Why value funds are losing money this year

26th May 2022 10:03

by Sam Benstead from interactive investor

Rising interest rates should be good for cheap shares, but reality is proving different.

After more than a decade predicting a return to form for cheap shares, “value” investors should finally have something to celebrate.

Rising interest rates – and the possibility that an extended period of above target inflation will keep them high – has pushed investors to prioritise profits today over profits tomorrow, prompting a crash in the value of technology shares.

Leading UK value investor Alex Wright, manager of the Fidelity Special Situations fund, says: “Over the past decade and a half since the global financial crisis, we have had a very unusual period where rates have been kept at such low levels, favouring growth stocks and acting as a headwind for value stocks.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

“This near-zero interest rate environment is changing rapidly as rising inflation is forcing the hand of central banks. This should be a better environment for value investing and companies whose valuations reflect to a greater extent nearer-term potential earnings.”

However, long-suffering value investors who hoped that performance would turn around this year have largely been disappointed.

- How to play the market rotation: fund, trust and ETF ideas

- Fund Finder: value versus growth investing

- The funds delivering when both growth and value stocks do well

This year, the MSCI World Value index is down 6% in dollar terms. In contrast, the MSCI World Index has fallen 16%. Converted back to sterling the value index is up 1% and the global index is down 9.5% as a result of a weaker pound.

The global value index, which UK investors can own via passive strategies, including the iShares Edge MSCI World Value Factor UCITS ETF, tracks global stocks “undervalued stocks relative to their fundamentals”.

It has a price-to-earnings ratio of just 9.3 compared with around 17 for the classic global index. It avoids expensive US tech giants and instead has large positions in AT&T (NYSE:T), British American Tobacco (LSE:BATS) and Toyota (NYSE:TM).

Actively managed value funds have not performed much better. Of the 10 open-ended, dedicated UK stocks value funds that we identified, just half have delivered positive returns this year.

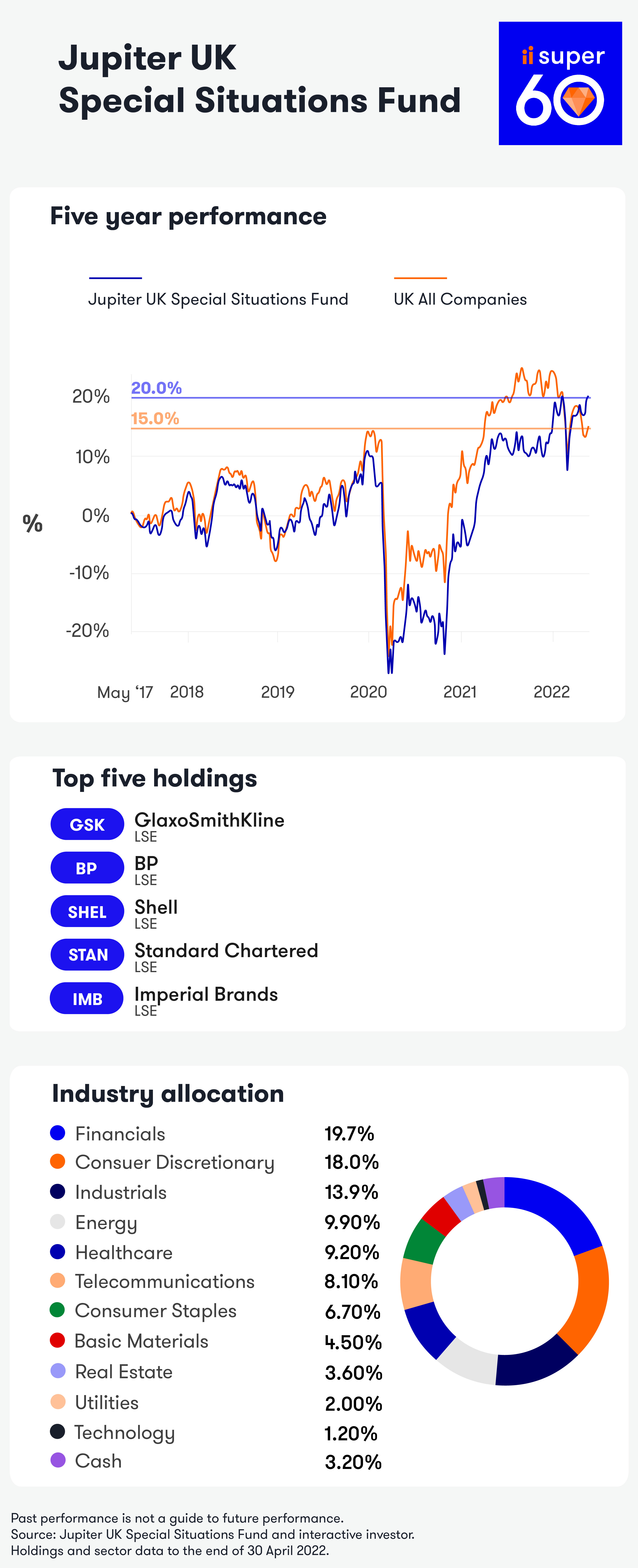

The top fund has been Jupiter UK Special Situations and Dimensional UK Value returning 6%, followed by Schroder Recovery at 5%. Man GLG Undervalued Assets and JPM UK Equity Value are up around 1%, while Premier Miton UK Value Opportunities has lost 18% and Polar Capital UK Value Opportunities has lost 11%.

The driver of strong performance for Jupiter and Dimensional has been a high allocation to energy stocks. The energy sector has soared this year as oil and gas prices have shot up as a result of Russia’s invasion of Ukraine.

| Fund | Year-to-date return (%) | 1-yr return (%) | 3-yr return (%) | 5-yr return (%) |

|---|---|---|---|---|

| Jupiter UK Special Situations | 6.2 | 8.22 | 23.73 | 20.41 |

| Dimensional UK Value | 6.1 | 10.71 | 17.72 | 20.09 |

| Schroder Recovery | 4.8 | 12.25 | 24.09 | 27.21 |

| Man GLG Undervalued Assets Professional | 1.5 | 4.65 | 6.47 | 16.3 |

| iShares Edge MSCI World Value Factor UCITS ETF | 1.1 | 7.2 | 24.54 | 30.9 |

| JPM UK Equity Value | 1 | 5.33 | 14.7 | 14.97 |

| Fidelity Special Situations | -2 | 3.24 | 16.55 | 17.47 |

| R&M UK Recovery | -3 | -2.51 | 23.88 | 27.46 |

| iShares Core MSCI World UCITS ETF | -9.5 | 4.21 | 36.8 | 59.57 |

| Polar Capital UK Value Opportunities | -10.1 | -4.88 | 10.76 | 15.46 |

| Slater Recovery | -10.5 | -1.58 | 48.5 | 82.01 |

| -17 | -16.85 | 18.27 | 21.19 |

FE Analytics, 24 May 2022. Past performance is not a guide to future performance.

James Penny, chief investment officer at TAM Asset Management, said that concerns about a recession were ruining the party for value investors.

He said: “If value managers five years ago were told about the economic conditions today, they would have predicted a stellar run for shares, but it has not happened that way. Recession fear is the big issue that is harming most stock market sectors.

“Almost all stocks are down given the outlook for the global economy. Stagflation is the big story: low growth and high inflation. This worry has become too extreme for value stocks to be booming. Therefore, they are broadly flat this year rather than making a lot of money.”

Penny added that banks have been one of the most disappointing cheap sectors this year, despite generally making more money when interest rates rise. Barclays (LSE:BARC) shares have fallen 17% and Lloyds (LSE:LLOY) are down 12% this year.

- A tactic to ride out the inflation storm using these funds and trusts

- Recessions are becoming more likely – here’s how to invest

“Banks should be soaring – but this hasn’t happened. Investors are not buying bank shares because they are worried about a recession,” he said.

Gregory Perdon, co-chief investment officer at wealth manager Arbuthnot Latham, agrees with Penny. He said fear of recession was holding back value stocks, but also fear generally was causing investors to flee to cash, which had the effect of bringing down the stock market.

“Financials should be doing well with rising rates as they make more money when rates go up. But the market dynamic is not just about Fed hiking, but instead fear of a recession.”

For Penny, the best investment strategy now is to forget about broad “growth” and “value” buckets and instead choose sub-sectors that can withstand a recession.

- How Terry Smith is investing as markets crash

- The UK shares three pros have snapped up in this volatile market

“Companies will need robust earnings and sustainable margins. You need to own firms that will be around when the dust settles – whether growth, value or a bit of both. High quality will rule.”

Dividend stocks is another area he likes at the moment. “They are a good source of certainty. Dividends have been a dirty word for the past five years but are coming back. They act as a safe haven when share prices are falling,” he said.

Overall, Penny said that owning cheap stocks would still be better than owning expensive ones because growth stocks were still expensive.

He said: “The value sector is still on a similar price-to-earnings ratio as its five-year average, but growth is still above its average. There could be more pain to come for growth.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.