Leading tech manager adds risk assets after sharp market drop

20th July 2022 12:10

by Sam Benstead from interactive investor

Polar Capital Technology Trust’s Ben Rogoff argues that the tech crash could be finished so long as there is not a recession.

It could be time to start adding to the highest-growth, but highest-risk, technology stocks that have fallen sharply over the past 18 months.

Ben Rogoff, manager of the £2.6 billion Polar Capital Technology Trust, is doing just that, citing the steepness of stock market falls this year from highs as a reason to invest.

Writing in the trust’s annual report, released today, he said: “Technology valuations have meaningfully corrected such that next-generation software stocks now trade broadly in line with incumbents on a forward enterprise value/sales basis.

“The last time this happened was 2015-16 when the market was also significantly concerned about a hard landing, suggesting that technology stocks have begun to meaningfully price in recession risk.”

The current S&P 500 drawdown of about 20% is consistent with the average non-recessionary bear market of an 18% drop over eight months.

However, Rogoff calculates that the average recessionary bear market has seen the market fall by around 33% over 17 months, suggesting the current correction may only be two-thirds complete in the event of a recession.

“As such, we have begun to rebuild our exposure to higher-growth stocks, while maintaining a modest amount of Nasdaq put protection and cash to help buffer the impact of further market weakness, while ensuring the portfolio remains highly liquid,” he said.

Rogoff remains bullish on the tech sector, saying that it is easy to forget how good the long-term technology story is.

He said: “We are confident that secular tailwinds will reassert themselves, supported by favourable demographics.

“Software spending growth remains robust as companies digitally transform, automate workflows, gain insight from artificial intelligence, secure themselves from cyberattacks and apply technology to drive productivity gains.

“Research firm Gartner believe software spending will increase 9.6% this year; digital transformation is a $10 trillion (£8.3 trillion) opportunity through 2025. And then there's a myriad of other secular themes within technology to get excited about: artificial intelligence, cybersecurity, electric vehicles, healthcare and clean energy to name a few.”

Concentration risk

One risk when investing in technology is that just a handful of companies dominate the space, meaning that if they were to fall out of favour then the entire sector could crash.

Just three stocks – Apple, Microsoft and Alphabet (Google’s owner) – make up 41.3% of Polar Capital Technology’s benchmark index, the Dow Jones World Technology Index.

Meanwhile, these three tech giants make up just 28.5% of the investment trust. Five years ago, these stocks accounted for 22% of the trust’s holdings and 30% of the benchmark.

However, Rogoff is not worried about this and is currently happy to have such a large weighting to the top tech stocks.

- Terry Smith: Fundsmith valuation at cheapest level in five years

- Why value funds are losing money this year

He said: “Although this makes the portfolio (and indices) more sensitive to the performance of a few stocks, we are encouraged by the fact that the largest 10 stocks also explained 29% of index earnings as at year end.

“Trading at around the market multiple, these stocks dominate market-cap indices because of their earnings progress, rather than because they sport outlandish valuations as was the case in the late 1990s. We are very comfortable moving materially underweight them should we become concerned about their growth or return prospects, or should we find more attractive risk-reward profiles elsewhere in the market.”

Sarah Bates, chair of the trust, adds: “We would expect that the concentration of stock performance in the largest companies will diminish as it tends to lead to overvaluation. Investors with long memories will remember the performance of Vodafone after it became 15% of the UK index in 2000.”

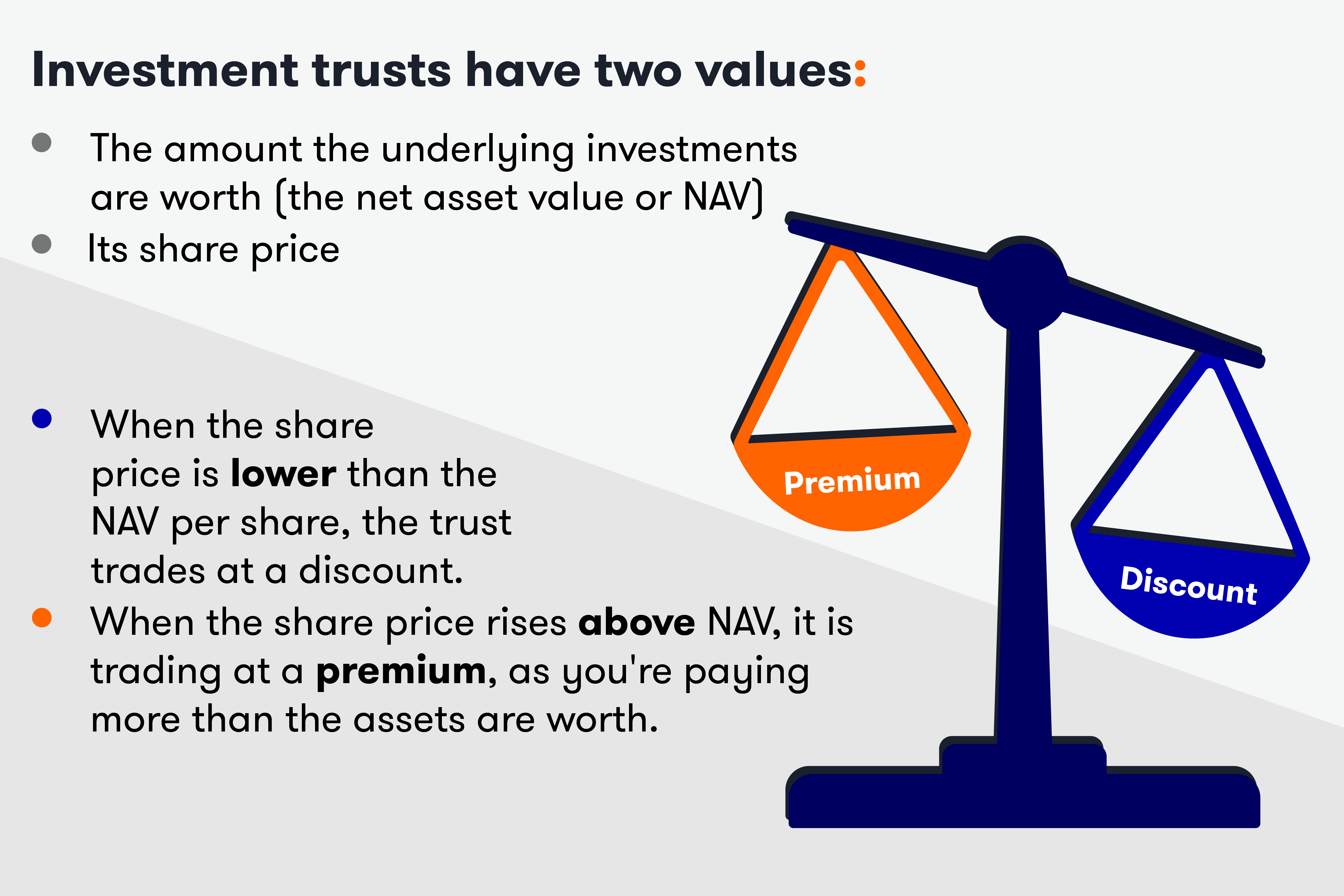

Polar Capital Technology’s net asset value per share fell 7.7% in the year to 30 April 2022 compared with a 0.9% drop for its benchmark. Its share price posted a bigger loss of 13.7%, owing to the trust’s discount widening over the period. Its current discount is 9.3%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.