The ‘lost decade’ for UK bank shares may be coming to a close

In our new FTSE Sector Watch column, Richard Hunter explains that while the banks face difficulties, t…

30th August 2019 10:13

by Richard Hunter from interactive investor

In our new FTSE Sector Watch column, Richard Hunter explains that while the banks face difficulties, the outlook is not entirely gloomy.

There are five UK banks within the FTSE 100, of which HSBC is the largest by market value (£129 billion), followed by Lloyds Bank (£36 billion), Barclays (£25 billion), Royal Bank of Scotland (£24 billion) and Standard Chartered (£21 billion).

The last decade, following the financial crisis, has been a torrid one for the banks. Some had quite simply expanded too far, all faced financial pressure with some cutting dividends for years, and only recently has the wave of regulatory fines and censures – which collectively ran to tens of billions of pounds – begun to ebb.

- Share Watch: looking beneath the bonnet of four good businesses

- The world’s top 10 dividend-paying companies

Challenges

Today’s challenges may be different, but they remain difficult. Traditionally, banks “borrow short and lend long”, since short-term interest rates tend to be lower than long-term. In practice, this means they borrow via savers’ bank deposits, for example, and then lend for instance to mortgage borrowers.

Since shorter-term borrowing is less risky, mainly because of the time factor, interest paid on deposits is relatively low, whereas for longer-term loans the rates will be higher. That said, the current interest-rate backdrop is at historic lows, even at the “long end”, and so banks’ net interest margins (the difference between the two) have been under pressure.

Banks in the firing line

Similarly, bad loans (impairments) are in fairly benign territory at present, but higher interest rates and/or a recession would alter the picture considerably. In terms of the latter, it is largely expected that the UK economy could be vulnerable to recession, with or without a no-deal Brexit. As such, banks have been in the firing line (along with the housebuilders) as potentially being worst-hit after 31 October, especially those with a particular UK focus such as Lloyds and RBS.

Quite apart from the European soap opera, the current trade war between the US and China has recently escalated to the extent that some believe this very impasse could presage a global recession. Add in geopolitical uncertainty and political instability around Hong Kong, and there is a mountain to climb for the banks.

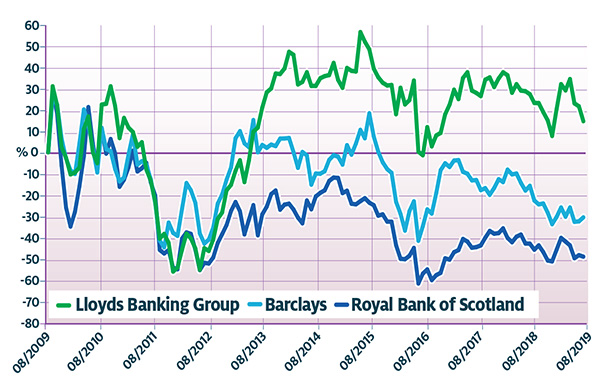

Indeed, all of the banks face at least some of the issues as described above, while the likes of HSBC and arguably Standard Chartered, both with a strong presence in Asia, are vulnerable to all of them. Perhaps not surprisingly, their share price performances have been extremely poor. Over the past year, Standard Chartered is down 7%, HSBC 12%, Lloyds 20%, Barclays 22% and RBS 23%.

However, it is not all gloom and doom. Since the financial crisis, the banks have been busy rebuilding balance sheets and disposing of non-core assets, and along with this streamlining they have been bearing down on costs.

As things stand, they each have strong capital cushions – the amount of capital they are required to set aside – which should provide much solace in the event of a downturn, prolonged or temporary.

Indeed, the regulators regularly model some stringent economic conditions to anticipate how the banks would fare, and of late these stress tests have shown the sector to be in better shape than it has been for the last decade.

There has also been some heavy investment into the digital sphere as the world around us changes. This should lead to further cost savings in due course, streamlining the banks’ business and allowing them to benefit from “positive jaws”, where, quite simply, income is growing faster than costs.

- ‘Free trading’ platforms: what’s the catch?

RBS is the returns laggard among the favourites

‘Lost decade’ ending

The recent half-year reporting season indicated the “lost decade” for banks may finally be coming to a close, with dividend payments (now resumed across the board) being held or increased, and in some cases supplemented by a special dividend. The advantage of a special dividend is that the bank is not compelled to repeat the payout should economic conditions tighten.

As such, and exogenous difficulties aside, dividend yields are generally looking healthy at present, with RBS’s special dividend propelling the current yield to 7%, Lloyds yielding 6.5%, HSBC and Barclays 5% and Standard Chartered around 3%.

The general market view on prospects for the banks is a mixed bag, with the market consensus at present ranging from a sell (HSBC), through hold (Standard Chartered), up to buy (Lloyds, Barclays, RBS). In the box at the top of this page we take a look at the three currently most favoured.

- Overseas shares that investors should learn to love

Banking on a strong trio to fulfil their true potential

Lloyds: There is little doubt that the business is well-run and there are grounds for optimism. The investment in digital banking, in which Lloyds is predominant, continues apace, the tie-up with Schroders should deliver benefits in what is the increasingly important space of financial planning, and the group’s efficiency drive is delivering results. Indeed, the cost/income ratio, which now stands at under 46% (compared to nearly 48% previously) is sector-beating and extremely healthy.

Nonetheless, the Brexit spectre continues to loom large and with Lloyds being regarded as a proxy for the UK economy, it is difficult to foresee an obvious exit from this financial maze until the terms of the withdrawal are resolved and implemented. Whilst the risks to the business are well-defined, the potential is also evident

Barclays: The bank has decided that in light of the challenging income environment, it is better served concentrating on costs for the rest of the year which, while prudent, is something of a disappointment.

More positively, the capital cushion is perfectly adequate at over 13% and the consumer, cards and payments parts of the business continue to make a worthwhile contribution while exhibiting further growth. The digital part of the bank has already gained traction and is becoming entrenched within the UK business, which should ultimately relieve some cost pressures.

Barclays seems to be making progress on a complicated transition, while managing its complex business. There’s probably enough in the half-year update to continue to give the bank the benefit of the doubt.

RBS: After years in the investment wilderness, RBS is finally making its way back into the fold.

A strong second quarter helped to inflate the half-year numbers, where total income rose by 20% and the earnings per share metric spiked sharply higher. From a wider perspective, the previous US settlement is now a number of the past, allowing more concentrated focus on day-to-day business. The bank has generated cash in abundance for the period, helped along by the sale of its Saudi bank stake, which enabled a generous special dividend.

In the here and now, RBS is enjoying the fruits of a decade of financial pain and re-engineering. The medium-term outlook may have been tarnished, but the bank has weathered bigger storms.

- Six UK share tips for 2019: here’s how they have fared at the halfway stage

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.