A little Charlie Munger wisdom: diversify, sure, just don’t diworsify

The late Charlie Munger and his business partner Warren Buffett were especially outspoken on one particular aspect of investing: diversification.

1st December 2023 14:06

by Paul Allison from Finimize

The real benefit of diversification is making sure you have the right balance of different asset classes in your portfolio.

When it comes to stocks though, you can definitely end up with too much of a good thing.

In fact, if you end up with more than 20 stocks in a portfolio, you’ll see the benefits of diversification quickly evaporate.

The late Charlie Munger has left a long trail of wise and witty quotes that will inspire generations of investors to come. He and his partner Warren Buffett were especially outspoken on one particular aspect of investing: diversification. They famously referred to the idea of adding ever more stocks to a portfolio as “diworsification” and “protection against ignorance”. So, in Munger’s honor, let’s talk about how to put your eggs in just the right baskets…

How can you diversify without diworsifying?

At Finimize, when we talk about making sure your portfolio is diversified, we’re usually suggesting you create a healthy mix of different asset classes – stocks, bonds, commodities, crypto, and so on – so that when one class goes down, there’s a good chance that another will be going up. We’re also suggesting you spread your stock investments across at least some different industries, so that if, say, tech collapses (like it did in 2022), you’ll have some blow-cushioning investments in other sectors.

But diversification is a term thrown around too casually without attention paid to the fact that there’s actually a risk of owning too many stocks. There simply comes a point when adding one more stock into the lineup makes little to no difference in terms of reducing your overall risk or volatility, but does reduce your potential return by spreading your money too thin and not piling enough of it into your best ideas. Munger scoffed at the idea that if you hold 100 stocks, you’re “investing more professionally” than if you hold just four or five that you like and understand.

Now, let’s be honest, that’s probably too few. After all, most of us don’t have Munger’s megabillions in the bank ready to soften the blow of a bad stock pick or two, and wouldn’t feel comfortable with only a handful of investments. But you can achieve an adequate level of risk reduction through diversification with a lot fewer stocks than you might think. And that’s really what Munger was saying too, just in a more colorful way.

So what’s the ideal number of stocks, then?

When it comes to diversifying away risk, there’s a tendency to think the more stocks, the better. But mathematically that’s not true. In the 1950s, American economist Harry Markowitz published what he called the “modern portfolio theory” (MPT), which explained the benefits of diversification and, incidentally, earned him a Nobel prize.

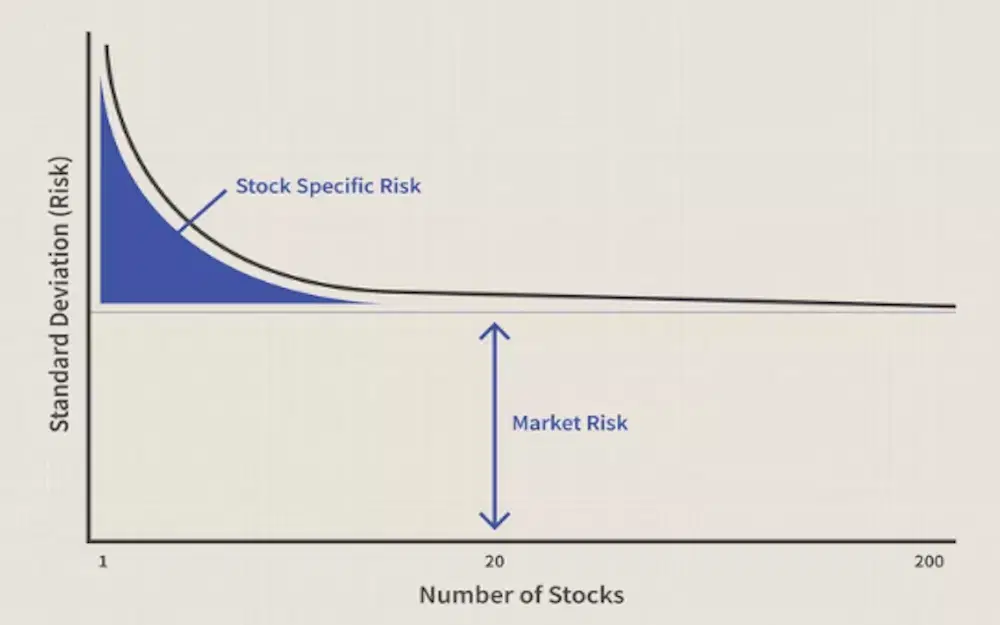

It accounts for the two big types of risk: systematic (or market) risk, and unsystematic (stock-specific) risk. Markowitz argued that you want to use diversification to reduce your amount of stock-specific risk: like, the chance that a stock will blow up because the CEO has committed fraud or the firm’s biggest contract falls through. But he also pointed out that no amount of diversification (adding more stocks) will reduce systematic, or market risk. That type of risk – like poor economic performance, a financial crisis, or a pandemic – will drag down the entire market (and your portfolio) with it.

The modern portfolio theory holds that once a portfolio achieves a certain number of stocks from across industries or sectors, it becomes sufficiently diversified from a stock-specific standpoint. And at that point, adding more stocks does not improve its diversification benefit. Source: Investopedia.

Markowitz found, then, that you can dramatically reduce the unsystematic risk in your portfolio by adding just one more stock to a one- or two-stock portfolio. And if you keep adding stocks, you can keep removing your portfolio’s risk – to a point. Eventually, as you can see in the chart, the slope of the curve flattens, and you can no longer shrink your unsystematic risk. That point’s around 20 stocks – keep throwing more stocks into your portfolio beyond that point and you won’t really be reducing risk. That’s because you’re already sufficiently diversified and the only risk left is that systematic risk, which can’t be diversified away.

So why do so many funds and ETFs have way more than 20 stocks?

That’s a tough question, and there really isn’t a good answer to it, to be honest. As a professional money manager, I rarely ever managed a portfolio with fewer than 50 stocks. And I’d say the reason mostly came down to the attitude toward risk – more specifically, the attitude of my bosses and our clients. What I’m getting at here is that people in the investment business tend to have an asymmetrical attitude toward risk: they fear losses far more than they enjoy gains. If you think about it, that makes sense. Professional fund managers can roll along for decades, just ahead or just behind their performance benchmark, and everyone’s happy. But have one or two very bad years, and they might be handed their pink slips. So what tends to happen is that professional managers are pressured into holding too many stocks, even though everyone knows that, theoretically at least, it’s a bad idea.

What’s the opportunity, then?

This might be a bit controversial, but I think you’d be better off constructing your own portfolio of 20 stocks spread roughly equally and from different sectors or industries versus paying a professional manager to invest in 50 to 100 stocks on your behalf. And I’ll include all the S&P 500 ETFs (which invest in, well, 500 stocks) in that too. I should point out here that there’s a level of confidence and risk appetite that’s required to manage your own stock portfolio, but with just 20 to 30 company names to keep tabs on, you could certainly learn a lot about your investments along the way.

To be absolutely clear, the S&P 500 has delivered very satisfactory returns of around 8% over a very long time period, and for some that might be good enough. And if that’s you, then you can avoid the headache of picking your own stocks. But my point is that a well-thought-out portfolio of 20 stocks should give you similar returns because you’ll have diversified away almost all of that stock-specific risk. And with just a bit of homework, you’ll have a good chance of performing better than the S&P 500.

Paul Allison is a senior analyst at finimize

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.