Is it the beginning of the end for the bull markets?

10th December 2018 11:52

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There is one sector that contains funds which aim to deliver positive returns in any market conditions. Saltydog analyst Douglas Chadwick tells us which one he's just bought.

Last week was another poor week for stockmarkets around the world and we've seen several like this over the last few months. When there is good news, like the recent easing of tensions between China and America after President Trump's meeting with Xi Jinping, markets temporarily rebound, but they struggle to gain any real upward momentum and soon drop back again.

The Dow Jones Industrial Average fell 4.5% last week, closing below 24,400. That's 9.5% lower than it was when it peaked at the beginning of October. The German Dax lost 4.2%, the French CAC 40 fell 3.8% and the Japanese Nikkei 225 was down 3.0% over the week. The Shanghai composite was one of the few stockmarket indices to go up last week, gaining 0.7%, but it lost that overnight and is currently 20% below where it started the year.

In the UK, the FTSE 100 has dropped below 6,800 and is back down where it was during 2014–2015.

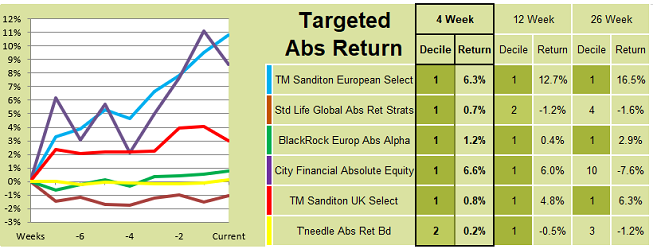

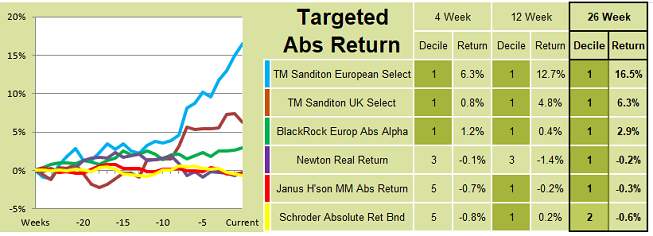

It’s not surprising that most of the equity-based sectors are struggling. However, there is one sector, Targeted Absolute Returns, which contains funds that aim to deliver positive returns in any market conditions.

Typically, funds in this sector would normally expect to generate absolute returns on a 12-month basis, but they are not guaranteed. The strategies employed by the fund managers vary considerably, and there is much debate about how many of these funds actually live up to their expectations.

One fund that has caught our attention in recent weeks is the TM Sanditon European Select fund. It is currently at the top of our four and 26-week performance tables. We invested in it a few weeks ago and it’s had a reasonable start.

Source: Morningstar. Past performance is not a guide to future performance.

Source: Morningstar. Past performance is not a guide to future performance.

It's interesting to see that quite a few of these funds are currently showing losses over twelve and 26 weeks.

The City Financial Absolute Equity fund is also down more than 20% over the last 12 months. This fund has done very well for us in the past, but it does prove the point that these funds can go down as well as up. This fund states that it seeks to achieve positive absolute returns over a rolling 36-month period – at the moment it can't even claim that it has done that.

We are going to stick with the Sanditon European Select fund while it continues to go up, but will be watching it closely.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.