ii view: Quiet April for Informa's exhibitions business

An equity fundraising, the dividend halted, and exhibitions rescheduled equal tough times for Informa.

16th April 2020 15:49

by Keith Bowman from interactive investor

An equity fundraising, the dividend halted, and exhibitions rescheduled equal tough times for Informa.

Covid-19 update

- Suspends dividend payment

- Issuing additional new equity

- No events scheduled for April

Chief executive Stephen Carter said:

"The strength of our specialist brands and customer relationships continues to provide confidence in our long-term value. However, in the near-term, we are facing material disruption in our Events-related businesses, with expectations for a gradual and phased recovery.

“Today we are taking action to stay ahead of this by building further stability and strength across our business. Through a range of measures, further reducing direct and indirect costs, supporting Colleagues and fully securing our finances, we are ensuring we can continue to manage Informa in the best interests of its long-term stability and strength."

ii round-up:

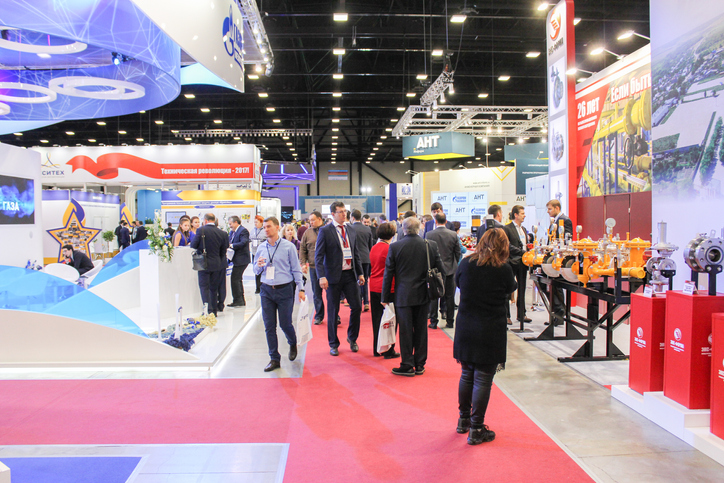

Business conferences and events company Informa (LSE:INF) has suspended its dividend payment and launched an institutional equity fundraising today as it announced measures to battle Covid-19.

The corona pandemic has forced it to cancel or reschedule hundreds of events with none now due to take place in April – events account for 65% of group sales.

In line with other media concerns such as WPP (LSE:WPP) and ITV (LSE:ITV), Informa shares have halved over the year-to-date although rose by just over 3% following these latest measures.

Its subscription related businesses, including academic journals and accounting for the balance of sales, has remained resilient and continues to grow.

Funds from the equity fund raising will be used to strengthen the balance sheet and reduce debt with total financing measures implemented taking the company’s overall liquidity to more than £2.3 billion.

The reduced level of activity at its events business is expected to last through the second quarter and into the Q3, with a gradual and phased recovery from Q3 into the final quarter forecast.

Following its previous acquisition of rival UBM (United Business Media), it has been busy executing an accelerated integration programme. It employs over 11,000 people in more than 30 countries.

ii view:

Informa’s diversity of business and solid track record have helped underpin investor confidence. The previous completion of its integration programme for UBM marked another positive milestone. But Covid-19 and social distance have knocked its events-related businesses for six. Over £460 million of revenue has now been rescheduled.

A series of financing initiatives including an equity fund raising and even an approach to the Bank of England’s Covid financing scheme have and could further bolster available funds, while £130 million of cost savings have already been executed.

For investors, the removal of the dividend payment is a further blow, although sensible in the current Covid-19 world. A prior record of six consecutive years of growth in underlying revenue, profit, adjusted earnings and cashflow is not to be forgotten. But with more than half of group sales dependent on large numbers of people congregating, a good dose of investor caution appears wise.

Positives:

- Around one-third of sales are subscription based

- Its Chinese business has seen some return of business activity

Negatives:

- End of 11 consecutive years of dividend increases

- Facing material disruption in its events-related businesses

The average rating of stock market analysts:

Buy

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.