2019 12:48

by Keith Bowman from interactive investor

Life-saving technology company Halma – a reputation for steady growth.

Trading update ahead of half-year results

- Performance in line with management expectations

- All sectors delivered organic constant currency revenue growth

ii round-up:

Halma (LSE:HLMA) describes itself as a global group of life-saving technology companies. It has customers in over 160 countries and operates across four sectors: process safety and infrastructure safety, medical and environmental & analysis.

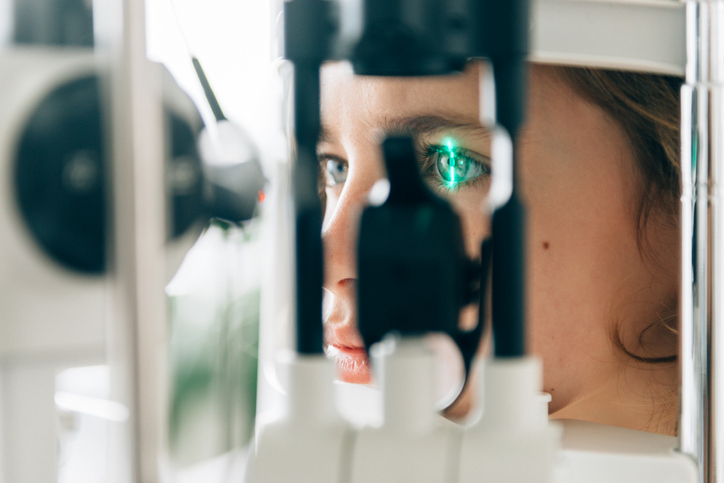

It makes instruments that detect flammable and hazardous gases, smoke detectors, devices that assess eye health and water quality testing equipment.

Over the past five-and-a-bit months, all four sectors grew organic currency adjusted revenue, with trading in line with management's prior expectations.

The environmental analysis division, offering services such as water analysis and treatment, led the way, with growth for its medical and infrastructure safety businesses witnessing more modest gains.

On a geographical basis, organic constant currency revenue growth was widespread. Good rates of growth were enjoyed in the UK and the USA, with more moderate upside seen in Europe and Asia-Pacific.

The weakness in the pound continues to have a positive currency translation effect on financial performance.

A healthy acquisition pipeline also remains in place, while several executive board changes were announced, with the aim of strengthening the group's operational abilities and expanding its digital growth strategies.

ii view:

Offering diversity in both product and geography, while pursuing a strategy to grow both organically and by bolt-on acquisitions, Halma is a business which has developed a reputation for steady growth, both acquisitive and organic.

The last financial year saw Halma report record revenue and profits for the 16th year running. Its progressive dividend policy has also generated 26 years of consecutive growth, although this is not an income stock.

However, a price for steady growth does appear to be in the valuation – a forward price/earnings (PE) ratio of over 30 arguably looks up with events.

Positives:

- Diversity in both products and geographical sales

- A progressive dividend policy

- Tried & trusted management team

Negatives:

- Brexit uncertainty – in 2018, approximately 9% of sales from the EU

- Lofty valuation

- Subject to currency fluctuations

The average rating of stock market analysts:

Hold

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.