More misery for Thomas Cook shareholders

The writing's been on the wall for months, but existing shareholders will own little of the new Cook.

28th August 2019 12:23

by Graeme Evans from interactive investor

The writing's been on the wall for months, but existing shareholders will own little of the new Cook.

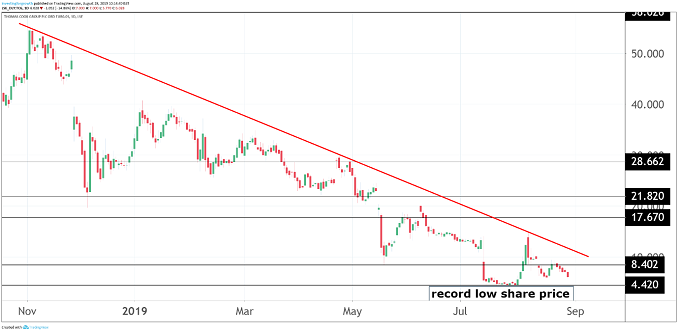

With Thomas Cook (LSE:TCG) remaining close to the stock market trap door, today's Chinese-led rescue plan represents an all too inevitable conclusion for bombed-out shareholders.

Analysts at Citigroup warned as long ago as May that the shares were worthless, with the "significant dilution" of shareholder interests under the proposed recapitalisation scheme hardly a surprise after months of speculation. Our own technical analyst issued a similar warning. A "hopeful bottom by 4p" correctly called the low less than two months later.

Despite this, there have been plenty of investors prepared to take a punt on the debt-laden tour operator as the saga played out over recent weeks. This was especially true towards the end of July, after Thomas Cook disclosed that it was in discussions with its largest shareholder, China-based tourism group Fosun, and its core lenders about a recapitalisation.

Those who bought at under 5p in the last week of July will still be sitting on a paper profit, even after today's share price fall of 16% to below 6p. Quite what happens next for these and other long-suffering shareholders is not entirely clear, beyond the certainty of significant dilution.

Source: TradingView Past performance is not a guide to future performance

Thomas Cook said previously that it hopes shareholders will be given the opportunity to take part in the restructuring by way of investment alongside Fosun and creditors on terms to be agreed.

It reiterated today that a recapitalisation with the support of shareholders was the preferred means of securing the future of the group, with the current intention being to maintain the company's stock market listing.

However, it warned that the proposed recapitalisation may "in certain circumstances" result in the cancellation of the company's listing. More details will be disclosed prior to the scheme's implementation in October.

Completion of the restructuring will put the 178-year-old group in much better shape to tackle the 2019/20 winter season and beyond, helped by Fosun's £450 million of new money in exchange for 75% of the tour operator business and 25% of Thomas Cook's airline operation.

The group's lenders and bondholders are also targeting £450 million of new money and plan to convert their existing debt into 75% of the airline and 25% of the tour operator business.

Under a previous turnaround plan, Thomas Cook had been looking to the sale of its airline arm as a means to tackling a debt mountain that stood at £1.2 billion at the end of March. The current market capitalisation is close to £100 million.

While Thomas Cook received multiple bids for the airline business, industry experts had warned the sale process would not have been straightforward given that potential airline bidders were facing problems of their own due to industry overcapacity.

An airline sale would also have triggered a new £300 million facility with lenders for additional liquidity over the winter months. But even if Thomas Cook had succeeded with its turnaround plan, trading conditions are unlikely to be any more favourable this winter due to the ongoing impact of Brexit uncertainty and the weak pound.

It is the second time in less than a decade that Thomas Cook has needed rescuing. CEO Harriet Green's restructuring efforts revived the company's fortunes and sent shares as high as 189p in 2014 before she handed over to chief operating officer Peter Fankhauser later that year. Shares have struggled ever since, although a year ago they were still trading at 138p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.