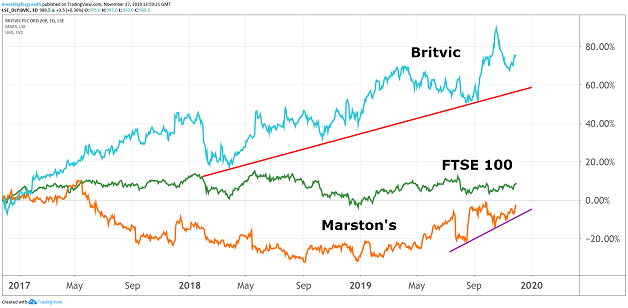

Marston's and Britvic shares more popular than FTSE 100

Big-hitting Britvic extends its long-term uptrend, but Marston’s is doing a great job playing catch-up.

27th November 2019 14:47

by Graeme Evans from interactive investor

Big-hitting Britvic extends its long-term uptrend, but Marston’s is doing a great job playing catch-up.

Britvic (LSE:BVIC) results today re-ignited questions about whether the soft drinks company can squeeze any more out of a share price that's risen steadily for several years.

While the full-year figures featured a large writedown on the value of Britvic's assets in France, this was offset by better-than-expected adjusted earnings per share and annual dividend, which was increased by 6.4% to 30p. The Robinsons, Fruit Shoot and Pepsi MAX maker added that it was confident of further progress in 2020.

Shares held firm at 988.5p in the wake of the results, with the FTSE 250 stock consolidating the 23% rise seen so far this year and the rally achieved since shares were below 300p in 2012.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Analysts at Jefferies point out that the company's 2020 price/earnings multiple of 15.7x still meant Britvic was trading at a 27% discount to other companies in the consumer staples sector and at a 21% discount to a group of soft drinks firms including AG Barr and Nichols.

Source: TradingView Past performance is not a guide to future performance

They said today's solid numbers and £51 million improvement in free cash flow to £116 million were welcome, but added that it was too early in the new financial year to consider a re-rating the shares, particularly with the peak trading season still to come.

Jefferies added that Britvic's proposed exit from private label juice in France and Fruit Shoot multipacks in the United States would help improve focus on growth areas.

In its British market, revenues from carbonates increased by 5.2% after strong volume growth in the second half compared with a year earlier, when there were CO2 shortages. In still drinks, revenues were up 0.4% thanks to a positive performance from the Robinsons range.

Revenues in France were down 9.2% after an 8.7% fall in volumes, with Fruit Shoot impacted by price competition and new entrants into the market. Overall, organic revenues were 1.4% higher and in line with market expectations at £1.54 billion.

Jefferies has a price target of 1,150p on Britvic, whereas other ‘buy’ recommendations from UBS and Investec are at 1,010p and 1,025p respectively.

Britvic's strong share price performance in 2019 has been mirrored by pubs company Marston's (LSE:MARS), which also posted annual results today. Underlying profits of £101 million were down £3 million after underlying sales growth of 0.8% was unable to offset cost inflation.

Shares still rose 2% to 130p today after the company said it was ahead of schedule on its target to reduce debt by £200 million by 2023. This includes £70 million of disposals of non-core pubs and assets next year, of which £50 million have already been exchanged or completed.

The progress of its plan has allowed the company to stick by the pledge to keep the dividend at its current level of 4.8p a share. Net debt stood at £1.4 billion at the end of September after operating cash flow improved 7%.

At 10 times underlying earnings, analysts at Shore Capital said Marston's current valuation failed to take into the account the value of the pub estate or attraction of its beers business.

Numis Securities added: “We view the rating as undemanding and believe evidence of a sustained de-gearing would lead to a re-rating over time.” They have a price target of 136p.

Shares have risen from 94p at the start of this year to above 130p at the end of September.

CEO Ralph Findlay praised the company's drink-led community pubs and brewing business for outperforming their markets over the financial year. Trading has also been in line with expectations over recent weeks.

He added:

“Our principal focus remains to reduce our net debt by £200 million by 2023 - or earlier - and the measures we are taking now will result in a high quality business which is cash generative after dividends and capital expenditure.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.