Investors braced for the long haul with buying on hold, poll shows

With further restrictions in the UK, our coronavirus poll reveals a shift in behaviour.

23rd September 2020 10:26

by Jemma Jackson from interactive investor

With further restrictions in the UK, our coronavirus poll reveals a shift in behaviour.

With the UK braced for the long haul, and another six months of restrictions hanging over our lives and the economy, the latest research from interactive investor suggests that bargain-hunting might be getting put on hold.

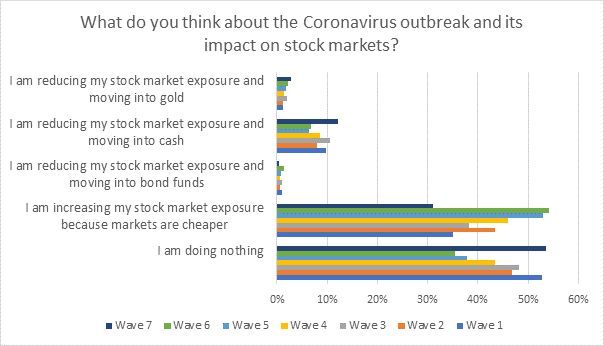

Between 21-22 September, interactive investor, the UK’s second-largest direct to consumer investment platform, polled 1,092 website visitors. More than half (54%) say that they are choosing to do nothing with their investments in light of the current crisis, compared to 35% in May. It is the seventh poll over the year to date, revealing some shifting behaviours.

Fewer buyers

While 54% of respondents in May said they were increasing stock-market exposure because markets were cheaper, only 31% were doing the same after Monday’s stock market falls and dire coronavirus warnings from government advisers.

Shift to cash

Lee Wild, head of equity strategy at interactive investor, says: “More investors are doing nothing than at any time since the pandemic took hold, which means fewer than ever are putting extra money to work in stock-market investments. The shift into cash and gold reinforces the pessimistic attitude of many investors, struggling to reconcile the current economic crisis with record valuations in areas like US technology.

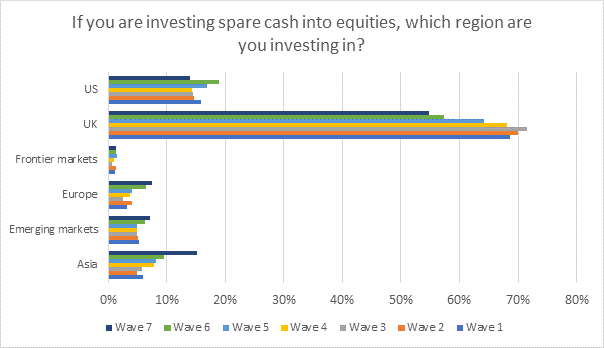

“It’s no wonder that demand for UK shares is at a pandemic low, given the potential damage both Brexit and a worsening wave of Covid infections could have on an economy already in recession. US shares have fallen out of favour too in recent weeks, as we see the first signs that buying is drying up at elevated levels and with a presidential election just six weeks away. It is interesting to see record interest in equity markets in Asia, Europe and emerging markets. Though not without their own problems, they do offer diversification and opportunities lacking elsewhere.”

The recent results also show more investors selling than ever, with 12% going into cash, and 3% into gold. In comparison, this was 7% in May for cash, and 2% for gold.

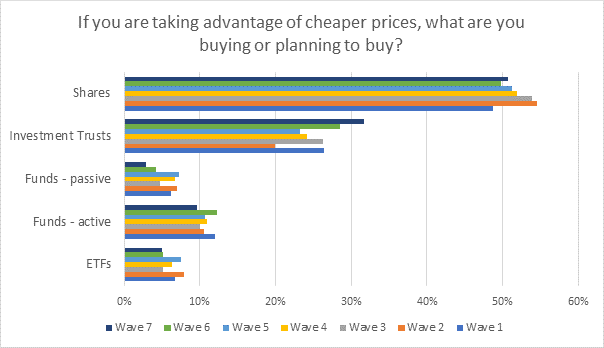

For those who are putting cash into the stock market, more investors than ever during this pandemic are turning to investment trusts (32%), compared to 29% in May and a low of 20% in mid-March, which could be due to either the search for income, or discount opportunists looking for a bargain – or the search for alternative assets. And it seems that active investing matters in these challenging times: 10% of investors are looking at active funds, and only 3% passives. Demand for ETFs remains comparatively muted at 5%, compared to a high of 8% in mid-March, again reflecting the demand for active strategies in the current climate. Half of investors are looking at direct equities.

Confidence in the UK is at its lowest since the poll began in February, with 55% putting spare cash into UK equities, compared to a high of 72% in late March. But it isn’t just the UK that has fallen from favour – just 14% are turning to the US, compared to a high of 19% in May, as investors see their horizons shrinking.

Richard Hunter, head of markets at interactive investor, says: “Markets have generally stemmed the declines of recent trading sessions, although any relief could be short-lived given overarching concerns which have not gone away.

“The potential for Covid-19 to wreak further economic damage was brought into sharp focus as the UK announced further restrictive measures. In the US, deteriorating relations with China and political distractions add to an economy which is still being hampered by the effects of the virus.

“Indeed, comments from the Federal Reserve pointed to the strength of the economic recovery seen so far, but also noted – again - that further fiscal stimulus would be required to maintain this momentum. While there were strong economic numbers announced yesterday in the form of existing home sales, unemployment remains a thorny issue, particularly given the political backdrop as the Presidential election campaign gathers pace.

“Big tech also saw something of a relief rally, with Amazon in particular seeing the benefit of a broker upgrade, taking its share price to a level of up 69% in the year to date. The Nasdaq is now ahead by 22% in the year to date, with investors contemplating whether fresh lockdowns being announced around the globe will lead to a repeat of the previous demand which the sector previously enjoyed at the height of the pandemic.

“In the UK, attempts to foil a second wave of the pandemic piles additional pressure on several already beleaguered sectors which had shown some signs of a tentative recovery. Hospitality, leisure, tourism and the banks will all come under the spotlight once more as the moves by the UK government threaten to choke recovery prospects. The additional concerns of a spike in unemployment after the end of the furlough scheme, as well as increasingly fraught discussions between the UK and the EU beg the question of whether more stimulus is required, or even possible. The previously coordinated package of fiscal and monetary stimulus from the government and the Bank of England was well-received and led to some economic success, and it will become apparent in the coming months whether there is appetite, or indeed the wherewithal, to provide further injections.

“In the meantime, the FTSE 100 remains down 22% in the year to date, despite some sustained recent weakness in sterling given the UK’s dampened economic outlook. Investors continue to search for value amid a backdrop of widespread uncertainty, but for the time being the UK’s premier index remains off the radar.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.