The markets most and least affected by the coronavirus outbreak

Since the start of the year, the UK has been the worst affected of all major markets.

13th March 2020 11:53

by Tom Bailey from interactive investor

Since the start of the year, the UK has been the worst affected of all major markets.

The past week has been the worst for markets since at least the 2008 global financial crisis, with yesterday (12 March) the worst day since 1987 for the FTSE 100 and S&P 500.

Following the announcement that the US will institute a travel ban on all nationals from the European Union’s Schengen Area, markets across Europe tumbled, with UK equities losing 10.9% in one day alone (despite the UK not being included in the EU ban).

On the continent, it was a similar story, with major indices also down more than 10%. In the US, the S&P 500 closed 9.5% lower, again triggering the market’s circuit breaker.

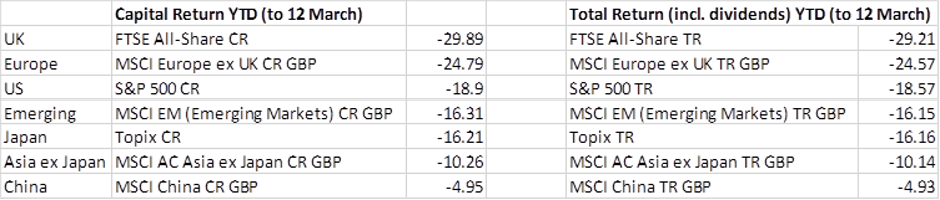

Since the start of the year, the UK has been the worst affected of all major markets. Dated to 12 March, the FTSE All-Share is down 29.9% in price terms. Meanwhile, China is one of the least affected, with the MSCI China index down just 4.95%.

Jason Hollands, managing director of Tilney Group, notes: “This might surprise those unfamiliar with the shape of markets and who have read about the massive economic disruption in China and – currently – relative low number of infections in the UK, albeit they are rising rapidly.”

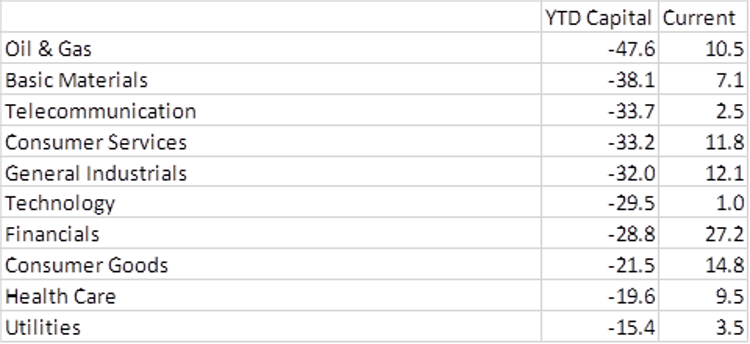

However, as Hollands points out, the UK equity market is not a particularly useful bellwether for the UK economy. He notes: “It is highly international in flavour, and the seemingly excessive pain it has been experiencing is a reflection of the markets’ high exposure to oil and gas and commodities.”

Meanwhile, China is now seen as having moved past the peak of the virus. Added to that, the government has offered ample support to its equity markets, helping to keep prices up.

Despite the virus initially being seen as a problem confined to East Asia, markets in Asia have broadly performed better. The second-worst performing market has been Europe, with the MSCI Europe ex UK index down 24.8%, followed by the US with losses of 18.9%. Meanwhile, Asia ex-Japan is down 10.3% and Japan 16.2%. While those losses are still steep, they are significantly better than the performance in Europe, reflecting growing concern over the damage the virus will do to European economies.

Which parts of the FTSE did best and worst?

As mentioned, the FTSE All Share has been the worst-performing of all major markets. However, this was primarily the result of the index’s exposure to oil and other commodities.

This can be seen when we take a sector-by-sector view. For instance, the Oil & Gas sector is currently down 47.6%, while Basic Materials is down 38.1%. The best-performing sector is Utilities, generally seen as a defensive sector.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.