Is it time to ‘buy the dip’?

Almost 100% in cash currently, Saltydog Investor sets out his approach to trading this crisis.

23rd March 2020 13:19

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Almost 100% in cash currently, Saltydog Investor sets out his approach to trading this crisis.

Over the last month we’ve seen dramatic falls in the value of stock markets around the world. It’s hard to believe, but it was only just over a month ago that some were setting new all-time highs.

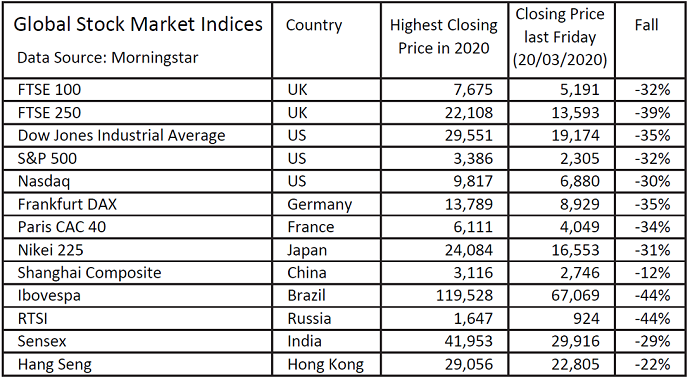

The table below shows just how much some of these indices have fallen since then.

On average they’re down 32%, which is roughly what the UK, US, European and Japanese indices are showing.

The main reason for the downturn is the spread of the coronavirus and the debilitating effect that it is having on global trade. When you consider that the virus was first discovered in China, and that they have more infected people and suffered more fatalities than any other country, it’s slightly strange to see that the Shanghai Composite is only 12% below its 2020 high.

The emerging economies of Brazil and Russia have suffered the most with the Ibovespa and the RTSI both down 44%.

At times like this it is not surprising that people are starting to talk about buying the dip and the plethora of bargains to be had.

The first problem is that many private investors are not sitting on large piles of cash waiting for the perfect time to get back into the markets. On the whole, the mainstream advice to private investors is ‘buy and hold’.

That means choose a balanced mix of investments that you are happy with and stick with them through thick and thin. If in the long-term equity markets go up, then so should your portfolio.

The advantages of the ‘buy and hold’ approach is that it is low cost and low maintenance. However, it does have its drawbacks, and they become particularly apparent at times like this.

When markets correct and then quickly recover most people will hardly notice, however it gets a bit painful when markets are down 30% and still heading lower.

The second problem is that if you’re relying on the fund managers to negotiate these turbulent waters then you will also be severely disappointed.

There will be people holding onto funds who expect that the fund managers, with their wealth of expertise and the almost limitless resources available to them, would have read the signs on the wall and already moved in to cash.

They should also know exactly when to reinvest. Unfortunately, that’s not how it works.

Most funds fall into one of the 30-plus Investment Association sectors. This is great for consumers because it means that they know exactly what a fund is investing in, but it does put limitations on the fund manager which many retail customers don’t fully understand.

As an example, any fund invested in the ‘UK All Companies’ sector must invest ‘at least 80% of their assets in UK equities which have a primary objective of achieving capital growth’.

Even if UK Equities were down 30% and the fund manager thought they may have another 20% to go, he would still have to remain 80% invested.

In these circumstances I wouldn’t criticise the fund manager or the Investment Association sector requirements, at least they make the situation clear.

The important thing is that private investors understand that if they want to reduce their exposure to a dramatic fall then they, or their financial advisers, need to take action and get out of these funds which have to remain invested.

The third challenge to ‘buying the dip’ is identifying when the market has reached the bottom. When indices started falling at the end of February, the US Federal Reserve reacted quickly.

On the 3 March the Fed announced its first emergency interest rate cut since 2008. It was the only unscheduled move since the Financial Crisis and also the largest, reducing rates by 0.5%.

The US stock markets had anticipated the move and the Dow Jones Industrial Average had its largest one-day point gain ever.

Other markets followed, but to a lesser extent. If you had picked that as the bottom of the dip, then you would now be licking your wounds.

The Dow Jones has subsequently fallen by a further 28%.

At Saltydog Investor we’re not in a mad rush to start reinvesting. We’ve now been almost 100% in cash for a couple of weeks and had started going safe before that.

In theory, we could wait for the markets to go up by 30% and we would still be getting in cheaper than when we sold.

Markets have a habit of falling quicker than they recover and, although this time may be different, I doubt it.

Governments around the world are putting forward ever-growing support packages, but it will take time for markets to evaluate how effective they are. In the meantime, the number of people affected by Covid-19 continues to increase.

It looks like governments are keen to stop fundamentally sound businesses from failing, which is both financially and socially desirable.

If that is the case, then economies around the world will at some point recover. No one knows exactly when that will be, but until we see some positive signs coming through in our numbers we will be erring on the side of caution.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.