Investors piled into markets, ahead of the coronavirus sell-off

While every sector saw net inflows, fixed income was the most popular, taking in a net total of £1.7 bi…

6th March 2020 11:54

by Tom Bailey from interactive investor

While every sector saw net inflows, fixed income was the most popular, taking in a net total of £1.7 billion.

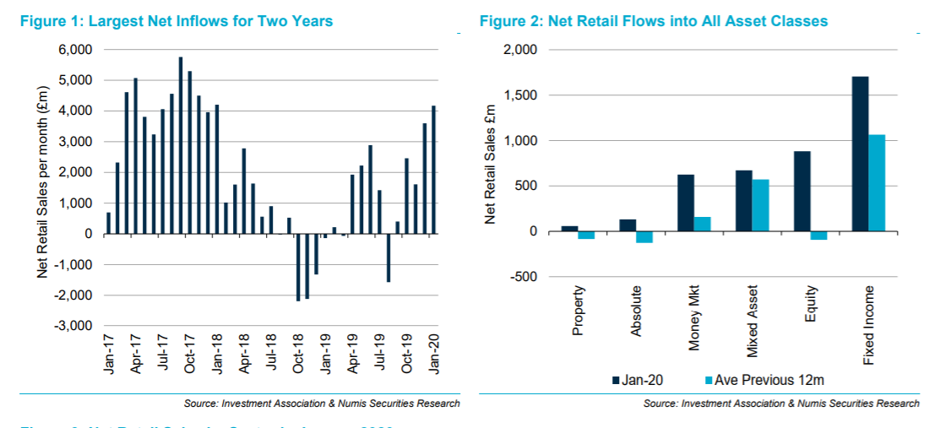

UK investors piled into investment funds in January, ahead of fears over the coronavirus negatively impacting markets, according to the latest data from the Investment Association.

In the first month of the year there was net inflows (the amount of money going into funds minus the amount being removed) of £4.2 billion. This was the largest amount invested in two years. This followed on from net inflows of £3.6 billion a month earlier.

While every sector saw net inflows, fixed income was the most popular, taking in a net total of £1.7 billion. This was followed by equities with £881 million and mixed asset with £673 million.

In terms of geography, UK-focused funds were the most popular (£335 million), with demand focused on UK All Companies and UK Smaller Companies. In contrast, UK Equity Income saw outflows of £47 million.

North America and Global funds also saw strong investor demand, with net inflows for the month standing at £273 million and £206 million, respectively.

Those investors, however, have had a rocky start to the year. First, there was some volatility following the rise of tensions between the US and Iran. This has since been overshadowed by the outbreak and global spread coronavirus, resulting in markets around the world tumbling.

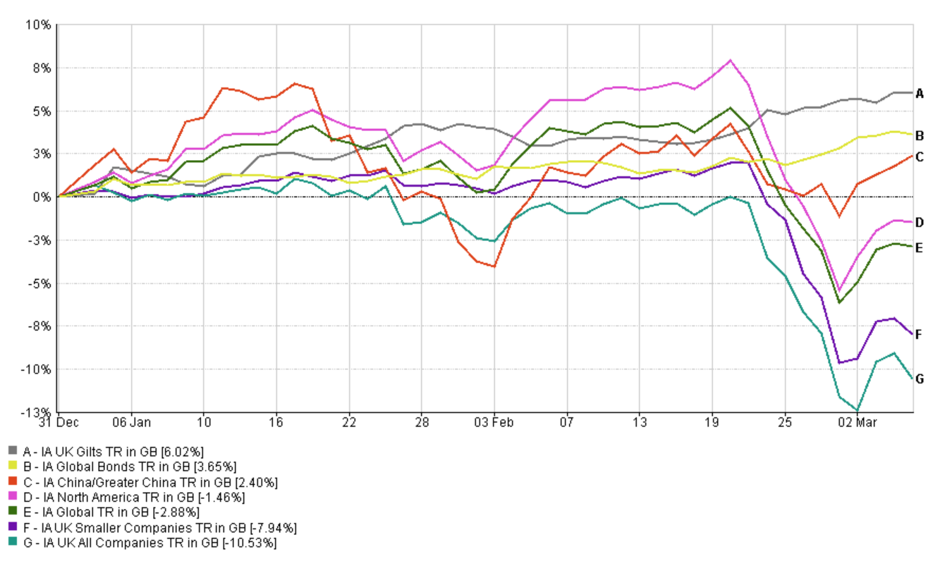

Those who piled into equity funds in January are likely now feeling some pain, depending on where they invested. According to data from FE Analytics, the UK Smaller Companies sector is down an average 7.94% and UK All Companies 10.53% since the start of the year.

The North America and Global sectors have also taken a hit, albeit less so, down an average 1.46% and 2.88%, respectively.

With investors seeking safety and central banks cutting rates in response to the crisis, fixed income has performed well. The UK gilts sector has returned 6.02% and Global Bonds 3.65%.

Strangely, given the source of the virus outbreak, the China /Greater China sector is in positive territory with year-to-date return at 2.4%

The large declines after such strong inflows shows how quickly markets can turn. Buoyed by a strong 2019, investors piled into equity focused funds. In contrast, January 2019 saw negative net flows on the expectation that the large markets decline in late 2018 was set to continue.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.